Equinox Partners, L.P. - Q3 2024 Letter

Dear Partners and Friends,

PERFORMANCE

Equinox Partners, L.P. rose +16.4% in the third quarter of 2024 and is up +25.9% for the year through September 30th. The positive performance for the quarter was driven by the revaluation of our largest position, Crew Energy, which was up +70% in the quarter on the news it would be acquired by Tourmaline Oil.

A breakdown of Equinox Partners exposures can be found here.

Crew Energy Investment Post-Mortem

On October 1st, Tourmaline Oil acquired Crew Energy bringing a decade-long Equinox Partners’ investment to a successful conclusion. Crew transacted for $1.15 billion USD, which included $960MM USD in Tourmaline shares and $190MM USD of assumed debt. The 72% premium Tourmaline paid resulted in an 11.6% IRR on our investment. This IRR, however, understates the positive impact Crew has had on our performance in recent years. Since we upsized our investment in Crew in the spring of 2020, Crew has been the most significant driver of our fund’s returns. Over the entire life of the investment, Crew contributed a cumulative +139% to our fund’s performance. Accordingly, we felt an investment review is in order.

Attracted by Crew Energy’s low-cost and long-lived natural gas reserves in British Columbia, we first invested in December of 2014. At the time of our initial purchase, the Canadian natural gas strip averaged CAD $3.75. If strip prices held, Crew would be able to grow its production at 20%+ per year for a decade with internally generated cash flow.

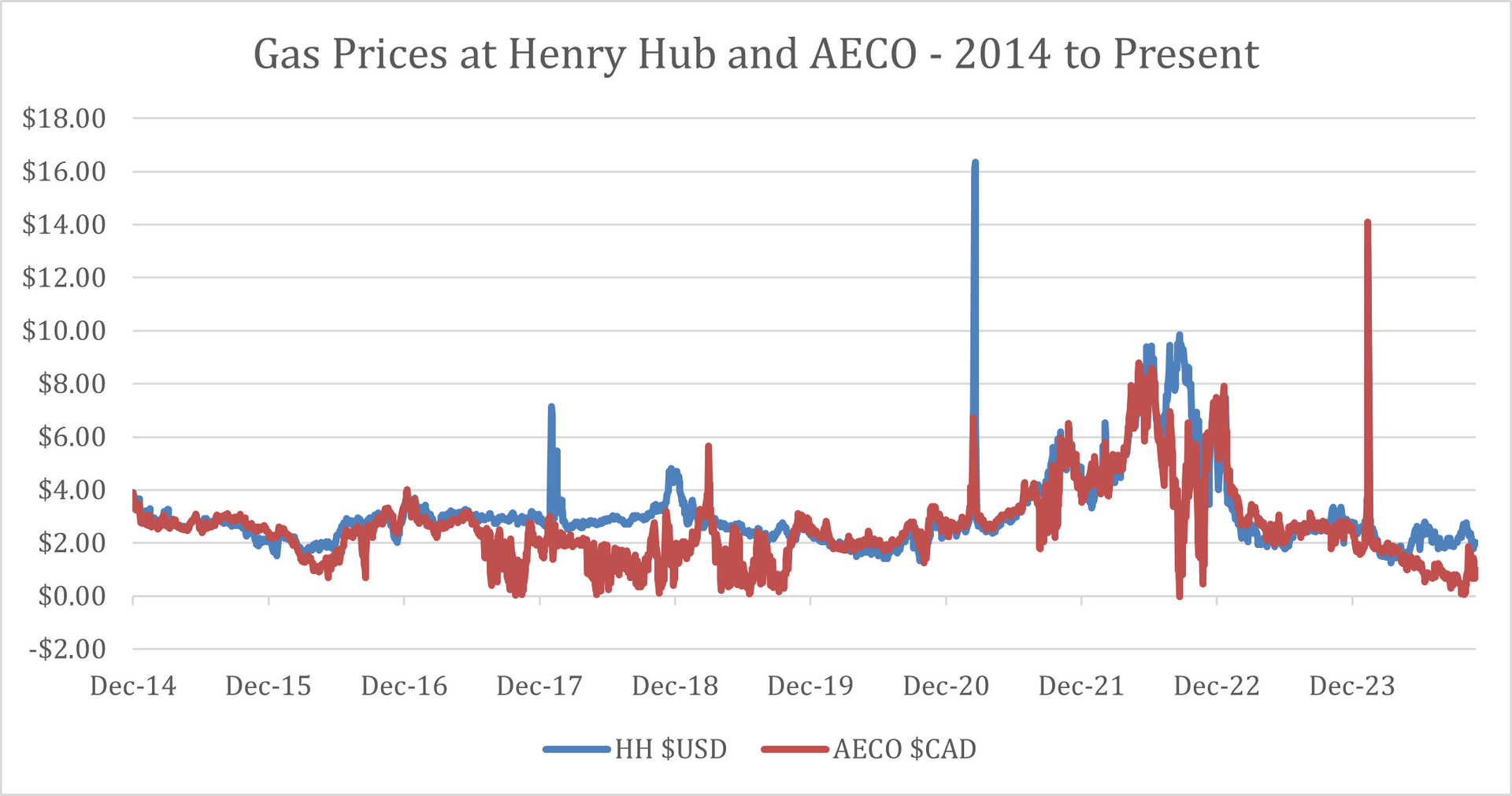

While our thesis about the quality of Crew’s assets was accurate, our assumptions about natural gas prices in North America proved too optimistic. The North American natural benchmark, Henry Hub, averaged just USD $3.09 over the past decade, and the Western Canada benchmark, AECO, fared even worse averaging CAD $2.59.

Source: TD Cowen

At the time of our initial investment, we understood that Western Canadian gas production would grow, but we failed to appreciate the extent to which Western Canada’s prolific Montney natural gas resource would overwhelm both Western Canadian demand and takeaway capacity. While Western Canadian demand and takeaway capacity both grew rapidly over the past decade, they never caught up with the even faster growth in Western Canadian natural gas supply. The result has been a decade of generally depressed natural gas prices in British Columbia and Alberta.

In this low gas price environment, Crew elected to take on debt to finance its ambitious growth plans. This proved ill-advised as continued weakness in gas prices gradually eroded Crew’s financial position. By the spring of 2020, Crew was poorly positioned for the COVID crisis which abruptly reduced the prices of natural gas and oil. At the lows in March of 2020, Crew traded at a market cap of just $15 million USD.

The collapse in Crew’s stock price was painful for us, but we continued to believe in the strategic value of Crew’s unique land package. Accordingly, we added to our position in March and April of 2020, increasing our ownership of the company from 8% of the shares outstanding to over 15%. As the market panicked, we calculated that the company’s stretched debt ratios were temporary, and that Crew would not face a liquidity problem given the principal on their debt was not due until 2024.

As expected, the COVID crisis receded, oil and gas prices rebounded sharply from their spring 2020 lows, and Crew’s financial ratios improved. But, despite the rebound in spot gas prices, a CAD $3 strip AECO price was still insufficient for Crew to internally finance the development of its massive land package in British Columbia. Crew, nevertheless, boldly published a four-year plan outlining a $1.5 billion CAD Capex strategy. This plan, while appropriate for a larger company, was not a strategy that Crew could prudently execute. Disappointed with the company’s inability to move forward, we joined Crew’s board with management's support at the 2023 annual meeting to seek an alternative path forward for the company.

Once on the board, we were pleased to find fellow board members with a deep knowledge of the business and strong shareholder alignment. It did not take long for Crew’s board to realize that the company's strategic assets and tax losses might prove attractive for a larger E&P company operating in Canada’s Western Sedimentary basin even in a weak natural gas environment. In clear confirmation of this assessment, despite paying a 72% premium, the Crew acquisition will be accretive to Tourmaline in year one.

While an 11.6% IRR is not an adequate return for Equinox Partners, it is not bad considering the price of natural gas fell by 74% during the decade in which we were invested. The ultimately positive outcome was possible as a result of two factors:

1) We invested in a high-quality asset

2) We added to our position at the right time

Upon closing of the all-stock transaction on October 1st, Tourmaline became our largest position. In our opinion, Tourmaline is the best natural gas company in North America and perfectly positioned to capture any upturn in natural gas prices looking into 2025 and beyond. Accordingly, we intend to hold a sizable position in Tourmaline for the foreseeable future.

The Importance of Oil Prices (Adapted from Sean's 10/1/2024 Grant's SpeecH)

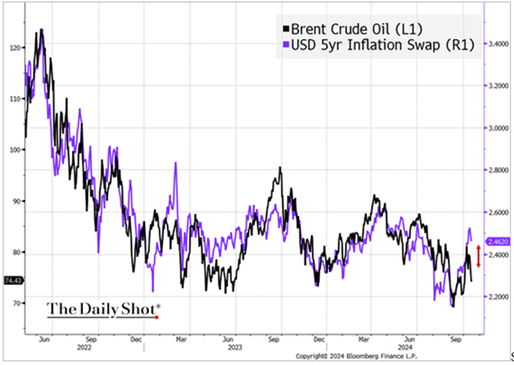

The threat posed by rising oil prices to the US economy and financial asset values is nothing new. Policy makers and market participants have long understood that rising oil prices tax the American consumer, increase inflation, and force the Fed to raise rates to keep long-term inflationary expectations anchored. Yet this general understanding misses how extraordinarily tight the correlation between oil prices and inflationary expectations has become in recent years. If this tight correlation holds in a rising oil price environment, inflationary expectations will immediately spike which in turn will have a negative impact on stock and bond valuations.

Source: Daily Shot, @TheTerminal - Bloomberg Finance, LP

While most investors are not sufficiently concerned about the threat posed to their portfolios by higher oil prices, American policy makers have honed-in on the potential risk. As the US Treasury market has become more illiquid and fragile, American policy makers have adopted a series of policies to forestall disruptive spikes in the oil price. The Biden administration, for instance, released ~270 million barrels from the strategic petroleum reserve and eased sanctions on Iran which in turn allowed Iranian oil exports to grow by more than 1 million barrels per day over the last three and half years. America has also sought to hem in OPEC’s power by stoking rumors about production increases and punishing American oil executives supporting OPEC’s policies. The targeting of Scott Sheffield and John Hess by Lina Kahn’s FTC sent a clear message to American oil executives to steer clear of OPEC and any talk of higher oil prices.

Regardless of who wins the Presidential election next week, America’s policy of oil price suppression will continue in the short-term. Vice President Harris will almost certainly maintain the oil policies of Biden, while Trump will pursue the same ends through different means. The proposed policy mix is different, but both Harris and Trump are clear proponents of lower oil prices as a means of anchoring American inflationary expectations. That said, regardless of who wins the election, we believe that the next President will have a hard time maintaining the pre-election intensity of the Biden oil price suppression scheme.

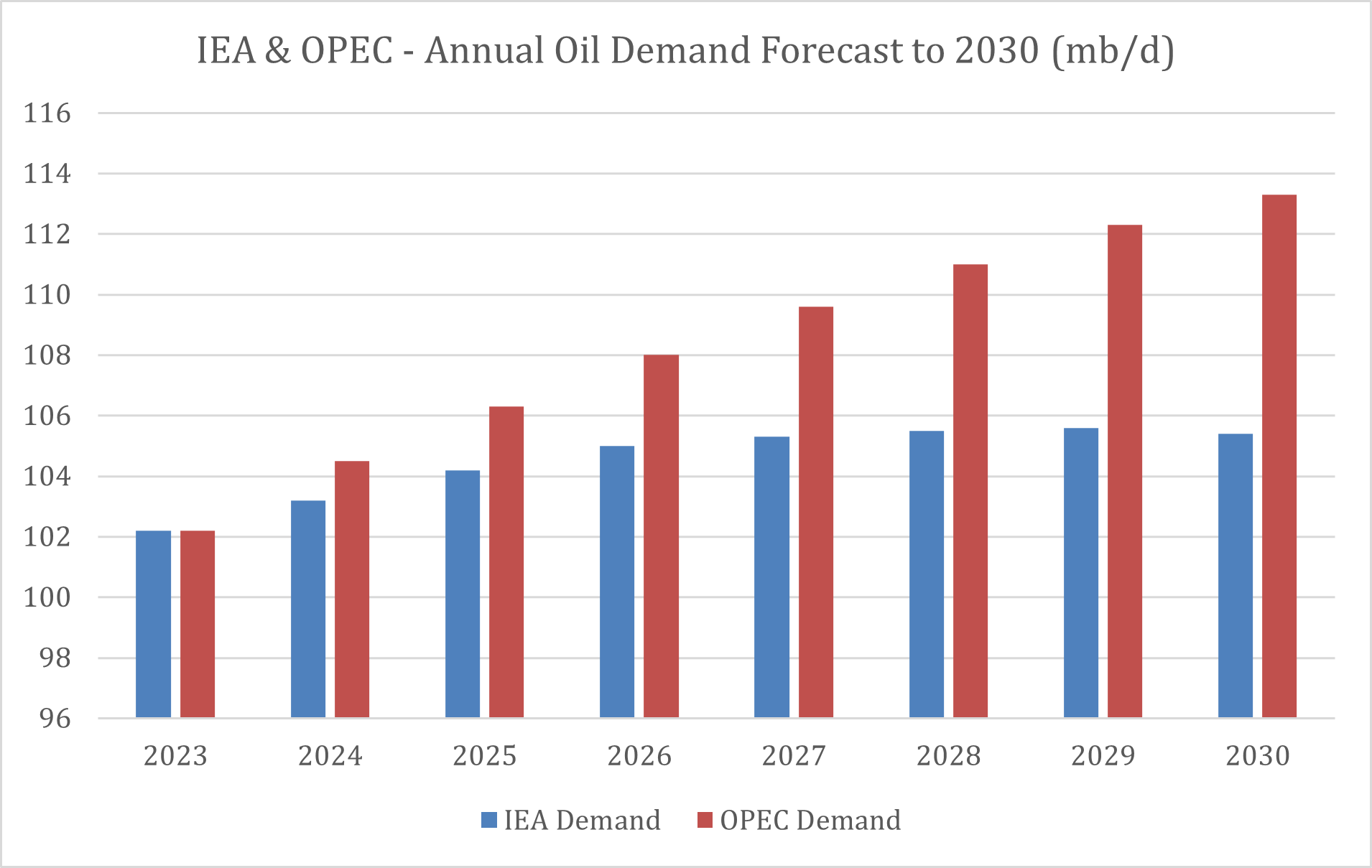

Over the balance of this decade, oil prices should succumb to supply and demand fundamentals. With respect to oil production, there is broad agreement. Both OPEC and the IEA estimate the global daily production capacity will grow to roughly ~114 million barrels by 2030. Their disagreement is over demand. IEA believes that world oil demand will grow less than 2 million barrels per day over the next six years and that the world will be awash in oil by 2030. OPEC forecasts almost 7 million barrels of growth over the same period and an oil market in balance.

Source: IEA Oil 2024, OPEC World Oil Outlook

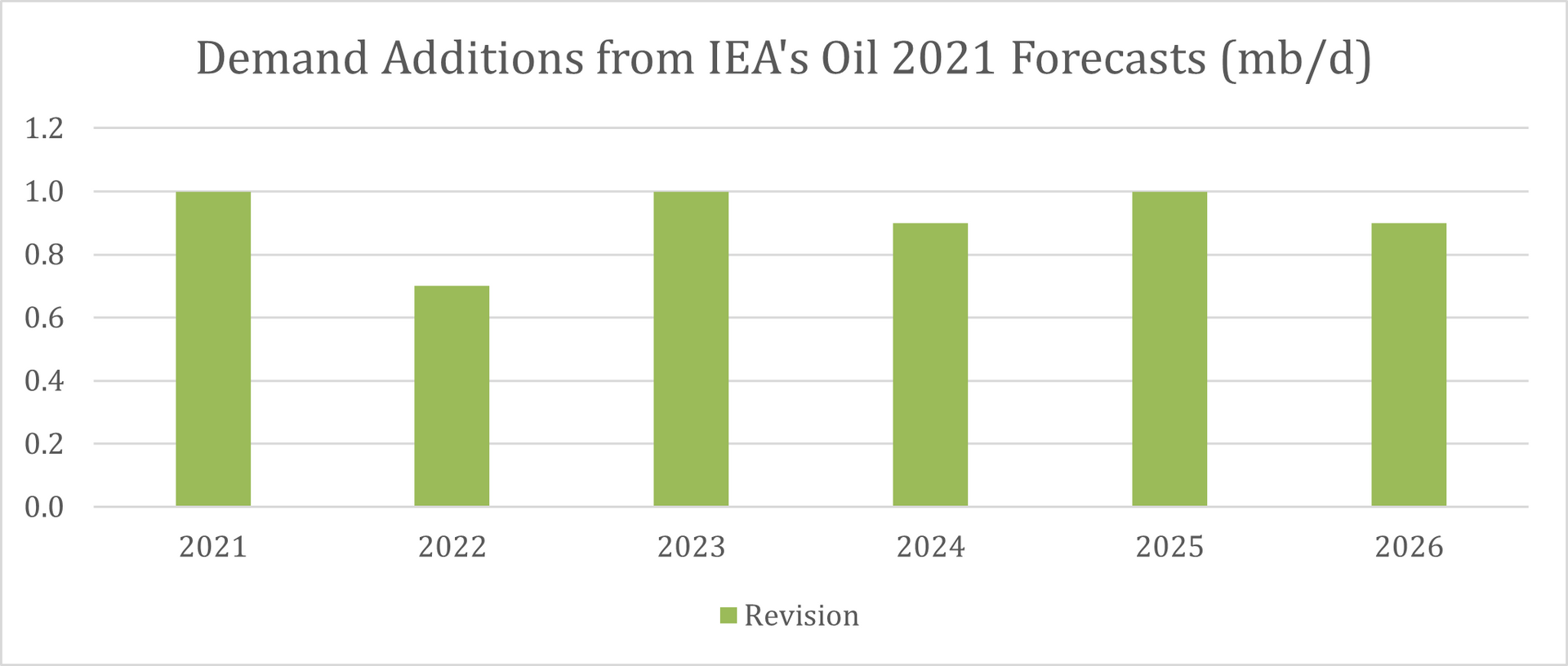

At the risk of saying something positive about OPEC, we think OPEC’s demand expectations are far more reasonable than the IEA’s estimate. OPEC estimates strike us as measured, rather than overly optimistic, anticipating a gradual reduction in OECD demand coupled with continued growth from emerging markets. The IEA figures on the other hand, reflect the agency’s historic pattern of strategically underestimating global demand. As the graph below shows, the IEA’s estimates have been about ¾ of a million barrels light for years.

Source: IEA Oil 2021, IEA Oil 2024

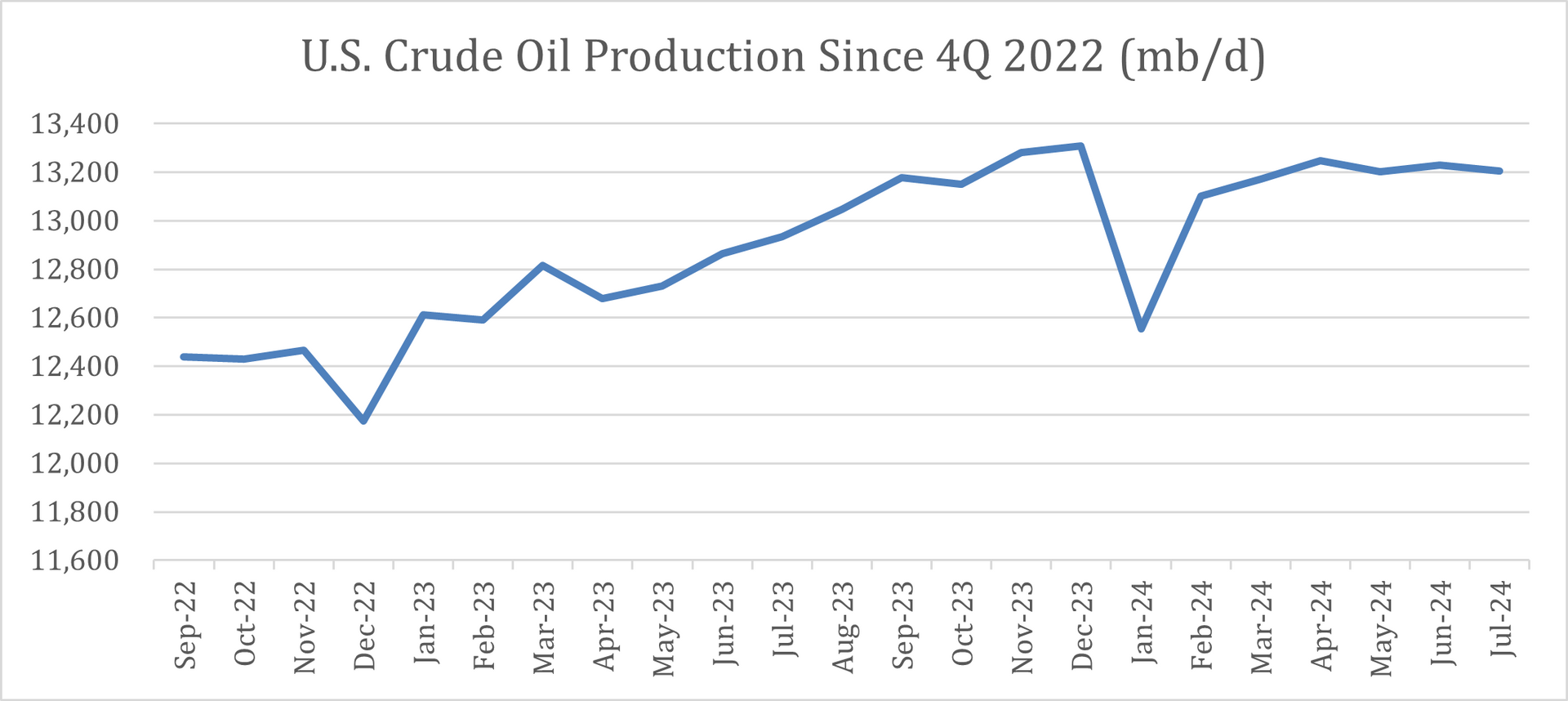

If US oil production eventually flattens out and declines, OPEC+ will take market share. In our estimation, increases in OPEC’s market share coupled with an inability of the US to respond by growing production, would translate into significantly higher oil prices. To this end, it is worth noting that US production has been flat for trailing 12 months as of the writing of this letter.

Source: TD Cowen

In the long run, we are confident that the current US policy of oil price suppression will not overwhelm oil market fundamentals. We do not even believe that oil price suppression is a logical long-term policy object of the U.S. Federal government. America is, after all, the largest producer of oil and gas in the world, and a net exporter of both. And, our near peer competitor, China, is the world’s largest oil importer, posting an 8.6 million barrels of oil per day deficit at last count.

Organizational Update

In October, Jeremy Nierman replaced Arthur Melkonian as our Chief Operating Officer. Arthur, our long-serving and highly competent COO will be building out of a family office in NYC. We wish him well and will miss his collegial presence in the office. Jeremy, our incoming COO, has served in a senior operational role at Pequot Capital and as COO of Hudson Executive Capital. We are confident that Jeremy and the rest of our non-investment team will continue to deliver the operational excellence which our partners expect.

Sincerely,

Equinox Partners Investment Management

[1] Please note that estimated performance has yet to be audited and is subject to revision. Performance figures constitute confidential information and must not be disclosed to third parties. An investor’s performance may differ based on timing of contributions, withdrawals and participation in new issues.

Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, FactSet or independent sources. Values as of 9.30.24, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notice.

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8