Equinox Partners, L.P. - Q1 2020 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Equinox Partners lost -48.2% in the first quarter of 2020.

The first quarter of 2020

For a brief moment on Monday, February 24th, with gold up $85 and the S&P 500 down 5%, our decision to avoid U.S. stocks seemed like it was finally going to pay off. Not only were stock prices declining but the market was anticipating the fiscal and monetary response to these declines. Gold, it appeared, would become a must-own asset for a broader swath of investors. We were particularly well positioned, confident that if even a small fraction of the world’s wealth moved into gold, the price of gold and gold miners would rise dramatically.

Unfortunately, gold’s late-February high proved fleeting. As stocks crashed, gold also traded down as investors scrambled for U.S. dollars. Worse still, gold mining stocks began falling much faster than the stock market. At its lows on March 13th, the GDXJ gold mining index was down 48% for the YTD. The S&P was down a comparatively modest 16% at that point. Our positioning for the end of the bull market was dead wrong.

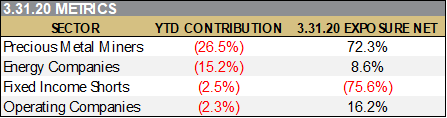

As of March 31st, our mining companies were down 40%, our E&P investments were down 80%, and our emerging market companies were down 15% for the year to date. Our fixed income shorts gained 4% in the first quarter, adding to our losses. As a result, Equinox Partners ended the first quarter of 2020 down 48%. We’ve managed to lose money in both the bull market in financial assets as well its end. That said, we are confident that the current chapter in financial history is far from over.

2020 Versus 2000

As in 2000, we believe that Equinox Partners’ current drawdown is a prelude to serious outperformance. Even the magnitude of this year’s decline is similar to what we experienced in late 1999 and early 2000. While our portfolio in the fall of 1999 was perfectly positioned for the next eight years, it declined 55% from the beginning of October 1999 through March 2000. During that six-month period, as in the first quarter of 2020, everything went against us. Then, over the following eight years, our fund increased fourteen-fold as the S&P rose just 1.5% cumulatively.

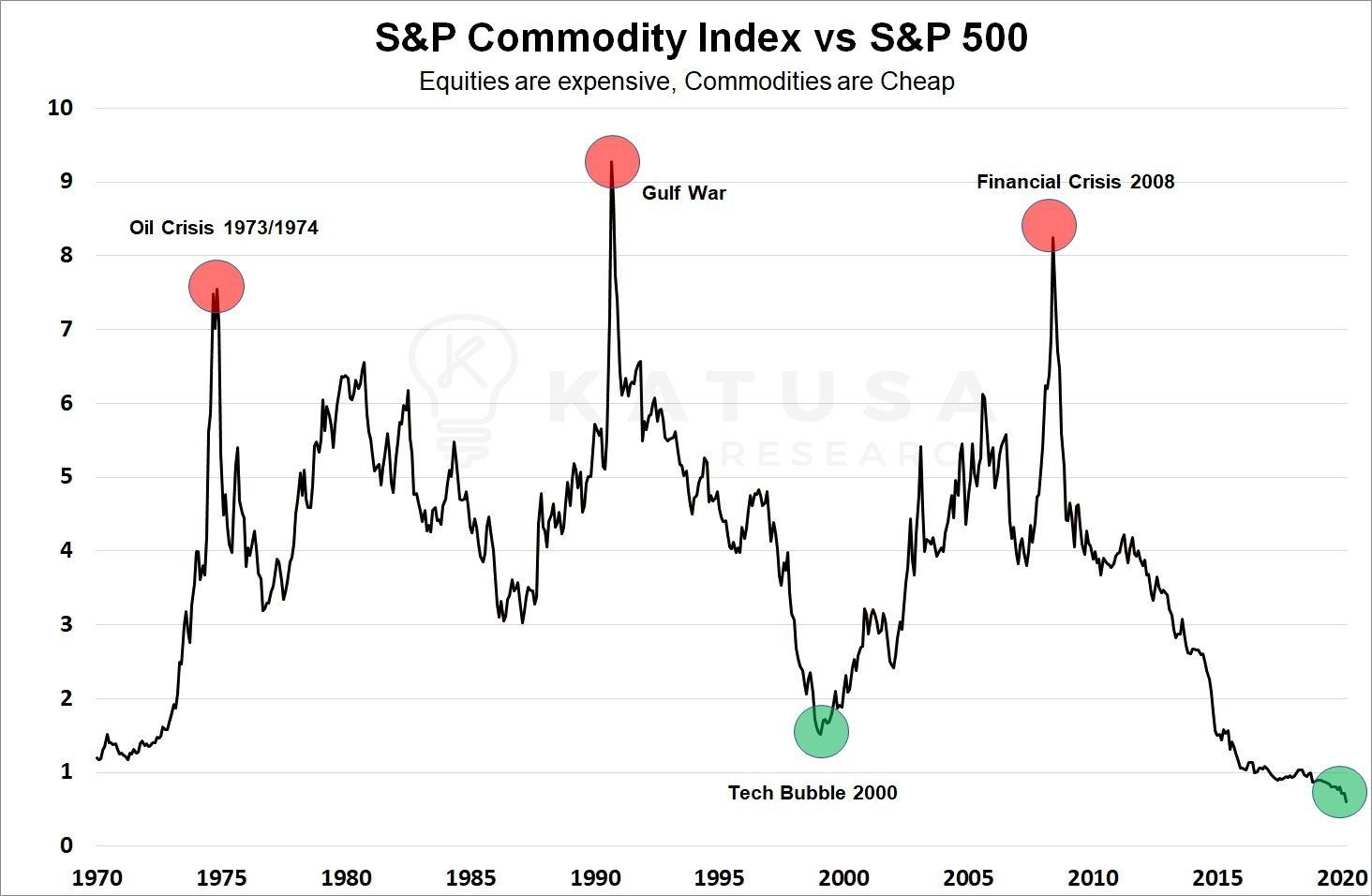

A confluence of factors contributed to the fund’s precipitous turn of the century and first quarter of 2020 declines. But, both periods are characterized by extreme peaks in financial assets and extreme lows in global commodity prices. The fifty-year graph of the S&P commodity index divided by the S&P 500 accurately captures these long-term trends. It is worth noting that by this measure, commodities are much cheaper today in relation to the S&P 500 then they were at the height of the tech bubble in early 2000.

Our eight-year run from April 2000 to February 2008, during which we compounded at 40% per year, was a result of many factors. First and foremost, post-peak 2000, we were mercifully free from the temptation to buy still-overvalued stocks just because they had declined. Our resistance to this temptation was in stark contrast to investors who participated in the tech bubble of the late 1990s and who struggled for years to buy anything other than the companies that they owned at ever lower prices.

Today, as in 2000, our companies simply jump off the page. Take Dundee Precious Metals and TBC as two cases in point. Dundee Precious Metals is a net-cash company with a market cap of $560m USD that we estimate will generate ~$175m of free cash flow in each of the next three years. There’s simply no reason why this company should trade at just 3.1x free cash flow. TBC, the best bank in the nation of Georgia, currently trades at 60% of book and at less than 3x trailing earnings. While it’s too early to tell how much TBC’s provisioning will increase and income will decline in 2020 because of the corona virus, we are confident of two things. First, TBC’s book value will not be impaired. Second, TBC will be able to generate a 20%+ ROE post-crisis. We haven’t seen valuations this compelling since 2000, not even at the lows of 2008.

In macroeconomic terms, 2020 is nothing like 2000. The macroeconomic imbalances of 2000 seem positively benign when compared to today’s situation. Both the Fed and the federal government have already taken unprecedented steps within two months of the stock market top. We expect the government’s “bold, persistent experimentation” to continue until such efforts prove obviously futile. We will manage our 9% short equity position accordingly, and we expect to generate most of our future returns from our undervalued longs.

Our Biggest Mistake

For more than a decade, first world central banks have adeptly supplied liquidity at the right moment and then balanced the supply and demand for U.S. Dollars, Yen, and Euros so as to keep inflationary expectations anchored. It seemed impossible to us that central bankers could manage this complicated dynamic, but they’ve done it over and over again. Broad disinflationary forces in the world economy gave central bankers free license to set the most important price in the economy, interest rates.

As a result of their success, our government bond shorts have been a disaster. Developed world central banks have ratcheted up the price of government bonds year after year, costing us and our partners over $200 million on a cumulative basis since 2008. We remain surprised that bond investors proved so eager to front-run central bank largess without any apparent concern about fiscal deficits. The market’s willingness to lend money to governments that can never pay it back is not a new phenomenon, but the eagerness to do so at ever lower rates is.

We were further mistaken not to anticipate that bonds would rally in a stock market crash even as deficits blew out to unimaginable levels. We are guilty of wishing that the markets wouldn’t rush to lend governments money even as they spent ever more profligately. In retrospect, we should have known that the central banks would set the price for their own government’s debt at ever higher levels until they had thoroughly debased their currencies.

Interestingly, government bonds in the U.S. not only rallied as stocks crashed this year, but they also rallied as stocks rose. The U.S. 30-year bond had already appreciated 8% for the year to date as the stock market peaked on February 19th. As the stock market crashed, the 30-year bond rallied even further. At its peak, the U.S. 30-year bond offered a yield of less than 1% and was up an amazing 35% for the YTD. Bonds started the year on a tear and rose further as the economic situation deteriorated. In the end, this year’s abrupt, unidirectional bond rally endangered our other positions, and we covered a majority of our fixed income shorts in the first quarter, crystalizing our losses.

The End of the Fed's Balancing Act

Even if the Fed could print just the right amount of money to stabilize the economy without unmooring inflation expectations, we doubt this intervention would lay the groundwork for future economic growth. Can we honestly expect Americans to resume their pre-crisis rate of debt-fueled consumption now that they know their life and work can be disrupted by a virus at any point? The federal government, as powerful as it is, cannot simply pass a Collective Amnesia Act to get everyone to go on borrowing and consuming as though nothing happened.

Accordingly, there are two plausible ways to lay the groundwork for sustainable economic growth: debt reduction via bankruptcy and debt reduction via inflation. Making debt worth less in real terms without making money worthless is unlikely, but the possibility of less pain is always more politically attractive than the tough medicine of debt restructuring. Therefore, we believe that policymakers will attempt an orderly transfer of wealth from creditors to debtors.

The problem is that a gradual transfer of wealth is unlikely to spur debt-fueled consumption anytime soon. We’ve reached a point that only intentionally irresponsible monetary and fiscal policy will generate more economic activity. People, even scared people, will anticipate their purchase of a new car or a house if the price of that car or house is rising fast enough. The trick for policy makers is achieving that fear of rising prices without creating too many negative externalities. A string of Fed officials touting their infinite ability to print money on TV certainly looks like an attempt to signal their irresponsibility. We doubt that signal will be enough. We suspect the Fed will actually have to deliver on some inflation to spur consumption. While presumably well intended, this monetary strategy coupled with supply shortages will make for a particularly punishing environment for the American consumer.

On a happier note, the message of monetary irresponsibility has already registered with gold and silver retail investors. The physical supply of both gold and silver is tight, and premiums are high in the retail market. Roy Sebag, the CEO of Goldmoney which holds over $2 billion of gold and silver metal, has gone on record detailing the trouble he is having acquiring physical gold and silver at reasonable premiums. How it is that gold and silver ETFs continue to acquire massive amounts of physical metal at no premium while others cannot, is a growing mystery.

Should today’s physical shortages of gold and silver persist, investors will likely change the way they hold their precious metals. In normal times, investors prefer the convenience of holding gold and silver in its de-materialized form: paper. But at times of financial stress, those same investors often decide they would rather own the physical metal. When this happens, the investors inevitably discover that there is not enough physical metal to go around, and the price spikes. This is the exact situation that gold and silver markets are in today.

oil & gas: the capitulation

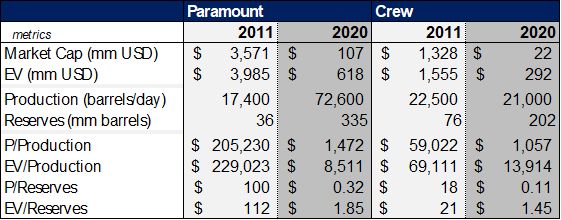

The oil war/corona virus combination finally forced the capitulation of a global oil industry that has been in a bear market for years. While $20 oil is obviously not sustainable, the industry has destroyed so much wealth that there are few asset allocators willing or able to invest based on 2021 or 2022 energy prices. The share prices of our two largest E&P companies have declined precipitously in this environment. Crew and Paramount are down 71% and 84% for the year to date and are down 98% and 96% from their 2011 peaks. Together these two companies have generated a loss of $94 million for our partnership over the past decade.

Amazingly, both of these companies have grown significantly since 2011. As such, on an enterprise value basis, we’re currently paying under $14,000 per flowing barrel per day at Crew and $8,500 per flowing barrel per day at Paramount. On a reserve basis, these companies are even cheaper. Today we are paying $1.45 for each barrel of reserves at Crew and $1.85 for each barrel of reserves at Paramount. Excluding the companies’ debt, the price per barrel of production and reserves of these two companies is just stupid.

The stock market clearly believes that E&P companies that have high debt-to-EBITDA ratios are not going to survive. As such, Crew and Paramount are likely worthless and certainly worth nothing more than an out-of-the-money option on much higher energy prices. This analysis overlooks the fact that today’s oil prices are in large part the result of a deliberate effort on the part of both Russia and Saudi Arabia to depress the oil price. Their attack on U.S. shale is working better than they could have imagined. As of this week, U.S. companies have already begun filing for bankruptcy. Whiting Petroleum sought protection from its creditors last week, and Callon and Chesapeake have hired restructuring advisors.

While the news of distressed liquidations seems bad, the lower oil prices go now the more quickly they will recover and the higher they will eventually be. Irresponsible, low-cost debt capital won’t be available again for U.S. producers for years. As such, those North American E&P companies that can weather the storm should enjoy years of strong returns as the industry insists on higher cash-on-cash returns.

Finally, it is worth noting that persistently low oil prices will improve the long-term fundamentals for natural gas in North America. In the unlikely scenario in which oil prices stay in the $20 range for the rest of the year, we’d expect natural gas prices to move up dramatically in 2021. Natural gas has not suffered demand destruction to the same extend that oil has, but capital budgets for new gas production are being cut along with oil budgets. For both Crew and Paramount, $4 gas would be even better than $50 oil.

Sincerely,

Sean Fieler

[1] Sector exposures shown as a percentage of 3.31.20 pre-redemption AUM. Performance contribution is derived in U.S. dollars, gross of fees and fund expenses. Interest rate swaps notional value and P&L are included in Fixed Income. P&L on cash is excluded from the table as are market value exposures for derivatives. Unless otherwise noted, all company data is derived from internal analysis, company presentations, or Bloomberg.

[2] From April 2000 to February 2008

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8