Equinox Partners, L.P. - Q4 2024 Letter

Dear Partners and Friends,

PERFORMANCE

Equinox Partners, L.P. declined -6.5% in the fourth quarter of 2024, finishing the calendar year 2024 up +17.7% net of all fees. Our poor performance in the fourth quarter was driven by a sharp selloff in gold and silver miners despite a flat gold price during the period.

2024 Year in Review

Crew Energy accounted for 100% of our fund’s performance in 2024. We offered a fulsome write-up of Crew in our third quarter letter and need not repeat the details of the acquisition by Tourmaline here, other than to note that the 72% premium resulted in an ~18% contribution to the fund’s total return.

While there was significant movement among our other investments, their aggregate contribution was close to zero. This is a disappointing result given the significant progress many of our companies made last year. The market was not impressed by Paramount Resources’ sale of its core asset to Ovintiv for $3.3bn CAD. Nor did the market seem to care that Kosmos energy finally brought its flagship Tortue asset online in December. Thesis Gold’s positive feasibility study elicited an initial positive reaction, which was quickly reversed. Elsewhere, the market remains totally indifferent to the rapid progress that West African Resources is making at their Kiaka asset. While we understand that our sectors are out of favor, we would hope to see at least some of the value they are creating reflected in their stock prices in 2025.

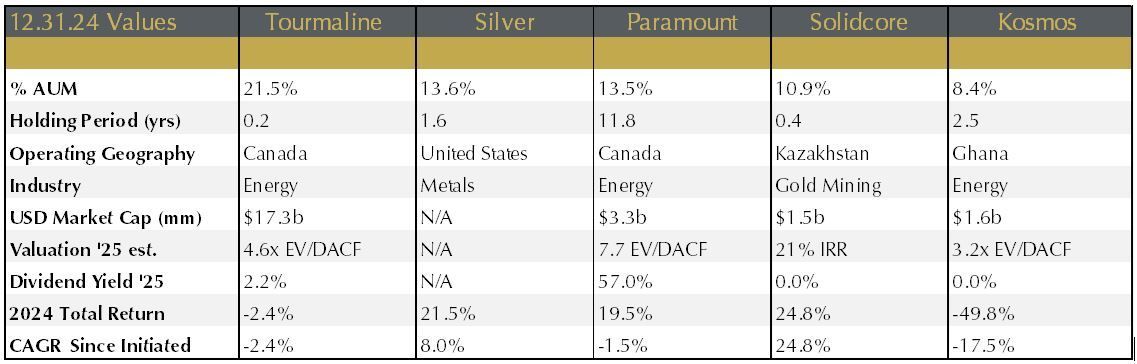

We’ve been busy over the past six months, establishing several sizable, new positions. We sold half of the Tourmaline shares we received in consideration for our Crew shares and used funds to make the following investments: an 11% portfolio weight in Solidcore Resources, an 8% position in Kosmos Energy, a 5% weighting in Ensign Energy, and a 5% weight in Gran Tierra Energy. Solidcore and Kosmos are both top five positions and receive a full writeup in the letter that follows. Ensign Energy is a North American energy service company, and Gran Tierra Energy is an E&P company with assets in Latin America and Canada. Both Ensign and Gran Tierra trade at particularly compelling valuations.

investment Thesis Review for our top 5 Long Positions by Weight

Silver: 14% Portfolio Weight

Silver is an atypical investment for us because we own the commodity directly. Our logic is as follows: First, we expect to generate a 20%+ annual return by owning the metal directly. Second, pure play silver mining companies trade at a significant premium to NAV. While we owned four attractively valued silver miners at year end, each of these companies is imperfect as a leveraged investment in silver. Adriatic Metals and Hochschild Mining are excellent companies, but more than half of their revenues derive from metals other than silver. Vizsla Silver and GoGold Resources control attractive silver deposits, but both companies face a challenging permitting environment in Mexico. Accordingly, we have elected to increase our silver exposure through the ownership of both the physical metal and silver futures.

Our bullishness on the metal is predicated on a supply-demand imbalance with no apparent fix. Last year, the annual silver deficit exceeded 200 million ounces.

In most commodity markets, higher prices would help bring the market back into balance. However, in the case of the silver market, it is not at all obvious to us that a higher silver price will be able to resolve the supply-demand imbalance. Even significant increases in the silver price would likely do little to increase the amount silver being mined or reduce silver demand.

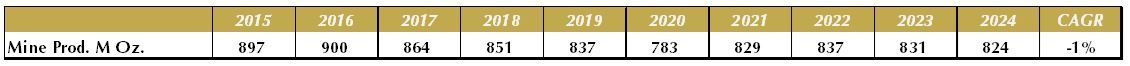

On the supply side, the past decade of silver mine supply is instructive. Silver mine supply has remained range bound at roughly 850 million ounces per year, even as the silver price has more than doubled. This reflects the serious impediments to increasing silver mine supply. First, silver mining projects take more than a decade to progress from discovery to production. Second, 50% of the world’s silver production comes from challenging Latin American jurisdictions, e.g. Mexico, Chile, Peru and Bolivia. Third, 72% of silver mine supply comes as a biproduct from the mines of other primary metals. That production has even less elasticity to a rising silver price.

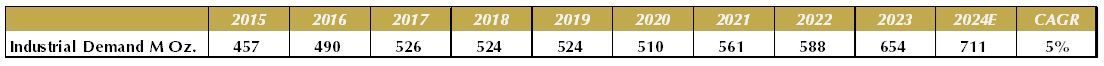

Silver demand is also largely indifferent to movements in the silver price. Silver is approx. 100 times more expensive than copper, an electricity conductor substitute that is 95% as good as silver. This vast price difference reflects the reality that copper remains an unworkable substitute for silver in many more technically demanding industrial applications. One notable problem with copper as a silver substitute that has yet to be economically solved is the effect of oxidization. Whereas oxidized silver remains highly conductive, the oxidized outer layer of copper acts as an insulator rather than a conductor. Because of this and other unique attributes of silver, industrial demand for silver has grown at a 5% compound annual growth rate over the past decade as shown below:

If silver mine supply continues to flatline and industrial demand for silver continues to increase even modestly, the only way to bridge the supply and demand back into balance is to eliminate net silver investment demand. This will also be a challenge as over 200 million ounces per year are consistently accumulated by silver coin and bar investors. Rather than reduce investment demand, we suspect higher silver prices would likely increase investment demand. Silver investors understand the supply demand imbalance in the silver market, and many believe that much higher silver prices, i.e. $100+ are just a question of time.

Tourmaline Oil: 21% Portfolio Weight

Tourmaline Oil Corporation is Canada’s largest natural gas producer and the fourth largest in North America, behind only Expand, EQT, and Exxon. Tourmaline differentiates from peers through its long reserve life, superior returns on capital, and founder-led culture. Tourmaline has 75 years of inventory while peers have a fraction of that. This depth of inventory allows management to focus on organic growth and avoid unattractive acquisitions. Tourmaline has generated a return on capital employed in the mid-high teens vs. an industry average in the low teens.

From 2010 to 2023, Tourmaline grew average annual production from 17k boepd to 520k boepd. Revenue per share and cash flow per share grew 1137% and 997% respectively. This compares to a peer group who, on average, grew those two metrics 44% and 22% respectively over the same period.

Tourmaline’s founder and CEO, Mike Rose, personally owns $1bn worth of stock in the company. Under Mike’s leadership, Tourmaline has focused on controlling its own infrastructure, acquiring countercyclically, and being the low-cost producer in the Western Canadian Sedimentary Basin. Three metrics that stand out pertain to their performance per employee relative to industry peers. Tourmaline generates $11.5m in CF / employee vs peers at $1.6m. Additionally, Tourmaline has 13.1m boe of reserves per employee vs peers at 2.1m, and Tourmaline has 13.6 100 boepd of production vs. peers averaging just 3.2. This is evidence of the type of cost-focused culture Mike has created at Tourmaline.

Tourmaline is Mike’s third company. He sold his previous company, Duvernay Oil, to Shell for $5.9bn CAD in 2008. He bought back essentially the same asset from them in 2016 for $1.4bn CAD. When energy prices cratered in 2020, Tourmaline went on a buying spree purchasing over 10 companies and doubling corporate production at generationally low prices. With Tourmaline you get the full package: a long-lived asset base, industry leading operators, superior returns on capital, and a best-in-class management team.

Paramount Resources: 13% Portfolio Weight

Early last year Paramount bid for Chevron’s Duvernay asset package. That asset and similar deals ended up going for significantly higher prices than Paramount was willing to pay. Through their failed bid, Paramount recognized that they could add more value by selling rather than buying producing assets and began soliciting bids on their mature Karr/Wapiti Montney package. In December, they announced the sale of these assets to Ovintiv for $3.3bn CAD. The company plans to pay out $2bn of this as a tax-friendly capital return and will invest the remainder to accelerate the growth of their oil-focused Duvernay package. Post deal, Paramount will be producing around 30k bpd with plans to grow to over 60k bpd in the next two years.

Concurrent to the Karr/Wapiti Montney sale, Paramount’s management team aggressively accumulated acreage in several other gas plays. They bought a large land package in the Sinclair Montney that they are currently testing. They think this is prospective for dry gas and if successful they can add between 0.5 - 1 bcf/d of dry gas from this land at what they hope is a basin-leading cost structure. In addition, they consolidated their position in the Horn River and the Liard Basin for next to nothing. This is an enormous gas resource that is commonly seen as uneconomic at current prices. There is infrastructure already in place and gas shut in. They are planning to test new well techniques to see if they can make this competitive, and if not, they are prepared to hold the acreage until such time as gas prices are supportive of development.

Solidcore Resources: 11% Portfolio Weight

Solidcore, a spin-out from Polymetal, is a new position in our fund. Solidcore is run by CEO Vitaly Nesis and controlled by Oman’s sovereign wealth fund which is a large minority shareholder. The company operates two long-lived mines in Kazakhstan and produces 480,000 ounces of gold annually at a competitive All-In Sustaining Cost (AISC) of $1,300/oz. With an EV/EBITDA multiple of 2.2x, Solidcore trades at an almost 50% discount to its peers. This undervaluation is largely due to the company’s sole listing on the Astana International Exchange in Kazakhstan.

We expect Solidcore to generate roughly $400 million in free cash flow per year at current gold prices. In 2025 and 2026, this free cash flow will be invested in a new pressure oxidation autoclave. Beginning in 2027, we anticipate that $100 million USD of the company’s free cash flow will be distributed to shareholders. This prospective dividend along with the company’s plan to re-list on the London Stock Exchange offer two catalysts that should drive a significant re-rating.

Kosmos Energy: 8% Portfolio Weight

Kosmos was our worst performing energy stock for the year, down -49%. This sizable decline was driven by repeated delays in the startup of its Greater Tortue Ahmeyim LNG Project, the underperformance of the Jubilee field offshore Ghana, and the shocked market reactions to a merger discussion with Tullow Oil. These three factors in combination with weak oil prices and a high debt load caused a significant decline in the company’s share price. While 2024 was a painful year to own Kosmos, we believe that the company has turned the corner.

The long-delayed Tortue field announced first gas in early January, and the company will begin shipping cargos and recognizing revenue this month or next. Kosmos’ Jubilee field in Ghana has seen production stabilize. Lastly, the merger talks with Tullow have been called off. Kosmos was only interested in merging with Tullow if the combined balance sheet of the two companies could be meaningfully de-leveraged.

Kosmos stock currently trades at over a 20% 2025 FCF yield assuming $75 Brent oil prices. The company has a multi-decade resource life with numerous existing discoveries they can develop to grow production further. Kosmos will reduce CapEx in 2025 to de-lever the balance sheet so that come 2026 they can begin returning capital to shareholders. Kosmos management has said on earnings calls that they are considering selling down part of their LNG project ownership to further accelerate plans to de-lever and return capital.

Sincerely,

Equinox Partners Investment Management

[1] Please note that estimated performance has yet to be audited and is subject to revision. Performance figures constitute confidential information and must not be disclosed to third parties. An investor’s performance may differ based on timing of contributions, withdrawals and participation in new issues.

Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, FactSet or independent sources. Values as of 12.31.24, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notice.

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8