Kuroto Fund, L.P. - Q4 2024 Letter

Dear Partners and Friends,

PERFORMANCE

Kuroto Fund, L.P. appreciated +6.5% in the fourth quarter of 2024 and finished the year up +11.1%. Performance for the quarter was driven primarily by the positive performance our operating company holdings in Nigeria, Ghana, and Georgia.

A breakdown of Kuroto Fund exposures can be found here.

2024 Year in Review

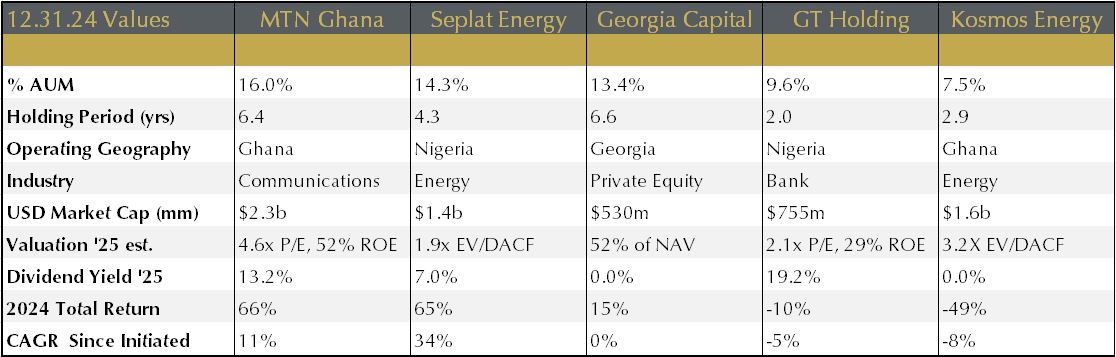

Kuroto’s top five investments made large strides last year. Seplat completed its ExxonMobil Nigeria acquisition, more than doubling its production, cash flow and reserves. Georgia Capital successfully sold a non-core asset and is in a good position to buy back a lot of stock this year. MTN Ghana saw strong operational performance while Ghana’s economy and currency stabilized. Guaranty Trust Bank completed a government-mandated equity raise, and Nigeria made steps towards stabilizing its economy. Lastly, Kosmos brought on its long-delayed Tortue LNG project. In each case, we believe the market has not adequately factored in the progress our companies have made, and we anticipate a more fulsome rerating of our top holdings in 2025.

investment Theses review for the top 5 positions

Seplat Energy

In December 2024, Seplat announced the closing of its long-delayed acquisition of Exxon’s shallow-water Nigeria business. This acquisition more than doubled the size of the company without increasing the company’s leverage profile or requiring additional equity. In addition to buying existing production and cash flow cheaply, Seplat can grow the acquired assets meaningfully and quickly. The assets they bought has over 600 completed wells, but only ~200 of these wells are producing today. Exxon had starved the asset of capital, with only $7 million dollars of cap ex being spent in 2023 on an asset that produced over 27 million barrels of oil and gas equivalent that year. Many of the ~400 shut in wells can be brought on quickly and easily, with inexpensive debottlenecking. Local news outlets have reported that Seplat hopes to double production from the assets in six months, but official guidance has yet to be released.

Recently, the market has been concerned about the effective tax rate Seplat will pay on cash flow from this new asset. Because Exxon had not been investing, the tax rate on the divested asset reverted to the statutory 85%. Seplat’s corporate tax rate, on the other hand, has been in the 20-30% range. When Seplat purchased its initial asset from Shell, that asset had a ~85% tax rate. With investment, Seplat was able to bring this rate down below 30%. Seplat’s management plans to do the same with the Exxon assets, and we believe they will be mostly successful in this regard.

Despite the strong performance of Seplat’s shares last year, Seplat’s stock remains very cheap. With the Exxon deal compete, Seplat is trading at less than 3x cash flow, and less than $2/boe of reserves. We look forward to the company showing the market its plans for the Exxon asset, specifically bringing production up and the tax rate down. We expect the amount of free cash flow that the company is generating will allow management to substantially increase the dividend in the near term.

MTN Ghana

In the first 9 months of 2024, (full year is not yet released) MTN Ghana grew revenue and earnings over 30%, generated a 50% return on equity, and paid a double-digit dividend yield. The company has been moving from strength to strength as they continue to dominate voice and data telecom services, as well as money transfer and digital payment in the country. We expect more of the same in 2025. The stock is trading at 4.6x our estimate of 2025 earnings, which is a 53% ROE, and 13% dividend yield on the year end 2024 stock price.

The biggest headwind to MTN Ghana has been the Ghanian government. In December, Ghana had a Presidential election which resulted in a transfer of power to the opposition. The new President – John Mahama – was the President from 2012 to 2017. We do not expect great things from his economic team, but encouragingly he has spoken out against both policies which had been most detrimental to MTN Ghana – the money transfer levy, and the government-owned 5G company. In addition, President Mahama’s team has indicated plans to continue working with the IMF on their bailout package. The reality is that Ghana does not have a lot of room to negotiate given the extent to which the country is indebted to the IMF. The status quo is fine for MTN Ghana, which will continue to grow its business despite local headwinds.

Georgia Capital

We detailed our view of Georgian politics in our Q3 letter. Politics remain the main risk to our Georgian investments. The October elections resulted in large protests which have mostly died down at this point. Despite the political calm, the US and EU have continued to sanction numerous politicians associated with Georgia Dream’s ruling coalition. There were even rumors that the CEO of Georgia Capital would be sanctioned by the US. Despite the obvious headline risk associated with these targeted sanctions, we remain confident that Georgia, the country, will not be redlined by the incoming Trump administration.

In December, Georgia Capital finalized the disposition of its beer business at a premium to CGAP’s self-reported NAV and immediately announced a further buyback of shares. Georgia Capital’s stock continues to trade at ~50% discount to a conservative valuation of the sum of its parts. As such, continuing to sell assets at a premium to NAV and using proceeds to buy back stock is very accretive for shareholders. In 2025, we expect stock buybacks to remain the main use of cash flow for the company. In addition, early this year the company will have the ability to exercise a put option to sell a minority stake in a water utility business. We expect them to exercise that and use the proceeds to buy back stock. Those proceeds plus buybacks from internal cash flow could see the company buy back over 20% of its stock in 2025.

Guaranty Trust

Guaranty Trust had a frustrating but profitable 2024. Through the first 3 quarters of the year (Q4 is yet to be released), the stock grew earnings 194% in local currency terms, and generated an annualized 55% ROE. At its current stock price, we estimate that it is trading at just over 2x earnings and 0.6x book for 2025, with a 19% dividend yield.

The biggest frustration for GT last year was the government’s mandatory recapitalization of the banking sector. GT did not need capital and if anything was overcapitalized. However, the government compelled the entire banking sector to raise capital, ignoring retained earnings when calculating the new capital ratios. This policy resulted in GTCO raising 209 billion naira, which represented a high-teens equity dilution.

Like MTN Ghana, Guaranty Trust’s business is strong and growing despite a challenging political and macro environment. Encouragingly, Nigeria seems to have stabilized for the time being. President Tinubu is in year two of his four-year term. After a large initial devaluation of the currency, the naira has been stable for over six months and has recently appreciated slightly. The fuel price subsidy which has dominated the fiscal expenditures of the country has become less significant. Encouragingly, Nigeria has had some success increasing the country’s oil production and we foresee more growth to come following a series of supermajor dispositions from Nigeria’s shallow offshore oil fields.

Kosmos Energy

Kosmos was our worst performing energy stock for the year, down -49%. This sizable decline was driven by repeated delays in the startup of its Greater Tortue Ahmeyim LNG Project, the underperformance of the Jubilee field offshore Ghana, and the shocked market reactions to a merger discussion with Tullow Oil. These three factors in combination with weak oil prices and a high debt load caused a significant decline in the company’s share price. While 2024 was a painful year to own Kosmos, we believe that the company has turned the corner.

The long-delayed Tortue field announced first gas in early January, and the company will begin shipping cargos and recognizing revenue this month or next. Kosmos’ Jubilee field in Ghana has seen production stabilize. Lastly, the merger talks with Tullow have been called off. Kosmos was only interested in merging with Tullow if the combined balance sheet of the two companies could be meaningfully de-leveraged.

Kosmos stock currently trades at over a 20% 2025 FCF yield assuming $75 Brent oil prices. The company has a multi-decade resource life with numerous existing discoveries they can develop to grow production further. With Kosmos spending minimally in 2025 to de-leverage the balance sheet, as we look ahead to 2026, we believe Kosmos will begin returning capital to shareholders. In addition, Kosmos management has said on earnings calls that they are considering selling down part of their LNG project ownership to accelerate de-leveraging and capital returns.

Sincerely,

Sean Fieler Brad Virbitsky

[1] Please note that estimated performance has yet to be audited and is subject to revision. Performance figures constitute confidential information and must not be disclosed to third parties. An investor’s performance may differ based on timing of contributions, withdrawals and participation in new issues.

Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, FactSet or independent sources. Values as of 12.31.24, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notice.

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8