Equinox Partners, L.P. - Q4 2019 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

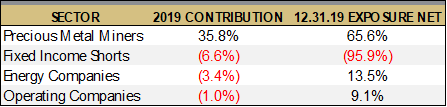

Equinox Partners rose +13.6% in the fourth quarter of 2019 and was up +22.8% for the full year.

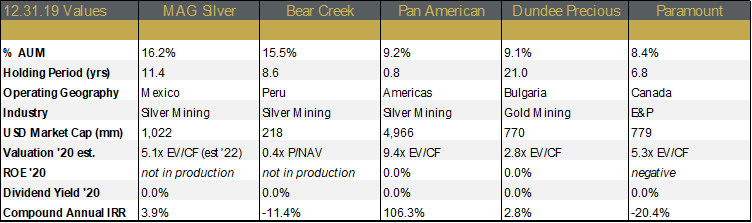

MAG Silver, Dundee Precious Metals, and Paramount Resources remain top-five positions in the fund year over year. Over the course of 2019, we sold both Aramex and Gold Road. The slowing growth of Aramex’s ecommerce business along with a management change tempered our enthusiasm for the company. We exited Gold Road in order to manage the fund’s growing exposure to precious metals miners. The new two additions to fund’s yearend top-five positions are Pan American Silver and Bear Creek Mining.

Yearend top-five holdings

Mag Silver

MAG Silver is the 44% owner of a high-grade, large-scale silver project in Zacateca, Mexico scheduled to begin production at the end of 2020.

The joint venture’s (JV) tonnage will begin at 4,000 tonnes per day (tpd) and should increase to 8,000 tpd within a few years of initial production. At 8,000 tpd, the JV will have a stated mine-life in excess of 12 years and a functional mine-life of much longer.

At $18 silver and 4,000 tpd, the JV generates a 44% IRR with a cash cost of ~$5 per ounce of silver. At 8,000 tpd, the project’s IRR rises, the cash cost falls, and MAG’s portion of the JV’s free cash flow tops USD$100m per year. In the first year of commercial production, we expect the JV’s free cash flow to be reinvested in the expansion to 8,000 tpd. After that expansion, we expect MAG’s board to either reinvest the company’s free cash flow into high-return projects on the JV property or to return the free cash flow to shareholders via dividends and share buybacks. Following the retirement of Johnathan Rubenstien, MAG’s current chairman, this spring, we expect the new board chair to crisply articulate MAG’s future capital allocation plans.

MAG’s unique combination of high-quality free cash flow and superior reinvestment opportunities should command a premium valuation. With a market cap of less than USD$1b, we believe that the company’s very desirable financial characteristics are being grossly undervalued by the market. Once MAG demonstrates its ability to generate and wisely allocate free cash flow, we believe the market will accord the company a much higher valuation.

Bear Creek Mining

Bear Creek’s fully-permitted Corani project in Peru is one of the largest undeveloped silver mines in the world. With reserves of 225m ounces of silver, 2.7 billion pounds of lead, and 1.8 billion pounds of zinc, the contained metal value of the deposit exceeds $8 billion USD. Per the company’s December 2019 feasibility study, the project has an IRR of +20% IRR, an NPV of $531m and a life-of-mine AISC of just $4.55 per ounce of silver.

The project’s $600m USD capital cost remains the sole impediment to the successful development of Corni. Given the Bear Creek’s current market cap of $200m USD, management is patiently waiting for the right price environment in which to finance the project. The quality of the project combined with the strategic patients of management makes Bear Creek one of the best options on slightly higher silver prices in the market today.

With the addition of Tony Hawkshaw as CEO, Alan Hair as a director, and Eric Calbra as VP of project development, the company is well positioned to structure the offtake agreements and partnerships necessary to move the project forward. And, with a concentrated shareholder base including the company’s founder and Chairman, Andrew Swarthout, the company is intent on protecting shareholders from excessive dilution in the financing of the project.

pan American silver

Pan American Silver is the world’s second largest primary silver producer, with a diversified portfolio of 10 producing assets located in North America and South America. In addition to its producing assets, Pan American has a diverse option-like project pipeline. From Navidad in Argentina to Escobal in Guatemala, the company has exposure to a number of world-class, but politically challenged, assets for which it currently receives little value.

Pan America has a long track record of creating free cash flow and consequently has a strong balance sheet and a consistent dividend. Ross Beaty, Pan American’s chairman, and Michael Steinmann, its CEO, both have well-deserved reputations as good capital allocators. We have confidence that these two gentlemen will continue to make wise decisions with respect to reinvestment and the return of capital.

The company’s current priorities are asset optimization, debt reduction, and brownfield exploration. In 2019, the company focused its brownfield exploration on the La Colorada skarn discovery. The result is a very significant poly-metallic discovery adjacent to the company’s La Colorada silver mine in Mexico that should add over $1 billion USD to Pan American’s NAV.

dundee precious metals

Dundee’s second Bulgarian mine, Ada Tepe, began commercial operations in the first quarter of 2019. While Ada Tepe was not completely immune to ramp-up issues, the plant has consistently achieved its designed throughput and recovery levels and should generate USD$75m of free cash flow this year. Chelopech, Dundee’s other Bulgarian mine, produces $100m of free cash flow per year, bringing the company’s free cash flow per year to USD$175m. At this run rate over the next five years, the cumulative free cash flow from Dundee’s two Bulgarian mines will exceed the company’s current market cap.

Dundee trades on an incredibly low multiple to its free cash flow for two reasons: 1) For years, the company’s smelter consumed all of its free cash flow; 2) The management failed to articulate a clear capital allocation policy. We believe both of these longstanding issues have been resolved. The smelter generated a modest amount of free cash flow in 2019 and should be a cash generator rather than consumer for the foreseeable future. David Rae, Dundee’s COO, will succeed Rick Howes as CEO this spring. With the company so undervalued and no internal use for its free cash flow, we expect David to announce a clear capital allocation policy with the support of Dundee’s board. For our part, we are encouraging the board and management to return half of the company’s free cash flow to shareholders, leaving a sufficient, but not excessive, amount of capital available for future growth.

Paramount Resources

Paramount Resources is a Canadian oil and gas company. The third quarter of 2019 marked the third quarter in a row that Paramount met or exceeded its operational guidance. This improved predictability of its operations reflects the company’s revamped internal budgeting process and focus on core competencies. Most importantly, the company has outsourced much of its infrastructure requirements to midstream partners.

Paramount’s focus on core competencies is a result of a concerted effort on the part of CEO Jim Riddell to take a more disciplined approach to capital allocation. Most notably, the company rationalized its non-core assets, selling a collection of midstream assets for CAD$470m and a marginal natural gas asset for CAD$55m over the course of 2019. These sales helped de-lever the company’s balance sheet and financed a share buyback, which the company did throughout the year. Combined with the company’s strong well results, these financially astute decisions led to Paramount’s meaningful outperformance last year.

Over the course of 2019, Paramount grew its production from 81k boepd in Q1, 37% of which were liquids, to a Q4 guidance of 84.5-97.5k boepd, 42% of which is liquids. Going forward, we expect Paramount to continue growing production at 10%+ per year, with high-value liquids growing much faster than gas. As a result, margins will continue to improve with cash flow increasing at a much faster pace than production.

At $60 WTI, the company is on pace to generate $350-500m of free cash flow per year from its Karr/Wapiti asset in 2022. This free cash flow theoretically would allow Paramount to buy back more than one third of its share outstanding in a single year.

Sincerely,

Sean Fieler

[1] Sector exposures shown as a percentage of 12.31.19 pre-redemption AUM. Performance contribution is derived in U.S. dollars, gross of fees and fund expenses. Interest rate swaps notional value and P&L are included in Fixed Income. P&L on cash is excluded from the table as are market value exposures for derivatives. Unless otherwise noted, all company data is derived from internal analysis, company presentations, or Bloomberg. All values are as of 12.31.18 unless otherwise noted. MAG Silver valuation using first full year of production and estimatied 8,000 tpd throughput.

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8