Mine Visit Note: Orezone

EQUINOX PARTNERS - Precious Metals Miners

Site visit - Orezone Gold Corporation

july 2022 Note and Videos

Watch our Research Room on Orezone

Dates July 25, 2022

Mines Visited Bomboré

Countries Visited Burkina Faso

Equinox Team CIO, Sean Fieler | Analyst, Stephen Saroki | Head of IR, Daniel Schreck

OVERVIEW

Orezone Gold Corporation (ORE Canada) is a development-stage gold mining company that owns the Bomboré asset located just south of the capital of Burkina Faso, Ouagadougou. They are in the process of building the asset, with first gold pour expected in Q3 of 2022. While in a tough jurisdiction, management has skillfully organized financing and put together a construction team that is on track to deliver the project on time and on budget in our view.

metrics

Market Cap $358 million USD

Enterprise Value $405 million USD

EV/CF 2.7x 2023 cash flow estimate

P/NAV (5% discount) 0.48x

Resources 6.2m ounces of gold

EV/Resource $66 per ounce of gold

Reserves 1.8m ounces of gold

EV/Reserve $221 per ounce of gold

AISC ~$900 per ounce estimate once in production

Thesis

We expect Orezone’s Bomboré build to be a real triumph in the mining space. While others have struggled with both schedules and budgets (IAMGOLD’s Côté and Argonaut Gold’s Magino), Orezone is tracking to be on time and on budget with the entirety of the mine build occurring during COVID. Trading at less than half of NAV, not including resources outside of reserves or exploration, Orezone should experience a re-rating as it goes from developer to producer. The additional upside in terms of its resource, the upsizing of its sulphide circuit, and the excellent exploration results, suggest that the market hasn’t internalized the opportunity here, in my view.

Trip summary

We've owned Orezone for years, seeing the company and project progress along the way, especially so in the last few years. Now, with Bombore supposedly only a month away from production, we wanted to assess the project and progress for ourselves as a part of our ongoing research and diligence. Making our way from the Ouagadougou to the mine site in the morning, Sean, Dan, and I were able to meet the team. We saw the processing facility, visited one of the oxide pits, the tailings storage facility, the off channel reservoir, and the core shack. We had excellent access to the team, and were able to conduct a thorough assessment of the project.

Management and governance

This visit was focused on the operating team. All in all, this is an impressive team, especially for a junior mining company like Orezone to put together. In getting to chat with them, it was clear that they were well organized and focused. In addition, they have all of the skill sets necessary to deliver the project.

John Le Roux, General Manager: He’s been everywhere in his 30 years in the mining space. This includes the Ok Tedi Mine, which at the time was owned by BHP Billiton and is one of the more prolific mining deposits in history. He improved operations there and told us that it is the only time in his mining career that he was asked to slow the rate of improvement. Previous to Orezone, he was the GM for NordGold’s 3 mines in Burkina Faso. He also held senior positions with AlacerGold, Eldorado Gold, and Centerra Gold, spending time in Turkey and the Kyrgyz Republic. He is an outstanding get for Orezone.

Ricardo Rodrigues, VP Projects and Project Manager: Previously worked as the construction manager for Perseus Mining, where he built Sissingué and Yaouré (Côte d’Ivoire), managing Lycopodium in the process. Sissingué was ahead of schedule and on budget and Yaouré was ahead of schedule and under budget. Importantly, he was able to complete a mine on time and on budget during Covid. If I were to be building a gold mine in West Africa, Mr. Rodrigues would be on my short list of candidates to consider to lead the build. He's working with basically the same team to build Bombore.

Pascal Marquis, Senior VP Exploration: He has 35 years of mineral exploration experience, having worked at Agnico Eagle and Trillion Resources prior to joining Orezone in 2002. From discussions, he has been a long-term holder of Orezone's stock. He’s got a ton of experience in West Africa exploration, which is especially important because not all rocks are the same. He leads the geologist exploration team of four. Pascal stressed that he is IRR conscious and not just digging for rock: for instance, having built the water reservoir close to the local river using a simple gravity-fed sluice.

Ousseni Derra, Country Manager: A native Burkinabi, Mr. Derra plays a vital role in exploration, permitting, and government relations. A geologist by training, he makes sure that the Orezone has the capability to operate in a continuous and unobstructed fashion. Prior to joining Orezone in 2009, he worked for Billiton Metals, Goldfields, and Ashanti Goldfields.

Watch our Research Room episode on Burkina country risk

JURISDICTION

The general perception of Burkina Faso is heavily influenced by international headlines. Between jihadist activities and coups, most investors are reticent to want to underwrite investments there. But despite this noise, we view it as one of the better mining jurisdictions in the world. Land concessions are easily attained. Exploration permits are readily given. Mining permits generally come within 12 months. To provide some context, even in Tier 1 jurisdictions like Canada, many projects take 4 to 5 years to permit. The government in Burkina understands the economic proposition offered by mining and enthusiastically supports the industry. The people line up for jobs as they pay considerably 3-4 times more than any alternatives available to them.

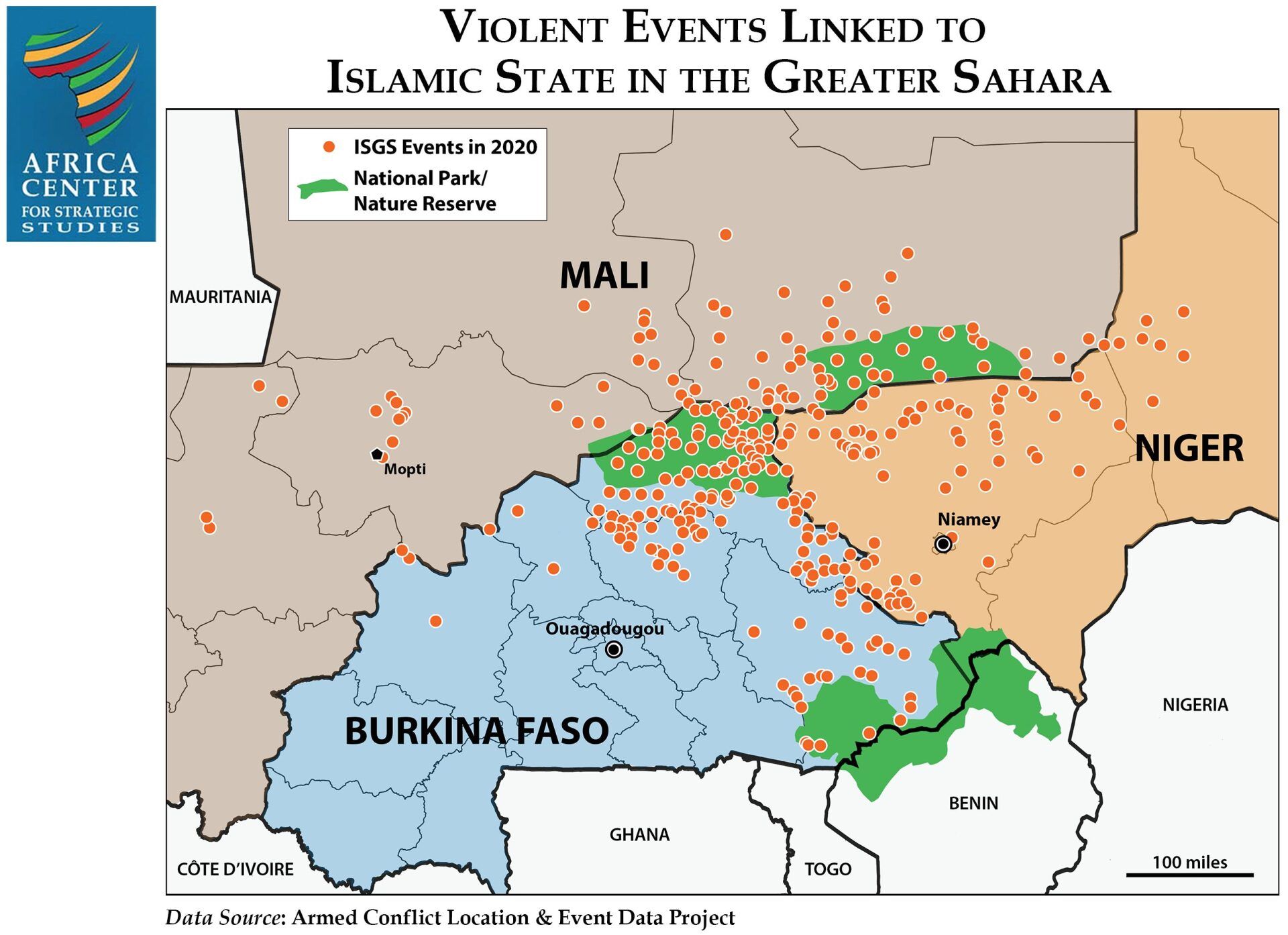

While there has been a rise in violence committed by jihadist militants, which is obviously concerning, our travels indicate that the corridor south of Burkina Faso’s capital (Ouagadougou), where Bomboré is located, remains a safe area in the country. We spoke with the head of security and saw some of his 20-person team. They have extensive local contacts in the villages which is essential for intel. The local community of around 15,000 people wants Orezone there due to the good, high-paying jobs and stability. There is a local military base nearby.

We actively track the security situation throughout the country, and find that the lion’s share of issues occur in the northeast and eastern portion of the country (see map). For example, Nordgold recently closed its Taparko mine, which is located 200 km northeast of Ouagadougou. However, the binary nature of security in the country is such that one region is very safe, while another is anything but. It is incumbent on miners to secure their site and logistics supply chain. While concerning from a headline perspective, security tends not to affect mining operations. In fact, we’ve recently come across a lot more difficulty in Latin America on that front than we have in West Africa. Even the coup in Burkina Faso in January 2022 had no impact on mining operations. In talking with people at the mine site, they seemed to suggest it was meaningless, having no effect either on the mine or the lives of the people.

Corporate Social Responsibility (CSR)

One of the more remarkable things about Burkina Faso is that mining constitutes the vast majority of direct foreign investment. There are no Starbucks or McDonalds, not even in the capital city. Google and Facebook will not be opening offices there any time soon. Mining, on the other hand, has brought in billions of dollars in investment to the country. In addition to the 10% free carried interest, ~4% royalty, and 27.5% tax rate, the project in operation will employ about 500 hundred people, with over 90% of these people being Burkinabe. Even what is ostensibly a low-paying job as a truck driver pays more than 4x the annual per capita income in the country. Mining promotes economic development, and is offering the people of the country an opportunity for a better life. According to the team, the Burkinabe people are the best and hardest workers regionally, and even globally. Given the regional importance of gold mining, and to Burkina in particular (80% of export value), there is a strong ecosystem of geology schools and company-specific advancement.

catalysts

The primary catalyst for Orezone is going from developer to producer, as there is commonly a multiple re-rating. Exploration will also serve as a focus as the company begins the show the potential of the land package, especially in the P17 zone. In addition, the sizing up of the sulphide circuit relative to market expectation should serve to improve the economics and NPV of the project.

bombore

Production: Expected first gold pour in Q3 2022, which we think they will hit.

The Processing Mill:

1. We weren’t able to walk through the mill since the construction team is actively putting on the final touches. We could see all of the major parts from a distance, discussed each, and had a quick handshake with the commissioning manager from the Lyco team whom Ricardo worked with at Perseus.

2. They’ve commissioned 70% of the systems, including all of the front end parts of the mill (Conveyor, Ball Mill, etc.). The only parts they haven’t commissioned (at least as of our visit) are on the back end of the flow sheet: the elution circuit (where gold is separated from carbon and returned to solution with the use of a concentrated cyanide solution) and the gold room (where a gold sludge is delivered, dried, and smelted resulting in doré gold bars).

3. In addition, Lycopodium, who is the contractor for the processing mill build, has a sterling track record of delivering projects on time, on budget, and with the ability to do 15-20% above nameplate capacity, which for the initial circuit at Orezone is 5.2 million tonnes per annum (Mtpa). In this case, Ricardo thinks they’ll be at 70% of name plate for about a week before quickly ramping up to full production.

4. Finally, we were also able to see how their current layout allows for the 2.2 Mtpa+ sulphide circuit.

Earth and Ore Movement:

1. A full year’s worth of ore has already been stockpiled. While we initially had some questions about their ability to move the appropriate tonnage with 30 tonne haul trucks, their movement of ore in fact has progressed well.

2. On top of this, given the sheer availability of ore stockpiles and the varying grade, it should be fairly easy for them to find of blend of ore that allows them to get the production that they are targeting.

3. The oxides are very soft and easy to move. They are free dig, and don’t require explosives. However, it remains an open question if the pit will continue to exhibit that characteristic.

Power Supply:

1. The build planned for 14 MW of capacity provided by four 3.5 MW generators. They have two of the 3.5 MW diesel generators, and they’ve rented two 1 MW generators, giving them a total capacity of 9 MW. They will replace their currently rented units with the two additional 3.5 MW generators. The third just shipped from the US, and the fourth will leave in August. They’ve already turned the plant on once and will do so again once they fix a gen set with injector issues.

2. According to the Feasibility Study, during the initial oxide treatment phase “the annual average electrical load on site is estimated to be 6.6 MW with a peak demand of 8.6 MW.” While this might be enough, we will be considerably more comfortable when the two additional 3.5 MW generators have reached the site. Of all the things we saw at the project, this is our greatest concern.

3. They don’t have grid power, but are looking to figure out if grid power is possible going forward.

4. Not specific to this operation, the rising fuel costs are a concern for all companies that use generators to provide power. It's a big chunk of AISC per ounce.

Tailings Storage Facility/Off Channel Reservoir/Etc.

1. The Tailings Storage Facility looks great. The earthworks and the lining are complete.

2. The Off Channel Reservoir is full of water, and there is river that runs through the land package that provides an abundance of water for the operation.

3. All in all, the rest of the project looks great in my view.

exploration & upside

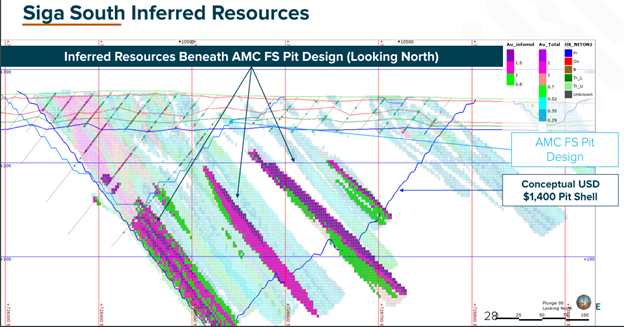

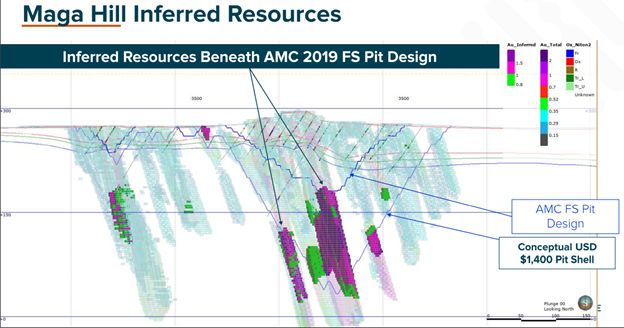

1. The Feasibility Study only includes the 1.835 M oz in the Mineral Reserve Estimate. Orezone has a Mineral Resource Estimate of 6.162 M oz. In addition, lots of these additional resources sit in a halo adjacent to the reserves, would be included in a mine plan if current precious metals prices persist. It should be noted that the current mine plan uses pit shells designed at $1250 gold, while $1400 gold would incorporate the vast majority of these additional resource ounces (see two images with this pit concept outlined).

2. Examples: Notice the AMC FS Pit Design, done at $1250 Au oz, versus the Conceptual $1400 Pit Shell. The strip appears to remain similar, and yet this would conservatively add 15-25 years of mine life to the mine. These are ounces that have already been identified, but haven’t been included in a mine plan. We see the same dynamic at Maga Hill.

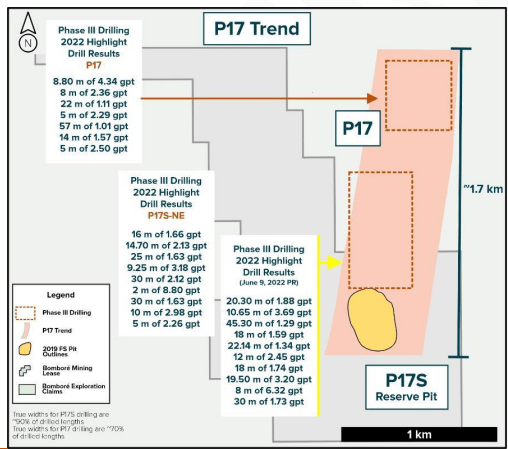

3. Exploration of the P17 Trend: The results speak for themselves. 32.00 meters at 3.98 g/t, 12.20 meters at 10.01 g/t, etc. They are just getting started. Some of the P17 trend is included in the mining concession (P17S), but most of is outside the mining concession. On top of this, there are several other targets on Orezone’s land package outside of the mining concession that are very attractive. Overall they want to, “convert a lot of inferred ounces that look good and expand our pits”

4. Upsizing the Sulphide Circuit: The current sulphide circuit, is expected to be 2.2 Mtpa, but with the right amount of sulphide ore, could be upsized to 5.2 Mtpa. This is contingent upon success than sulphide exploration success. Given what they’ve already found at P17, this decision already appears to make economic sense. Specifically, they think they have 1.2m ounces of convertible inferred suphides via 77k meters of drilling. 75% of the core drilling is done and 1/3 has been assayed. Of the overall drilling the new P17 region is just 10% of that. They are “feeling out” how big the sulphide plant should be. Orezone should be able to do this without tapping equity markets . They are soft-targeting next year for a construction decision that would take them into 2024.

*** END ***

*Figures and statements as of July, 2022 visit. This is an internal research note written by an analyst employed by Equinox Partners Investment Management, LLC. It is not intended for distribution. This information was intended exclusively for the person to whom it was delivered and ought not to be distributed further. Opinions are expressed throughout this note as of the date of the note. Opinions can be wrong or can prove to be right. Investment decisions are made in part as a result of mine visits and company discussions, but not exclusively so.

Past performance is not a guarantee of future results. Any investment in a fund or managed account entails a risk of loss, including the entire amount invested. Performance is shown net of management fees, performance fee, and expenses, for each series in the consolidated managed account unless otherwise indicated. Account values are presented gross. Index returns adjusted for inception date of accounts. All performance is unaudited and based on valuations prepared by the adviser and is subject to revision. Net exposure includes short position exposure. See the End Notes on the following page for more important information regarding the performance information shown.

End Notes

THIS INFORMATION IS INTENDED EXCLUSIVELY FOR THE PERSON TO WHOM THIS WAS DELIVERED WHO IS DEEMED TO BE A PROFESSIONAL FAMILIAR WITH FINANCIAL INSTRUMENTS AND HEDGE FUND PRODUCTS IN PARTICULAR. ANY FURTHER USE BY AND/OR DELIVERY TO A THIRD PERSON IS STRICTLY PROHIBITED AND ALLOWED ONLY AFTER THE PRIOR EXPRESS WRITTEN CONSENT OF MASON HILL ADVISORS, LLC. THIS INFORMATION IS CREATED SOLELY FOR INFORMATIONAL PURPOSES WITH THE EXPRESS UNDERSTANDING THAT IT DOES NOT CONSTITUTE: (I) AN OFFER, SOLICITATION OR RECOMMENDATION TO INVEST IN A PARTICULAR INVESTMENT; (II) A MEANS BY WHICH ANY SUCH INVESTMENT MAY BE OFFERED OR SOLD; OR (III) ADVICE OR AN EXPRESSION OF OUR VIEW AS TO WHETHER A PARTICULAR INVESTMENT IS APPROPRIATE. NO SALE OF SHARES OR INTERESTS WILL BE MADE IN ANY JURISDICTION IN WHICH THE OFFER, SOLICITATION OR SALE IS NOT AUTHORIZED OR TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE THE OFFER, SOLICITATION OR SALE. ANY OFFERING OF SHARES OR INTERESTS BY AN INVESTMENT FUND WILL BE MADE SOLELY PURSUANT TO THE PRIVATE PLACEMENT MEMORANDUM PREPARED BY AND FOR SUCH INVESTMENT FUND AND WILL CONTAIN MATERIAL INFORMATION NOT CONTAINED IN THIS DOCUMENT. ANY DECISION TO INVEST IN ANY SHARE OR INTEREST OF ANY INVESTMENT FUND SHOULD BE MADE SOLELY IN RELIANCE UPON THE PRIVATE PLACEMENT MEMORANDUM AND ANY SUPPLEMENTAL DOCUMENTS. FURTHER, AS A CONDITION TO PROVIDING THIS INFORMATION, MASON HILL ADVISORS, LLC SHALL HAVE NO LIABILITY, DIRECT OR INDIRECT, TO ANY OTHER ENTITY ARISING FROM THE USE OF THIS INFORMATION.

THE INFORMATION PRESENTED HEREIN IS CURRENT ONLY AS OF THE PARTICULAR DATES SPECIFIED FOR SUCH INFORMATION, AND IS SUBJECT TO CHANGE IN FUTURE PERIODS WITHOUT NOTICE. THERE IS NO OBLIGATION TO UPDATE THE INFORMATION HEREIN. NONE OF THE INFORMATION CONTAINED HEREIN HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, ANY SECURITIES ADMINISTRATOR UNDER ANY STATE SECURITIES LAWS OR ANY OTHER GOVERNMENTAL OR SELF-REGULATORY AUTHORITY. NO GOVERNMENTAL AUTHORITY HAS PASSED ON THE MERITS OF THE OFFERING OF INTERESTS IN A FUND OR THE ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

IRS CIRCULAR 230 NOTICE. TO ENSURE COMPLIANCE WITH REQUIREMENTS IMPOSED BY THE U.S. INTERNAL REVENUE SERVICE, YOU ARE HEREBY NOTIFIED THAT THE U.S. TAX INFORMATION CONTAINED HEREIN (I) IS WRITTEN IN CONNECTION WITH THE INFORMATION PROVIDED ON THE FUND AND OF THE TRANSACTIONS OR MATTERS ADDRESSED HEREIN, AND (II) IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED BY ANY TAXPAYER, FOR THE PURPOSE OF AVOIDING TAX RELATED PENALTIES UNDER U.S. FEDERAL, STATE OR LOCAL TAX LAW. EACH TAXPAYER SHOULD SEEK ADVICE BASED ON THE TAXPAYER’S PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISER.

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8