Mine Visit Note: WAF

EQUINOX PARTNERS - Precious Metals Miners

Site visit - west African resources

july 2022 Notes and Videos

Watch our Research Room episode on WAF

Dates July 26, 2022

Mines Visited Sanbrado

Countries Visited Burkina Faso

Equinox Team CIO, Sean Fieler | Analyst, Stephen Saroki | Head of IR, Daniel Schreck

OVERVIEW

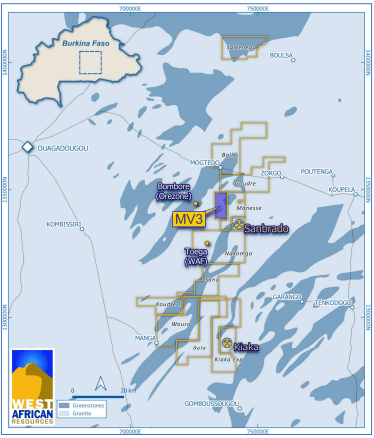

West African Resources (WAF Australia) is a gold producer that owns the Sanbrado mine located south of the capital of Burkina Faso, Ouagadougou. Ahead of schedule and under budget, WAF poured first gold in Q1 2020. In 2021, its first full year of production, the company produced 288,719 ounces of gold, meeting guidance on costs while exceeding guidance on production. In the final quarter of 2021, the company made two key acquisitions. They acquired the 1.3 million ounce Toega deposit, which will go through the Sanbrado processing facility. In addition, they acquired the 6.8 million ounce Kiaka deposit. These acquisitions lengthen mine life along with giving the company sightlines to 400,000 ounces of annual production. Despite the unique challenges offered by the jurisdiction, WAF’s management team has shown an ability to operate and deliver, and in the meantime allocate capital in an accretive fashion.

metrics

Market Cap

$960m USD

Enterprise Value

$795m USD

EV/CF

4.8x 2023 estimated cash flow

P/NAV (5% discounts)

0.4x

Resources

11.6m ounces of gold

EV/Resource $69 per ounce of gold

Reserves 1.5m ounces of gold

EV/Reserve $530 per ounce of gold

AISC ~$1000 per ounce estimate '22

Thesis

Aligned with shareholders, CEO Richard Hyde, who owns 1.7% ($16 million) of the company, has put together an impressive operation. In addition to the exploration upside on the original Sanbrado land package, he accretively acquired the Kiaka and Toega deposits from B2Gold. In the process, he has generated considerable value and given the company a runway toward 400,000+ ounces of annual gold production by 2025. The attractive organic growth and production profile should lead to both improved NAV and a re-rating in the company’s stock.

Trip summary

Sean, Dan, and I were picked up from Orezone’s Bomboré mine and spent the evening at Sanbrado with the senior operations team. The next morning, we visited two of the pits, the processing plant, the tailings storage facility (TSF), and the underground mine. The team was welcoming and offered us a comprehensive picture of the asset and future plans. We got a good sense of the organic growth in/around the core operations, while getting a better understanding of Kiaka. It's essential to meet the people actually operating the mine.

Management and governance

This visit was run by the operating team. While definitely the youngest operating team at the mine level that I’ve come across, the experience was impressive. The group was both knowledgeable and motivated. We had ample time to speak with them on a personal and professional level, and they demonstrated that they are a capable and cohesive group.

Luke Holden, General Manager: He’s has over 15 years of experience in the mining space, with site-based operational roles in West Africa and Australia. Most recently, he was Director General of Nordgold’s Taparko mine in Burkina Faso. Intelligent, honest, and hard working, he’s put together a solid team. He commands his team’s respect.

Tim Ashworth, Underground Manager: Having both open pit and underground mining experience, Tim is the elder statesman of the team. He has managed mines all over the world, including nickel mines in the Philippines, Turkey, and Vietnam. In addition to other African experience, he was previously working as the Underground Manager for Regis Resources, an Australian producer with a good reputation.

Jessica Morgan, Open Pit Manager: With 20 years of experience in the space. She worked for Freeport-McMoran and Glencore in the Democratic Republic of Congo. She did work for Randgold in Mali. Jessica worked at Nordgold’s Taparko mine in Burkina Faso. Her most recent position prior to West African Resources was as Regional Manager for Nevada Gold Mines.

Watch our Research Room episode on Burkina country risk

JURISDICTION

The general perception of Burkina Faso is heavily influenced by international headlines. Between jihadist activities and coups, most investors are reticent to underwrite investments there. But despite this noise, we view it as one of the better mining jurisdictions in the world. Land concessions are easily attained. Exploration permits are readily given. Mining permits generally come within 12 months. Projects come on time and on budget. To provide some context, even in Tier 1 jurisdictions like Canada, many projects take 4 to 5 years to permit. The government in Burkina understands the economic proposition offered by mining and enthusiastically supports the industry. The people line up for jobs as they pay considerably 3-4 times more than any alternatives available to them.

The country poses several challenges, first and foremost security is an issue. There is also limited and unreliable grid power; the country is land locked; and, asphalt roads are infrequent as you approach the interior. That said, the local work ethic is outstanding, and economic development, whether from FDI, local spending has a long fairway.

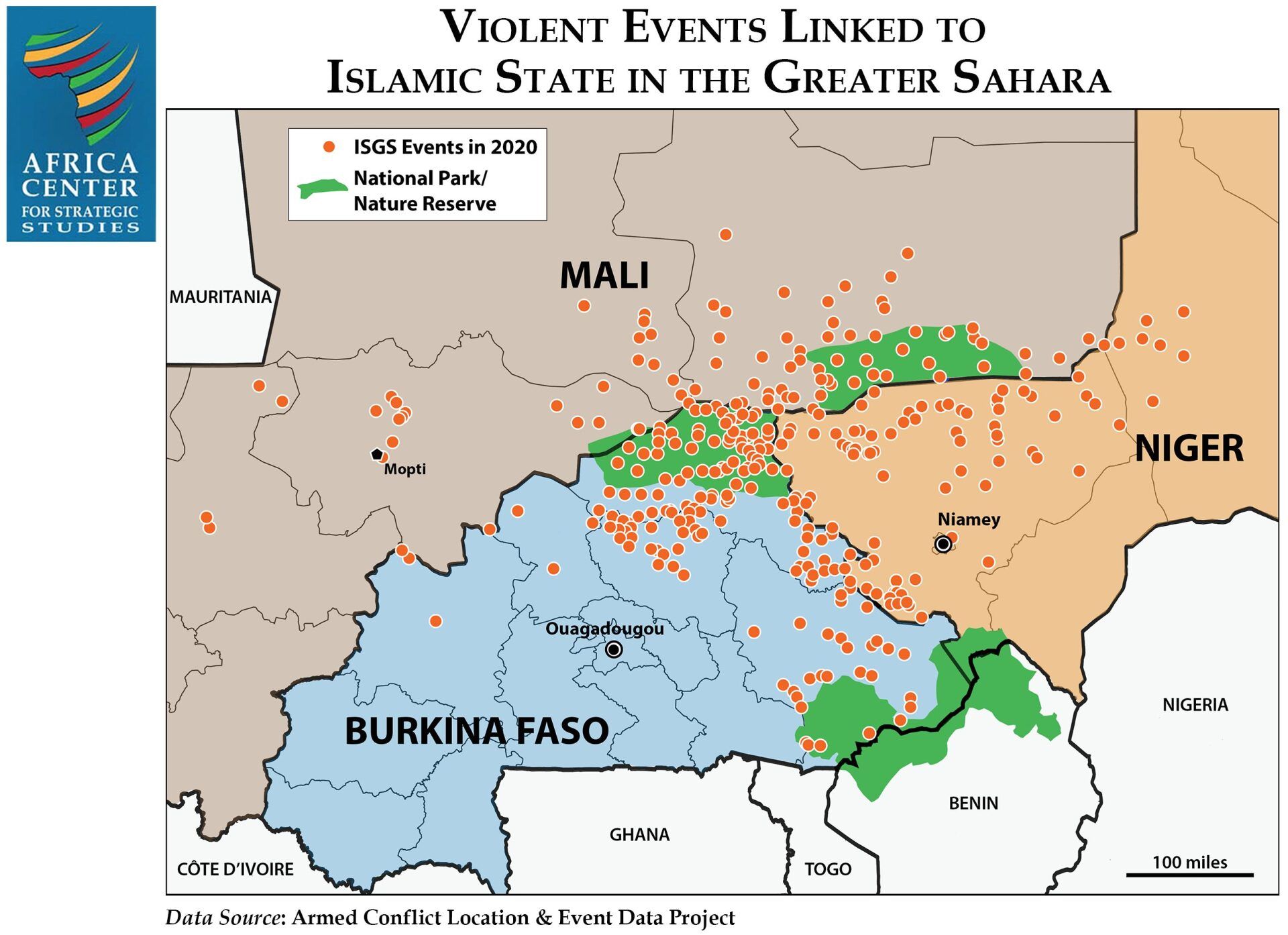

Since the killing of Muammar Gaddafi in the fall of 2011, security has deteriorated throughout French West Africa. In recent years, there have been a widespread rise in violence committed by jihadist militants, a trend which is obviously concerning for Western mining companies. While the overall concern is warranted, the particularly location of a mine is of paramount importance. Where the Sanbrado mine is located, for example, remains a relatively safe. The lion’s share of issues have been occurring in the lawless northeast and eastern portion of the country. Mines in these regions, such As Nordgold’s Taparko mine and Endeavour’s Boungu, have suffered as a result (see map).

The good news is that safe and unsafe areas are relatively well defined. As such, your mine’s location in the principal determinant of its security situation. But, even in the safe parts of the country, security requires a significant investment. Accordingly, the mine has a series of security check points, a double walled camp, proximity gun towers, numerous security protocols, and an ample complement of security guards with military experience.

Our take aways are that while security is concerning, mining operations are not effected unless the mine is actually attacked. In particular, the mines benefit from strong community support, and it doesn’t take a genius to figure out why. There is so much local support for the companies because the alternative to mining for most people is substance farming. Because of the deep residue of local support, even the coup in Burkina Faso in January 2022 had no impact on mining operations. In talking with people at the mine site, they seemed to suggest it was not going to change what they do.

Corporate Social Responsibility (CSR)

One of the more remarkable things about Burkina Faso is that mining constitutes the vast majority of direct foreign investment. There are no Starbucks or McDonalds, not even in the capital. Google and Facebook don’t have offices there. Mining, on the other hand, has brought in billions of dollars in investment to the country. In addition to the 10% free carried interest, ~4% royalty, and 27.5% tax rate, the project employs about ~1350 people, with 90% of these people being Burkinabe. Even what is ostensibly a low-paying job as a truck driver pays more than 4x the annual per capita income in the country. Mining promotes economic development, and is offering the people of the country an opportunity for a better life. According to the team, the Burkinabe people are the best and hardest workers regionally, and even globally. Given the regional importance of gold mining, and to Burkina in particular (80% of export value), there is a strong ecosystem of geology schools and company-specific advancement.

investment timeline

West African Resources has a robust pipeline of organic growth opportunities. With their acquisition of Toega, they’ve evened out and lengthened Sanbrado’s production profile. The Kiaka acquisition will be a new, separate asset, and is expected to be in production in 2025. On top of these, there are clear opportunities on the Sanbrado land package that have yet to be fully explored, including what will likely be additional satellite pits and another underground which could extend the mine life by 15+ years.

sanbrado

The Processing Mill:

1. Built by Lycopodium, the mill operates like a well-oiled machine. We walked the mill from rock crushing to gold pour (Sean pressed the button but sadly couldn't keep the gold). Lycopodium builds tend to operate at ~10-20% above nameplate capacity, and Sanbrado’s mill is no exception.

2. They are in the process of installing an additional gravity circuit. This is an improvement should help to enhance throughput through the mill with minimal cost and a high return.

3. What became apparent in observing the mill is the hardness of the rock (Bond Work Index ranges from 10-25) and the importance of reliable power to get the appropriate grind size. While far from the hardest rock, it is no simple task to get the right grind size, and WAF does a great job of doing this.

The Open Pits:

1. After visiting the M1 Pit, which has been fully mined out, we visited the M5 pit.

2. There are two blasts in each 24 hour period. They occur before each shift change.

3. Even though we visited during the rainy season, the open pits seem to be operating well. The excavators are operating efficiently, and the trucks are not waiting long before they are filled with either ore or waste.

4. Given the competency of the rock, the bench widths were fairly narrow, and the pit slope angles were fairly steep. This is good precisely because it means the company is not moving excess waste.

The M1 Underground:

1. The underground mining conditions are excellent. The rock is competent. Most noticeably, the shotcrete wasn’t redundant, an affirmation of the competency of the rock.

2. They were 3 or 4 working faces, and this is more than sufficient to get the right tonnage and blend to meet production targets. It is clear that the group has done a great job of grade control drilling, so they’ve been effective identifying the ore with minimal dilution.

3. There is room to extend the ramp further down, as the ore slopes 80 degrees and appears as if there’s more depth. They are drilling exploratory holes now to prove out the thesis. There is some exceptional grade in the pit which we saw up close.

Tailings Storage Facility/Off Channel Reservoir/Etc.

The Tailings Storage Facility looks great, has plenty of capacity, and is managing the water well.

growth

1. Toega: WAF acquired Toega from B2Gold for what amounts to ~$50 per ounce in the ground plus a 0.5% royalty that kicks in after a 3% royalty pays $25 million (this $25 million is included in the purchase price of $45 million, but is staged as production occurs) and the 0.5% royalty is capped 1.5 million ounces of Toega production. Toega has a 1.3 million ounce resource with a gold grade of 1.9 g/t. Combined with a strip ratio that is below 5 (4.7 to 1), these ounces are very economic. What’s more important is that the Toega deposit is located just 14 km from Sanbrado and will be trucked to the asset. As a result, this high grade material will not require substantive capex to mine and process. This was a shrewd acquisition on behalf of WAF. We expect this deposit to enter the mine plan within the next 24 months and will solidify WAF’s ability to produce ~200,000 ounces at Sanbrado over the next 10 years.

2. Kiaka: Acquired from B2Gold for less than $15 per ounce plus a 3% royalty on the first 2.5 million ounces produced and a 0.5% royalty on the next 1.5 million ounces produced, WAF again exhibited excellent judgement from a capital allocation standpoint. Located 45 km to the south of Sanbrado, Kiaka ore will not be shipped. Instead, WAF just released a feasibility study on the economics of a mine at Kiaka. With $430 million in capex, the project has an NPV using $1750 gold and a 5% discount rate of $856 million. This includes just 4.5 million of the 7.7 million ounces in resource and delineates an 18.5 year mine life with production averaging 219,000 ounces per year. With widths of hundreds of meters, 0.8g/tonne, and a low strip it’s “like an iron ore body that could do 250k ounces/year for 20 years”. Expected to go in production in 2025, WAF has sight lines to doubling their production in just 3 years. They have to be prudent on developing the mine, as always, as mills now have a 96 week lead time. They will be making a decision soon as a result.

exploration

1. WAF’s land package is large and, on our view, in the early stages from an exploration perspective. Given the prolific nature of the belt, we have confidence about the ability to consistently add mine life over time.

2. Underground Potential: On just the Sanbrado land package, we expect there to be multiple undergrounds. In addition to the M1 underground that is currently being mined, it seems clear that there will also be an M5 underground below the M5 pit. In looking at the continuity of the mineralization at depth, this is low-hanging fruit for the company. On top of that, the M1 underground shows no signs of stopping at depth, which is pretty consistent with what we’ve seen in this region of West Africa.

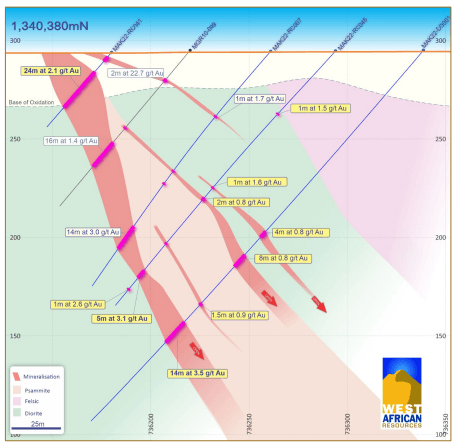

3. MV3: Just 6 km from Sanbrado, the company has already found this satellite open pit deposit with depth potential. They have already drilled out excellent widths and grades, and this deposit has just started to be drilled. (bottom image to right)

*** END ***

*Figures and statements as of July, 2022 visit. This is an internal research note written by an analyst employed by Equinox Partners Investment Management, LLC. It is not intended for distribution. This information was intended exclusively for the person to whom it was delivered and ought not to be distributed further. Opinions are expressed throughout this note as of the date of the note. Opinions can be wrong or can prove to be right. Investment decisions are made in part as a result of mine visits and company discussions, but not exclusively so.

Past performance is not a guarantee of future results. Any investment in a fund or managed account entails a risk of loss, including the entire amount invested. Performance is shown net of management fees, performance fee, and expenses, for each series in the consolidated managed account unless otherwise indicated. Account values are presented gross. Index returns adjusted for inception date of accounts. All performance is unaudited and based on valuations prepared by the adviser and is subject to revision. Net exposure includes short position exposure. See the End Notes on the following page for more important information regarding the performance information shown.

End Notes

THIS INFORMATION IS INTENDED EXCLUSIVELY FOR THE PERSON TO WHOM THIS WAS DELIVERED WHO IS DEEMED TO BE A PROFESSIONAL FAMILIAR WITH FINANCIAL INSTRUMENTS AND HEDGE FUND PRODUCTS IN PARTICULAR. ANY FURTHER USE BY AND/OR DELIVERY TO A THIRD PERSON IS STRICTLY PROHIBITED AND ALLOWED ONLY AFTER THE PRIOR EXPRESS WRITTEN CONSENT OF MASON HILL ADVISORS, LLC. THIS INFORMATION IS CREATED SOLELY FOR INFORMATIONAL PURPOSES WITH THE EXPRESS UNDERSTANDING THAT IT DOES NOT CONSTITUTE: (I) AN OFFER, SOLICITATION OR RECOMMENDATION TO INVEST IN A PARTICULAR INVESTMENT; (II) A MEANS BY WHICH ANY SUCH INVESTMENT MAY BE OFFERED OR SOLD; OR (III) ADVICE OR AN EXPRESSION OF OUR VIEW AS TO WHETHER A PARTICULAR INVESTMENT IS APPROPRIATE. NO SALE OF SHARES OR INTERESTS WILL BE MADE IN ANY JURISDICTION IN WHICH THE OFFER, SOLICITATION OR SALE IS NOT AUTHORIZED OR TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE THE OFFER, SOLICITATION OR SALE. ANY OFFERING OF SHARES OR INTERESTS BY AN INVESTMENT FUND WILL BE MADE SOLELY PURSUANT TO THE PRIVATE PLACEMENT MEMORANDUM PREPARED BY AND FOR SUCH INVESTMENT FUND AND WILL CONTAIN MATERIAL INFORMATION NOT CONTAINED IN THIS DOCUMENT. ANY DECISION TO INVEST IN ANY SHARE OR INTEREST OF ANY INVESTMENT FUND SHOULD BE MADE SOLELY IN RELIANCE UPON THE PRIVATE PLACEMENT MEMORANDUM AND ANY SUPPLEMENTAL DOCUMENTS. FURTHER, AS A CONDITION TO PROVIDING THIS INFORMATION, MASON HILL ADVISORS, LLC SHALL HAVE NO LIABILITY, DIRECT OR INDIRECT, TO ANY OTHER ENTITY ARISING FROM THE USE OF THIS INFORMATION.

THE INFORMATION PRESENTED HEREIN IS CURRENT ONLY AS OF THE PARTICULAR DATES SPECIFIED FOR SUCH INFORMATION, AND IS SUBJECT TO CHANGE IN FUTURE PERIODS WITHOUT NOTICE. THERE IS NO OBLIGATION TO UPDATE THE INFORMATION HEREIN. NONE OF THE INFORMATION CONTAINED HEREIN HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, ANY SECURITIES ADMINISTRATOR UNDER ANY STATE SECURITIES LAWS OR ANY OTHER GOVERNMENTAL OR SELF-REGULATORY AUTHORITY. NO GOVERNMENTAL AUTHORITY HAS PASSED ON THE MERITS OF THE OFFERING OF INTERESTS IN A FUND OR THE ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

IRS CIRCULAR 230 NOTICE. TO ENSURE COMPLIANCE WITH REQUIREMENTS IMPOSED BY THE U.S. INTERNAL REVENUE SERVICE, YOU ARE HEREBY NOTIFIED THAT THE U.S. TAX INFORMATION CONTAINED HEREIN (I) IS WRITTEN IN CONNECTION WITH THE INFORMATION PROVIDED ON THE FUND AND OF THE TRANSACTIONS OR MATTERS ADDRESSED HEREIN, AND (II) IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED BY ANY TAXPAYER, FOR THE PURPOSE OF AVOIDING TAX RELATED PENALTIES UNDER U.S. FEDERAL, STATE OR LOCAL TAX LAW. EACH TAXPAYER SHOULD SEEK ADVICE BASED ON THE TAXPAYER’S PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISER.

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8