Precious Metals Fund - Q3 2024 Letter

Dear Partners and Friends,

PERFORMANCE

Equinox Partners Precious Metals Fund, L.P. rose +3.1% in the third quarter and is up +11.0% through the end of September 2024. Performance for the quarter was driven primarily by our group of explorers, with additional positive contribution coming from the producing segment of the portfolio. These gains were partially offset by the decline of one of our development stage companies which has experienced delays and raised additional capital.

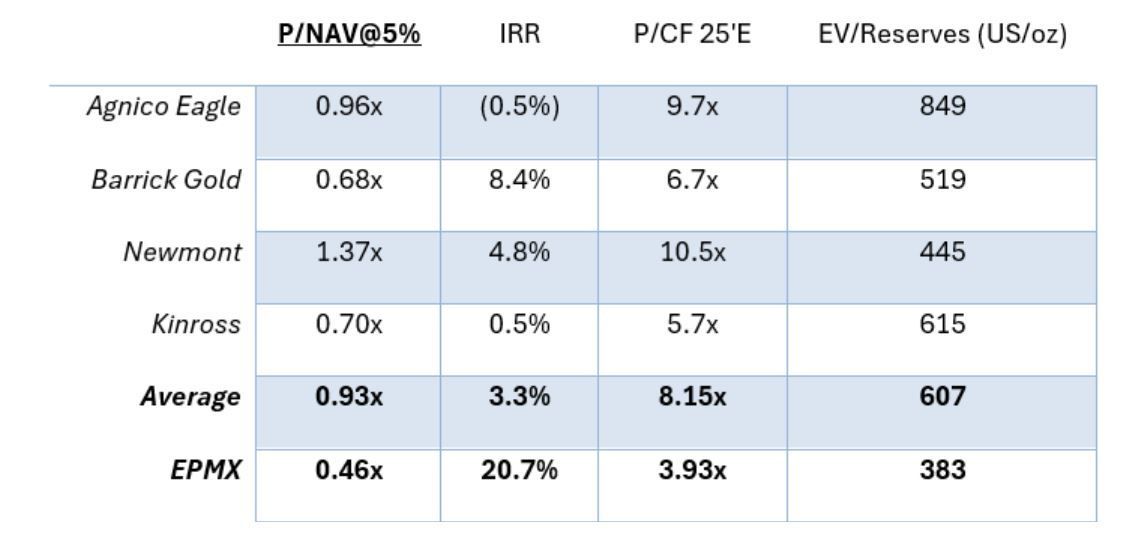

As our gold miners have lagged the indices, a substantial valuation gap has opened between the largest gold miners in the industry and the producing companies we own. At spot pricing, consensus sell-side models have Agnico, Barrick, Kinross and Newmont delivering an IRR of just 3%. Our portfolio of producers, on the other hand, models out to an IRR of 20% using the same metals price assumptions. There's substantial value in the gold mining sector, but the largest companies are not the ones to own.

Source: Equinox Internal Analysis

*Note on IRR calculation here – we use the current market cap of the company and then future free cash flow to equity.

A breakdown of Equinox Partners Precious Metals Fund's exposures can be found here.

the Benefits of Gold's Macroeconomic Irrelevance

For more than a century, the gold price was an explicit objective of US monetary policy. Even after Nixon ended the link between the dollar and gold, rising gold prices were seen as a sign of loose monetary policy and a predictor of future inflation. This relationship between gold and inflation was well enough established that Paul Volker expressed regret in his 2018 memoir for not doing more to contain the price of gold during his tenure as Federal Reserve chair. His successor, Alan Greenspan, did not make the same mistake. Greenspan promised Congress that central banks would help manage the price of gold if it rose too quickly, a promise that central banks delivered on in 1999 when the gold price spiked following the announcement of the Washington Accord.

Despite this deeply rooted historical correlation between gold and inflationary expectations, there is no direct or necessary link between gold and inflation or any other US macroeconomic indicator for that matter. Gold is not in the CPI; goods are not priced in terms of gold; and, the currencies of America’s trading partners are not tied to gold. Accordingly, if the market were to treat the gold price as irrelevant from a macroeconomic perspective, then it could be, which is exactly what has happened since February of 2022.

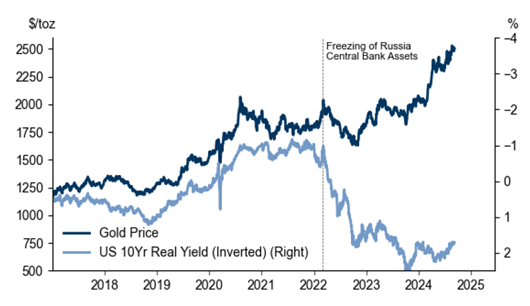

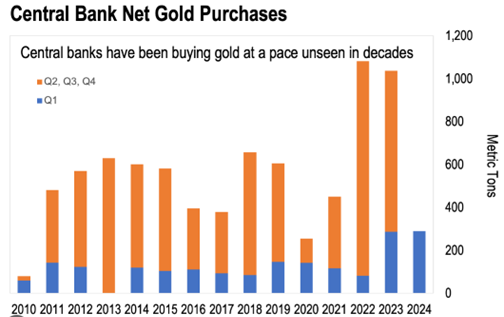

When Secretary Yellen seizure of $300 billion dollars’ worth of Russian FX reserves on February 28th, 2022[1], she broke the longstanding relationship between gold and inflationary expectations. Prior to that, financial investors buying gold for its financial characteristics dominated the gold market. Since then, central banks buying gold for its insurance and security characteristics have dominated the gold market. The 2022 breakdown in the correlation between inflationary expectations and the gold price can be shown by mapping inverted real rates against the gold price (below). The new dominance of central banker demand can be shown by the more than doubling of annual central bank gold purchases since 2022.

Source: Goldman Sachs Research

Source: Crisis Investing; Metals Focus, Refinitiv GFMS, World Gold Council

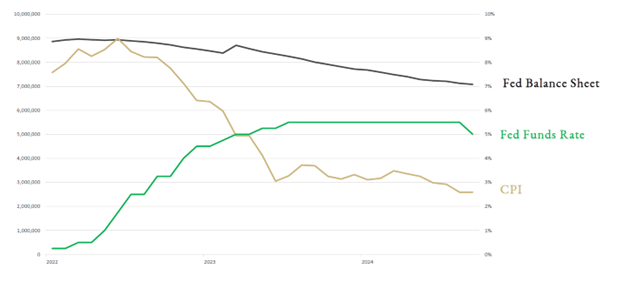

The freezing of Russia's foreign exchange reserves did more than break the long-standing correlation. It led to an unprecedented situation in which the Federal Reserve’s credibility as gold prices rose together. Beginning with a 25bps rate increase in the Fed Funds rate on March 16th, 2022, the Fed began tightening monetary policy. Over the ensuing two and a half years, the fed fund’s rate rose 525 bps, the Fed contracted its balance sheet by $1 trillion dollars and inflation fell from a peak of 9% to 2.7%. Over that same period, the price of gold rose from $1,900 to $2,700 per ounce.

Source: FRED

If gold could rise ~$800 an ounce as inflation declined and real rates increased, then perhaps gold could rise to $3000 or $4000 an ounce without having a meaningful impact on inflationary expectations or real rates. While most Western investors viewed the breakdown in correlations between gold and real rates as worrisome, the change has been an unmitigated positive thus far. The reason is simple: So long as gold remains broadly disconnected from US macroeconomic indicators, US policy makers no longer have any interest in keeping the gold price contained.

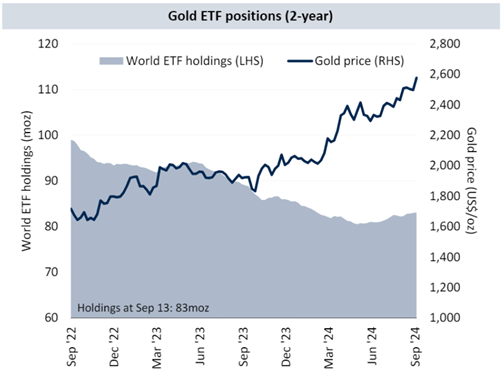

Western investors worried that the historical relationship between gold and real rates will reassert itself have largely missed the recent rally in gold. This lack of Western participation can be seen in the outflows of 15 million ounces from the gold ETFs, and the weak performance of junior gold mining companies. The GDXJ ETF is up only as much as the gold price, and smaller gold mining companies have fared worse. The value of undeveloped gold assets continues to trade at near all-time lows.

Source: RBC Research

The decoupling of gold from US macroeconomic indicators which has made gold more rewarding for investors has also made gold a much more interesting tool for policy makers. Prior to 2022, the revaluation of gold higher would have damaged policy makers’, especially the Fed’s, credibility. But there has not been even a hint of this historic relationship between gold and real rates of late. The macroeconomic irrelevance of gold means that this precious metal, a $19 trillion dollar asset class, can creatively be employed to absorb the massive capital flows created by today’s extreme trade and fiscal imbalances. In fact, gold is the only asset that could plausible be used to absorb the world’s trade surplus without triggering painful macroeconomic consequences.

While the exact contours of how central banks plan to reintroduce gold into the international monetary system is unclear, the probability of a reintroduction is growing. Central banks are spending hundreds of billions of dollars buying gold because they have a use in mind. And, while we don’t know how central banks intend to use the gold they are acquiring, all the more plausible use cases will be a massive positive for this asset that has been pushed to the margin of the world’s financial system over the past half century.

Sincerely,

Equinox Partners Investment Management

[1] Please note that estimated performance has yet to be audited and is subject to revision. Performance figures constitute confidential information and must not be disclosed to third parties. An investor’s performance may differ based on timing of contributions, withdrawals and participation in new issues.

Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, FactSet or independent sources. Values as of 9.30.24, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notice.

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8