Kuroto Fund, L.P. - Q3 2024 Letter

Dear Partners and Friends,

PERFORMANCE

Kuroto Fund, L.P. declined -0.8% in the third quarter of 2024 and is up +4.2% for the year through September 30th. Performance for the quarter was driven by a pullback in our energy holdings, which more than offset the gains in MTN Ghana and several of our financials.

A breakdown of Kuroto Fund exposures can be found here.

Kuroto Fund's Energy Investments Since SUmmer of 2020

Kuroto Fund began adding oil producers to the portfolio in August 2020. Today, we own four oil companies. Cumulatively, our portfolio of oil companies have added $5mn to our P&L, but more than all of this performance has come from one company, Seplat. By our calculation Seplat will be generating a free cash flow yield of ~28% once it consummates the acquisition of Exxon Mobil Nigeria early next year.

While our remaining portfolio of oil companies, in aggregate, have yet to contribute positively to our returns, they are executing and delivering strong fundamental progress. One of these portfolio companies we expect will complete an acquisition this month that should increase production by 60%. Two others should bring on long-delayed fields before year-end and we expect all three to release meaningful exploration results over the next six months.

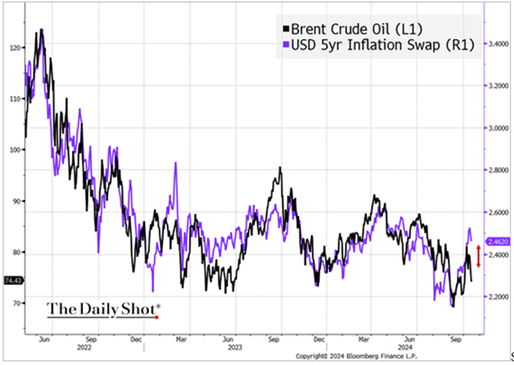

The Importance of Oil Prices (Adapted from Sean's 10/1/2024 Grant's SpeecH)

The threat posed by rising oil prices to the US economy and financial asset values is nothing new. Policy makers and market participants have long understood that rising oil prices tax the American consumer, increase inflation, and force the Fed to raise rates to keep long-term inflationary expectations anchored. Yet this general understanding misses how extraordinarily tight the correlation between oil prices and inflationary expectations has become in recent years. If this tight correlation holds in a rising oil price environment, inflationary expectations will immediately spike which in turn will have a negative impact on stock and bond valuations.

Source: Daily Shot, @TheTerminal - Bloomberg Finance, LP

While most investors are not sufficiently concerned about the threat posed to their portfolios by higher oil prices, American policy makers have honed-in on the potential risk. As the US Treasury market has become more illiquid and fragile, American policy makers have adopted a series of policies to forestall disruptive spikes in the oil price. The Biden administration, for instance, released ~270 million barrels from the strategic petroleum reserve and eased sanctions on Iran which in turn allowed Iranian oil exports to grow by more than 1 million barrels per day over the last three and half years. America has also sought to hem in OPEC’s power by stoking rumors about production increases and punishing American oil executives supporting OPEC’s policies. The targeting of Scott Sheffield and John Hess by Lina Kahn’s FTC sent a clear message to American oil executives to steer clear of OPEC and any talk of higher oil prices.

Regardless of who wins the Presidential election next week, America’s policy of oil price suppression will continue in the short-term. Vice President Harris will almost certainly maintain the oil policies of Biden, while Trump will pursue the same ends through different means. The proposed policy mix is different, but both Harris and Trump are clear proponents of lower oil prices as a means of anchoring American inflationary expectations. That said, regardless of who wins the election, we believe that the next President will have a hard time maintaining the pre-election intensity of the Biden oil price suppression scheme.

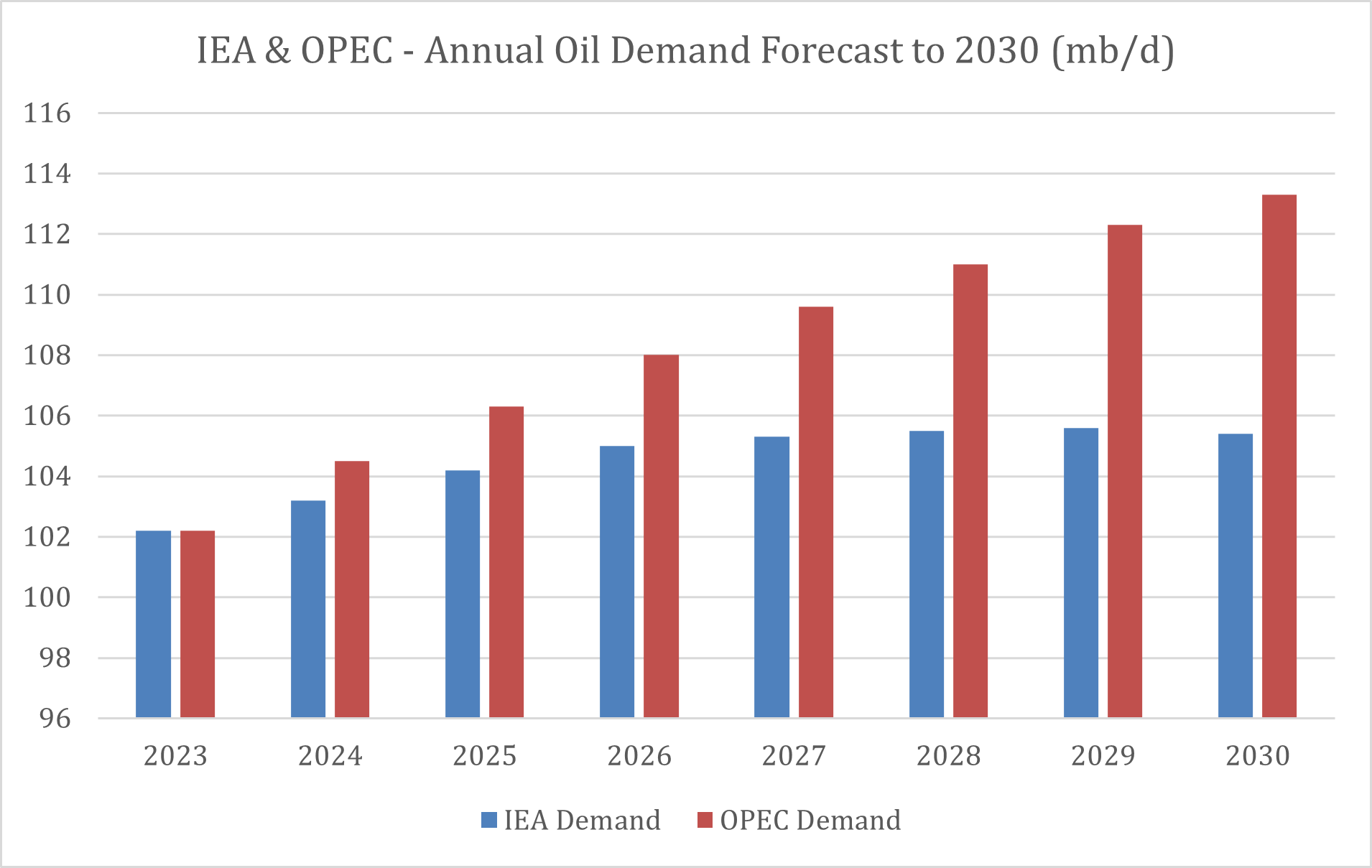

Over the balance of this decade, oil prices should succumb to supply and demand fundamentals. With respect to oil production, there is broad agreement. Both OPEC and the IEA estimate the global daily production capacity will grow to roughly ~114 million barrels by 2030. Their disagreement is over demand. IEA believes that world oil demand will grow less than 2 million barrels per day over the next six years and that the world will be awash in oil by 2030. OPEC forecasts almost 7 million barrels of growth over the same period and an oil market in balance.

Source: IEA Oil 2024, OPEC World Oil Outlook

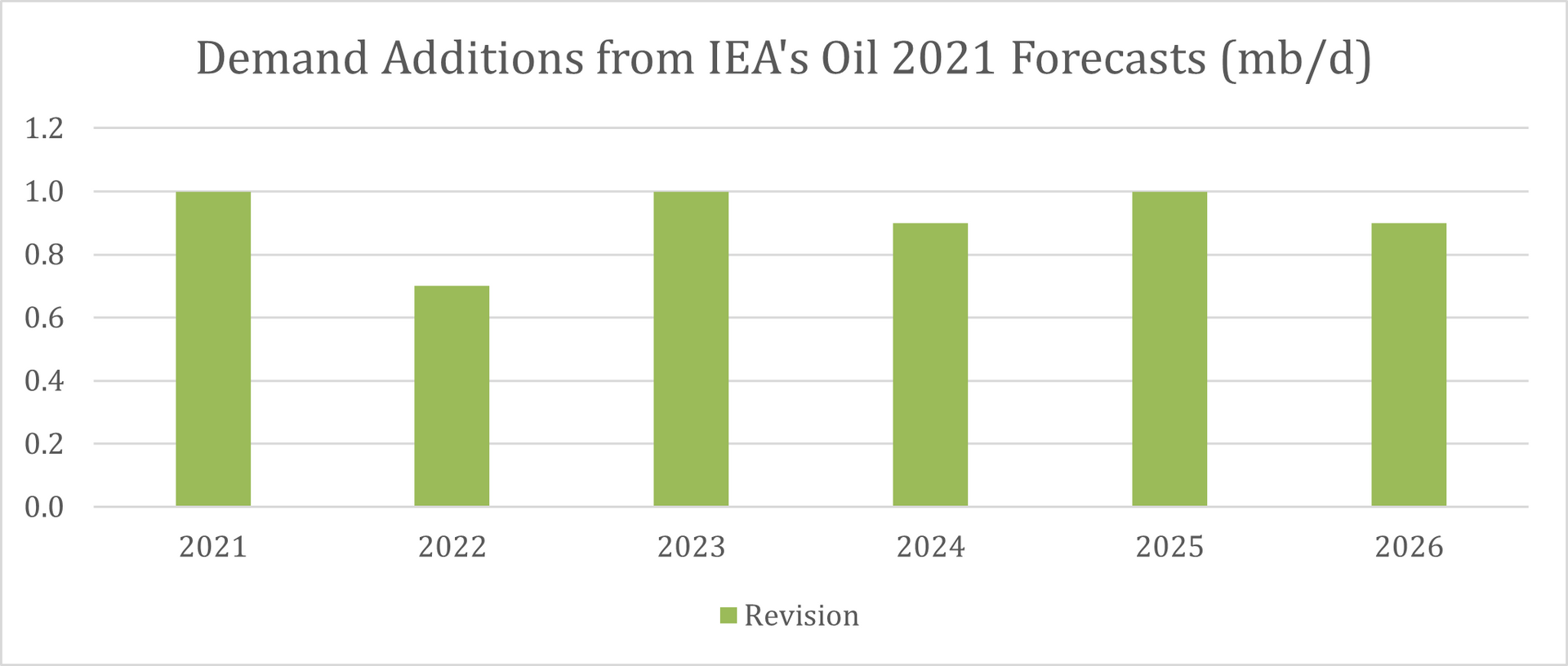

At the risk of saying something positive about OPEC, we think OPEC’s demand expectations are far more reasonable than the IEA’s estimate. OPEC estimates strike us as measured, rather than overly optimistic, anticipating a gradual reduction in OECD demand coupled with continued growth from emerging markets. The IEA figures on the other hand, reflect the agency’s historic pattern of strategically underestimating global demand. As the graph below shows, the IEA’s estimates have been about ¾ of a million barrels light for years.

Source: IEA Oil 2021, IEA Oil 2024

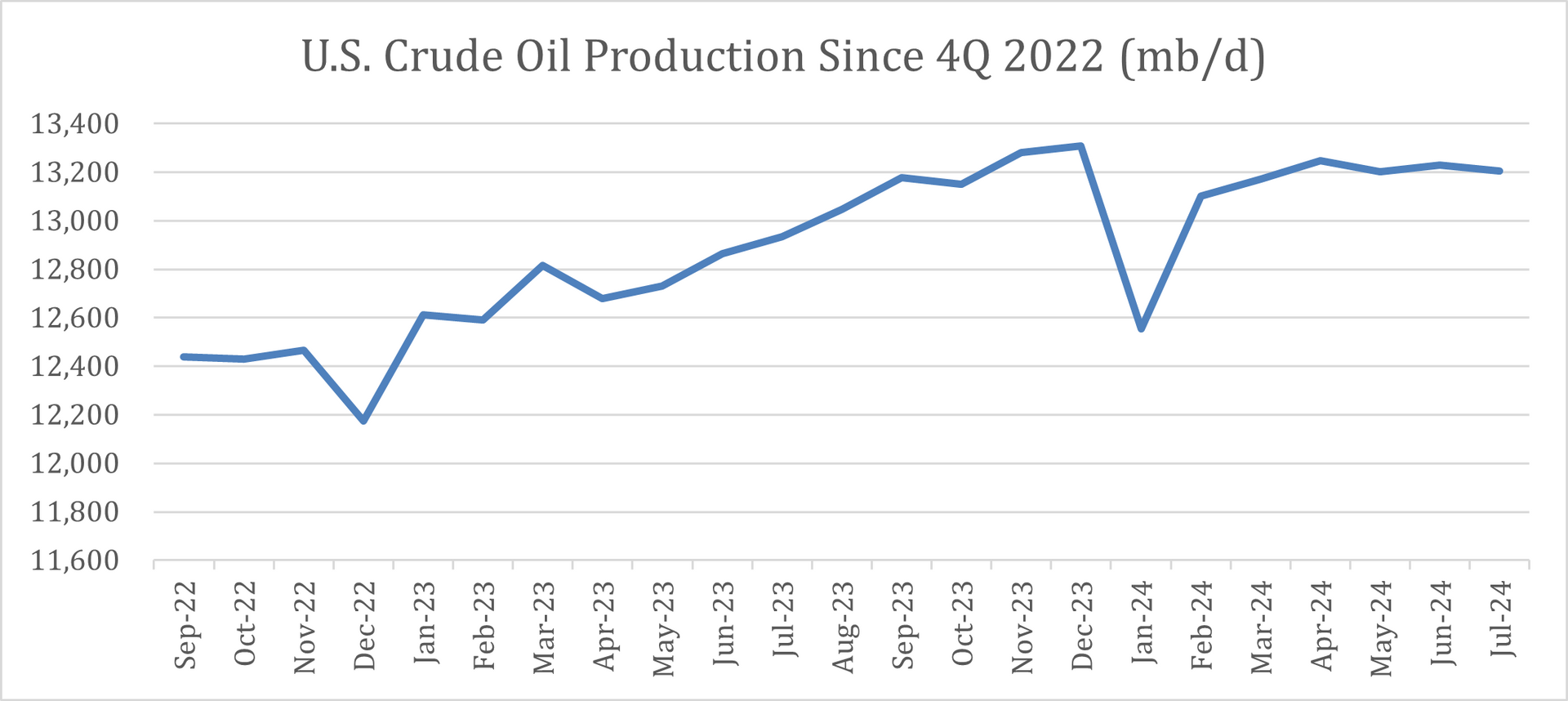

If US oil production eventually flattens out and declines, OPEC+ will take market share. In our estimation, increases in OPEC’s market share coupled with an inability of the US to respond by growing production, would translate into significantly higher oil prices. To this end, it is worth noting that US production has been flat for trailing 12 months as of the writing of this letter.

Source: TD Cowen

In the long run, we are confident that the current US policy of oil price suppression will not overwhelm oil market fundamentals. We do not even believe that oil price suppression is a logical long-term policy object of the U.S. Federal government. America is, after all, the largest producer of oil and gas in the world, and a net exporter of both. And, our near peer competitor, China, is the world’s largest oil importer, posting an 8.6 million barrels of oil per day deficit at last count.

Organizational Update

In October, Jeremy Nierman replaced Arthur Melkonian as our Chief Operating Officer. Arthur, our long-serving and highly competent COO will be building out of a family office in NYC. We wish him well and will miss his collegial presence in the office. Jeremy, our incoming COO, has served in a senior operational role at Pequot Capital and as COO of Hudson Executive Capital. We are confident that Jeremy and the rest of our non-investment team will continue to deliver the operational excellence which our partners expect.

Sincerely,

Equinox Partners Investment Management

[1] Please note that estimated performance has yet to be audited and is subject to revision. Performance figures constitute confidential information and must not be disclosed to third parties. An investor’s performance may differ based on timing of contributions, withdrawals and participation in new issues.

Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, FactSet or independent sources. Values as of 9.30.24, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notice.

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8