Mine Visit Note: Perseus

EQUINOX PARTNERS - Precious Metals Miners

Site visit—Perseus Mining

February 2020

Dates February 6-11, 2020

Mines Visited Yaoure, Sissingue, and Edikan

Countries Visited Cote d’Ivoire and Ghana

Analyst Coille Van Alphen

OVERVIEW

Perseus (PRU Australia) is a gold miner with two operating mines and one mine in development in West Africa. The company is well capitalized and has top tier management, good governance and can execute in a tough jurisdiction. PRU is a 2% position in the SMAs.

metrics

Market Cap

$900m USD

Enterprise Value

$907m USD

EV/CF

5.1x 2020 estimate cash flow

P/NAV (5% discounts)

0.6x

Resources

6.5m ounces of gold

EV/Resource

$141 per ounce of gold

Reserves

2.9m ounces of gold

EV/Reserves

$309 per ounce of gold

All-in-sustaining cost

$888 per ounce of gold

Thesis

Perseus Mining has two producing assets and is in the middle of constructing its third asset, Yaoure, in Cote d’Ivoire. Once Yaoure is commissioned, the company should produce ~500,000 oz. by 2021 and generate substantial FCF (~USD$125m per year at $1700 gold). Yaoure has the potential to provide PRU with a “cornerstone asset” from which they can start to upgrade the portfolio metrics. The company trades at 0.6x P/NAV and is not covered by any sell side analysts because of its 2014 operational failure at Edikan. Management replaced several key people in 2014, and the company has clearly demonstrated operational stability at Edikan. Generating FCF from low grade material in Ghana is challenging at the best of times, but PRU has achieved plant and mine stability over the last 12 months and I am optimistic they have finally found the right balance.

Trip summary

Overall, the trip was well run, informative, and I left having a better understanding of their operational strengths which weren’t evident prior to seeing the assets. The one thing that particularly stood out from the tour is the very conservative nature of the company: from security protocols to resource modeling, the company doesn’t want to lose the market credibility they have built up over the last 18 months which is stemming from more consistent operations. The company has learned a lot from building Sissingue, a small mine footprint, which they are applying to Yaoure and should enable them to meet capex and construction timelines of Q1 2021.

By the end of this quarter (Q1 2020) they will have paid back their initial capex of $106M at Sissingue, and they are trying their best to extend the mine life to generate as much FCF as possible. Edikan was working much better than it looks on paper, and I have more confidence in their current LOM plan, and am keen to see what the new exploration targets generate. Processing ~1 gpt rock in Ghana is marginal, but they seem to have reached an inflection point where they can consistently generate FCF. They have not historically had a lot of additional FCF to spend on exploration at any of the assets due to patchy operational success, but they are starting to spend money on this area now due to a growing cash balance. Their exploration approach seems quite sensible, and they are willing to allocate more capital based on results.

Management and governance

Jeff Quartermaine, CFO of PRU during all of Edikan’s previous woes and Managing Director (CEO) since 2014, personifies the company’s conservative culture. Andrew Grove has recently been brought on in an IR/Corp development role and does a good job of providing a more enthusiastic face to the market, while also being very qualified for corporate development given his time at Macquarie. In terms of compensation, it should be noted that their compensation packages are very modest when compared to their North American peers.

JURISDICTIONO

Cote d’Ivoire is a high-risk country: the upcoming election outcome is very uncertain, but with President Ouattara and Gbabgo both out of the race, the election outcome should not spark civil disorder. Ghana is a medium risk country: there is also a presidential election in 2020 and growing frustration with mining taxes not reaching the local communities. Within the Cote d’Ivoire, a 0.5% royalty goes to the community in the form of a fund called the CDLM. The fund is composed of two individuals from each impacted community, along with one person from PRU. At the moment, most of the money is going towards infrastructure, but as they get further up the development curve they would like it to transition to education.

Corporate Social Responsibility (CSR)

In Ghana, because the royalty that is supposed to be paid to the community is not reaching the community, PRU decided to allocate USD$300,000 per year towards a fund in order to win the trust of the community. From the surface, it doesn’t appear they are doing anything beyond basic infrastructure, basic health, and basic education. I would

like to see the CSR projects more advanced at Yaoure, given the community started with a higher level of development versus the other mine sites. This being said, the communities were all welcoming and happy to have us walk around and see the various infrastructure initiatives.

Security

The Security costs in Cote d’Ivoire have picked up. The company is monitoring the election in December because they worry that if Ouattara (the current president) doesn’t step down and give it to the second in line, then another civil war could break out. Flights started once per week in January 2020 from Sissingue in order to limit the use of roads. In Abidjan, we stayed in a hotel that had the most stringent bomb checking measures I have ever been through. While we were allowed to go out for one meal, the rest of the time we were not allowed to the leave the hotel ground.

In Ghana, the security tone was much more muted: they drove us 8 hours to the airport without a security convoy. The roads in Ghana were far worse than I remembered, and I could see why there is growing frustration with the level of infrastructure in the country.

Catalysts

Perseus will publish a new life-of-mine plan (LOM) shortly. It will use $1300 versus the current $1250/oz., which should have a positive impact by bringing in additional ounces (particularly Edikan). Because PRU’s LOMs are quite short, this should be meaningful to the valuation. Overall, I will add ~1 year of production at Sissingue and ~3 years at Edikan. Bringing in Yaoure on time and on budget will also help, but I think exploration success at the asset will be more meaningful to cement it as their cornerstone asset.

MINES

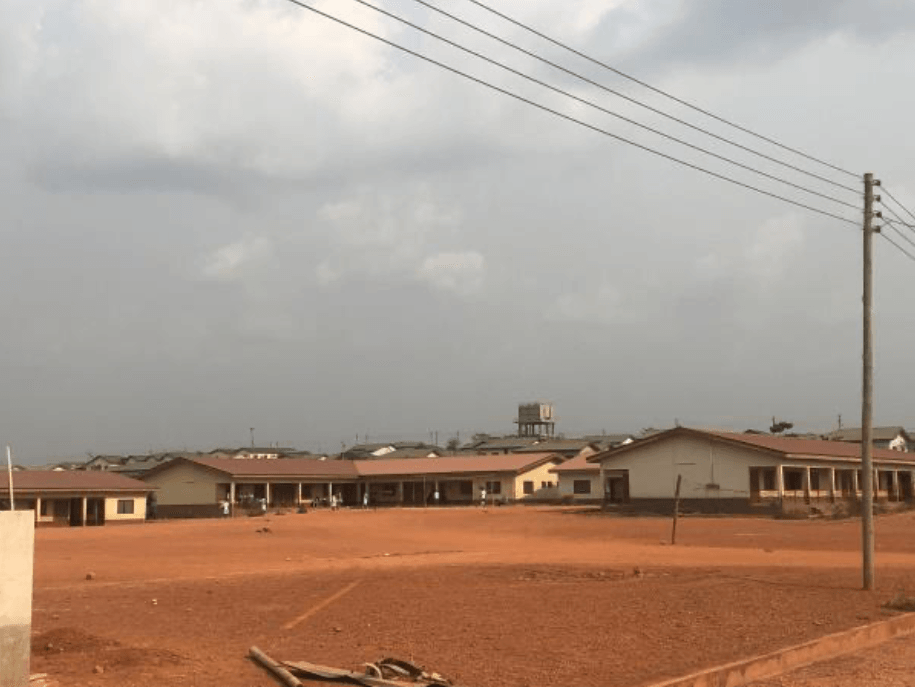

Edikan (90% interest)

Their COO has had a very large impact on the organization. Chris came from Barrick/Goldcorp, and is energized about turning around operations. I attribute his arrival to Edikan’s recent consistency. His impact at Edikan is obvious, as they have really started to make sustainable progress keeping the mill recoveries stable.

LOM gold production is currently expected to be 1.08 million ounces over the remaining 6 year mine life; however, there is potential to extend the current mine life through exploration and inclusion of the Esuajah South and the AG pit optimization into the LOM.

Esuajah South: the potential material could be removed by open pit and or underground mining at Esuajah South (ESS) but part of the reason they prefer the underground option is because it reduces the number of people impacted (and therefore relocated). The open pit option would require relocating essentially half the town, which would be a very significant cost. They had to relocate 200 homes, along with a church, police station etc. The topography was a little more difficult (on top of a hill) which increased the cost. The cost was $25 million. This relocation gives them plenty of flexibility though to expand the relocation area with more houses if necessary.

The nameplate capacity of the mill is 5.5Mtpa but they are currently doing 7.5Mtpa. The addition of the Mill Slicer (an initiative put in place by Chris) has been an upgrade that has also led to several additional improvements in the mill. They usually use grid power, but the transmission of grid power isn’t consistent so they have added generator sets. They are now working with GenSer who is providing another source of stable power and will lower their power costs. Keeping the mill going is particularly important there given the grade—every hour the mill is down costs them ~$500 oz.

Continuous improvement has been started and they are identifying 2nd order projects to work on. They believe they have executed on the obvious first pass projects. They added a carbon column to reprocess the tailings water which is now adding 500 oz per month. The cost of carbon column was paid back in three weeks.

Exploration at Edikan: The company has recently changed out its exploration team because they needed “new blood”. Targets that had been previously identified as unlikely are now proving to be much more interesting. They have also identified some new areas (don’t have the ground yet) that have many artisanal miners working on it. They are going to be spending ~$6.5 million in 2020. While it is difficult to quantify how many more ounces are there, I was the most optimistic about the mine’s upside vs. the rest of the portfolio. The Anikokoso prospect and the Agyakusu prospects are the targets we should be monitoring for progress.

Yaoure (90% interest)

The main takeaway is that the project is roughly on schedule and running slightly below budget. At the moment they are forecasting it to cost $258m vs. the $265m in the feasibility study; however, they are only 35% through construction. They are still targeting initial production for December 2020, but that is a stretch goal. At the moment, the FS outlines Yaouré’s life of mine gold production to be 1.4Moz at an AISC of USD$759/oz over 8.5 year. This study doesn’t include the initial underground inferred resource of 595 koz grading 6.2 g/t gold. I would expect ~50% of those ounces to con vert to reserves and make it into a mine plan which would further extend mine LOM by ~1.5 years. Currently within the Cote d’Ivoire there isn’t an underground mining convention, so they need to work through this before they can upgrade to a reserve and provide economics around those ounces.

All major contracts have been awarded, and so far EPC work is on schedule and there have been no major scope changes. They are clearly having some issues getting items released at the port, which is impacting various things but nothing on the critical path at the moment.

The project is much closer to infrastructure and people than Sissingue is, which will have positive and negative impacts on the project. The communities have much higher expectations. They have 5 impacted communities, along with a 6th that they include despite it technically not being in the catchment area. They include it because they feel it is close enough to be included and want to keep the expectations the same for all communities nearby. At the moment, they are employing 56% of the workforce from the local communities, and they would like to increase this figure to 60% once production starts. In addition to employing locals the government mandates that 0.5% of revenue must go back to communities and the communities decide how to allocate that money.

Exploration at Yaoure: They have some additional targets; Sayiko is the next key target. They need to remove the artisanal workers before they are able to mobilize a rig to test it, despite it being on their mining lease. They continue to believe it’s a large system, but so far they haven’t found anything meaningful. They have had a few “technical successes” but haven’t vectored in on the next CMA pit. It should be noted though that they haven’t spent a lot of money on exploration, so they are in the very early stages of exploration on the rest of the ground.

Sissingue (86% interest)

The mine started in 2018, exiting construction ahead of time and on budget. Currently the mine is producing 80,000 oz. per year from 3 pits. The flowsheet and mill are basic, but it has been running closer to 1.4 Mtpa due to blending (nameplate capacity of the mill is 1Mtpa). The recoveries have also been slightly better at ~94% vs. the 90% outlined in the FS. They believe, based on what they have milled so far, that as they transition to 100% fresh rock the recoveries should not drop to 86% as outlined in the FS. They think they can keep them around 90-94%, which would be an incremental positive. Maintenance (and therefore productivity) has been an issue, but the contractor has compensated for this by having extra equipment around.

Exploration at Sissingue: Zanikan is the most tangible exploration target that they have. They think it could at ~9 months of production. Sissingue doesn’t look like it has a lot of additional upside, so the likely outcome is that the mill is packed up and moved to a new deposit in country. Lykopodium has told them that relocating the mill would save them ~$30- $40m in capex.

*** END ***

*Figures and statements as of February visit. This is an internal research note written by an analyst employed by Mason Hill Advisors, LLC. It is not intended for distribution. This information was intended exclusively for the person to whom it was delivered and ought not to be distributed further. Opinions are expressed throughout this note as of the date of the note. Opinions can be wrong or can prove to be right. Investment decisions are made in part as a result of mine visits and company discussions, but not exclusively so.

Past performance is not a guarantee of future results. Any investment in a fund or managed account entails a risk of loss, including the entire amount invested. Performance is shown net of management fees, performance fee, and expenses, for each series in the consolidated managed account unless otherwise indicated. Account values are presented gross. Index returns adjusted for inception date of accounts. All performance is unaudited and based on valuations prepared by the adviser and is subject to revision. Net exposure includes short position exposure. See the End Notes on the following page for more important information regarding the performance information shown.

End Notes

THIS INFORMATION IS INTENDED EXCLUSIVELY FOR THE PERSON TO WHOM THIS WAS DELIVERED WHO IS DEEMED TO BE A PROFESSIONAL FAMILIAR WITH FINANCIAL INSTRUMENTS AND HEDGE FUND PRODUCTS IN PARTICULAR. ANY FURTHER USE BY AND/OR DELIVERY TO A THIRD PERSON IS STRICTLY PROHIBITED AND ALLOWED ONLY AFTER THE PRIOR EXPRESS WRITTEN CONSENT OF MASON HILL ADVISORS, LLC. THIS INFORMATION IS CREATED SOLELY FOR INFORMATIONAL PURPOSES WITH THE EXPRESS UNDERSTANDING THAT IT DOES NOT CONSTITUTE: (I) AN OFFER, SOLICITATION OR RECOMMENDATION TO INVEST IN A PARTICULAR INVESTMENT; (II) A MEANS BY WHICH ANY SUCH INVESTMENT MAY BE OFFERED OR SOLD; OR (III) ADVICE OR AN EXPRESSION OF OUR VIEW AS TO WHETHER A PARTICULAR INVESTMENT IS APPROPRIATE. NO SALE OF SHARES OR INTERESTS WILL BE MADE IN ANY JURISDICTION IN WHICH THE OFFER, SOLICITATION OR SALE IS NOT AUTHORIZED OR TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE THE OFFER, SOLICITATION OR SALE. ANY OFFERING OF SHARES OR INTERESTS BY AN INVESTMENT FUND WILL BE MADE SOLELY PURSUANT TO THE PRIVATE PLACEMENT MEMORANDUM PREPARED BY AND FOR SUCH INVESTMENT FUND AND WILL CONTAIN MATERIAL INFORMATION NOT CONTAINED IN THIS DOCUMENT. ANY DECISION TO INVEST IN ANY SHARE OR INTEREST OF ANY INVESTMENT FUND SHOULD BE MADE SOLELY IN RELIANCE UPON THE PRIVATE PLACEMENT MEMORANDUM AND ANY SUPPLEMENTAL DOCUMENTS. FURTHER, AS A CONDITION TO PROVIDING THIS INFORMATION, MASON HILL ADVISORS, LLC SHALL HAVE NO LIABILITY, DIRECT OR INDIRECT, TO ANY OTHER ENTITY ARISING FROM THE USE OF THIS INFORMATION.

THE INFORMATION PRESENTED HEREIN IS CURRENT ONLY AS OF THE PARTICULAR DATES SPECIFIED FOR SUCH INFORMATION, AND IS SUBJECT TO CHANGE IN FUTURE PERIODS WITHOUT NOTICE. THERE IS NO OBLIGATION TO UPDATE THE INFORMATION HEREIN. NONE OF THE INFORMATION CONTAINED HEREIN HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, ANY SECURITIES ADMINISTRATOR UNDER ANY STATE SECURITIES LAWS OR ANY OTHER GOVERNMENTAL OR SELF-REGULATORY AUTHORITY. NO GOVERNMENTAL AUTHORITY HAS PASSED ON THE MERITS OF THE OFFERING OF INTERESTS IN A FUND OR THE ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

IRS CIRCULAR 230 NOTICE. TO ENSURE COMPLIANCE WITH REQUIREMENTS IMPOSED BY THE U.S. INTERNAL REVENUE SERVICE, YOU ARE HEREBY NOTIFIED THAT THE U.S. TAX INFORMATION CONTAINED HEREIN (I) IS WRITTEN IN CONNECTION WITH THE INFORMATION PROVIDED ON THE FUND AND OF THE TRANSACTIONS OR MATTERS ADDRESSED HEREIN, AND (II) IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED BY ANY TAXPAYER, FOR THE PURPOSE OF AVOIDING TAX RELATED PENALTIES UNDER U.S. FEDERAL, STATE OR LOCAL TAX LAW. EACH TAXPAYER SHOULD SEEK ADVICE BASED ON THE TAXPAYER’S PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISER.

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8