Equinox Partners, L.P. - Q4 2023 Letter

Dear Partners and Friends,

PERFORMANCE

Equinox Partners, L.P. declined -8.87% in the fourth quarter and –11.4% for the full year.

Equinox Partners’ 2023 decline follows four strong years of performance. Over the five-year period from January 2019 through the end of December 2023, our fund delivered a 174% cumulative net return and a 22.3% compounded annual growth rate. Oil and gold, our largest commodity exposures, were both up, with WTI Crude rising 57.5% and the spot gold price rising 61%. The equities linked to these commodities enjoyed positive performance as the Canadian Energy index appreciated nearly 100% and the Junior Gold Mining index rose 30% cumulatively. Within the Equinox portfolio, we outperformed both the Canadian Energy and Junior Gold Mining indices since the end of 2018.

Going forward, we anticipate higher gold and oil prices and believe that our producers of these commodities are deeply undervalued. We also believe that the severe volatility that continues to characterize the commodity complex offers us an exceptional opportunity to add value through our concentrated stock picking. In today’s commodity price environment, our portfolio of undervalued companies should generate reasonable rates of return. In a better commodity price environment, we expect our portfolio to compound rapidly.

Visit our performance page to view the Equinox Partners, L.P. fund summary in more detail.

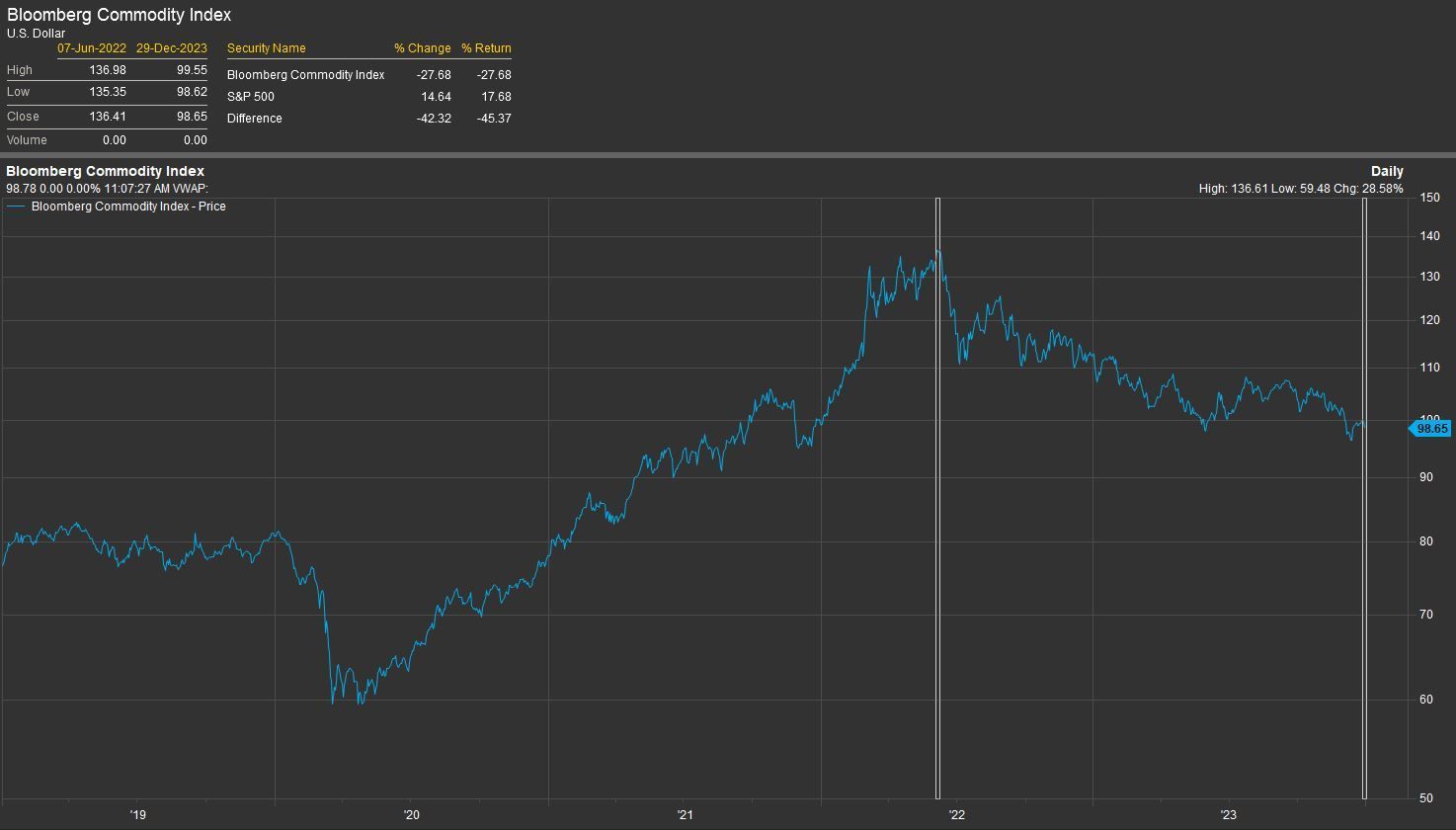

Bloomberg Commodity Index Chart 2019 - 2023

Down 27.7% since June 2022 peak

Source: FactSet

The Politics of Oil & Gold

The price and supply of oil and gold were central to American foreign and economic policy for much of the twentieth century. FDR’s meeting with Abdul Aziz ibn Saud on the deck of the USS Quincy in 1945 secured a long-term oil supply from Saudi Arabia. And, the Bretton Wood’s conference in the summer of 1944 tied the world’s currencies to the dollar and the dollar to gold.

By 2000, the political relevance of oil and gold had ebbed. At the turn of the millennium, oil traded at $25 USD per barrel and gold traded at $288 per ounce. There appeared to be more oil and gold than the market needed, and it was not obvious what America had to gain from actively managing the price or supply of either. So, while American policymakers remained engaged in the oil and gold markets, they understood that the price movements of these two commodities didn’t threaten the world’s security or macro economy.

As market forces asserted themselves and the world's economy boomed, the price of oil increased to $140 per barrel and gold rose to $970 per ounce by the summer of 2008. Rising oil prices were inflationary but not problematic as their effect was more than offset by the deflationary tailwind created by China’s 2000 accession to the WTO. Similarly, gold was gaining appeal as an investment but did not threaten the dollar’s role as the world’s reserve currency. That was then, this is now.

With the return of inflation and the obvious use of the US dollar as a tool of American foreign policy, the supply and price of oil and gold are again clearly political. The $3-trillion-dollar oil market is the largest commodity market in the world, and the price of oil is highly correlated with inflation. Accordingly, in an inflationary environment, the US government is incentivized to actively manage the oil price. Similarly, the world’s $16-trillion dollars of above-ground gold is the only asset class large enough and deep enough to seriously threaten the dollar’s role as the world’s reserve currency. Accordingly, the federal government has an interest in preventing gold price action that makes US Treasury look insolvent or the Fed look impotent.

It is broadly understood that the Biden administration has attached enormous significance to the oil market and is willing to use the power of the American government to suppress the oil price. This suppression helped the Federal Reserve get inflation down and denied Russia a foreign exchange windfall. It is also worth noting that low oil prices should help Biden’s reelection efforts if they can be sustained through November. To achieve the oil price suppression, the Biden administration cut the US strategic petroleum reserve in half and facilitated increased oil production in Iran and Venezuela.

While not explicitly, the federal government also cares about the gold price. In a break with precedent, the New York Fed is refusing to answer basic questions about its participation in the gold market . Importantly, this refusal comes as foreign central banks are buying more than 1,000 tonnes per year in an effort to diversify away from the US dollar. In the case of Russia and China, these purchases clearly reflect a political desire to challenge the dollar. But, in the case of the central banks of the Netherlands and Poland, the gold purchases are driven by growing discomfort with the US fiscal position rather than geopolitics.

Investing in markets that the US government is intent on keeping quiescent has been frustrating over the past eighteen months. Since a spike in the summer of 2022, the oil price has fallen 45% and the gold price is up just 2%. While the past eighteen months have been painful, there is good reason to believe that we are nearing the limits of the US government's ability to suppress these markets.

In the case of oil, the US strategic petroleum reserve has already disgorged 280 million barrels . These barrels can’t be released again. And, support for Iran and Venezuela’s oil production is becoming more of a political liability. The Biden administration pulled out all the stops to suppress the oil price when the Fed's credibility was on the line and there was a possibility that Russia would lose the war in Ukraine. Those moments have both passed.

With respect to gold, not only are the Chinese and Russians done accumulating dollars, but a broad swath of central banks are now committed to acquiring gold. According to a recent World Gold Council survey, 24% of central banks intend to acquire gold over the next twelve months. And, while the US government can easily participate in the market for paper gold, foreign central banks are accumulating physical metal, a much more difficult market to manage. There are also signs that U.S. retail investors are developing a taste for physical gold which they can actually hold. The popularity of one ounce gold bars at Walmart and Costco merits close attention. In the fourth quarter, these two retailers each sold several tonnes of gold. These figures pale in comparison to the 1,000 tonnes foreign central banks bought last year but raise the possibility of growing Western retail demand that would be very hard to manage.

The politics of commodity price suppression are central to the investment opportunity we see in both oil and gold. The American government’s effort to manage the price of oil and gold, while painful at times, is part of a process that produces the opportunity to invest in oil producers and gold mines at prices that don’t reflect the underlying market fundamentals. When the fundaments of the market eventually assert themselves, as we believe they will, we expect the upward revaluation of the companies we own will be substantial.

investment Thesis Review for the TOP 5 EQUITY LONG POSITIONS BY PORTFOLIO WEIGHT

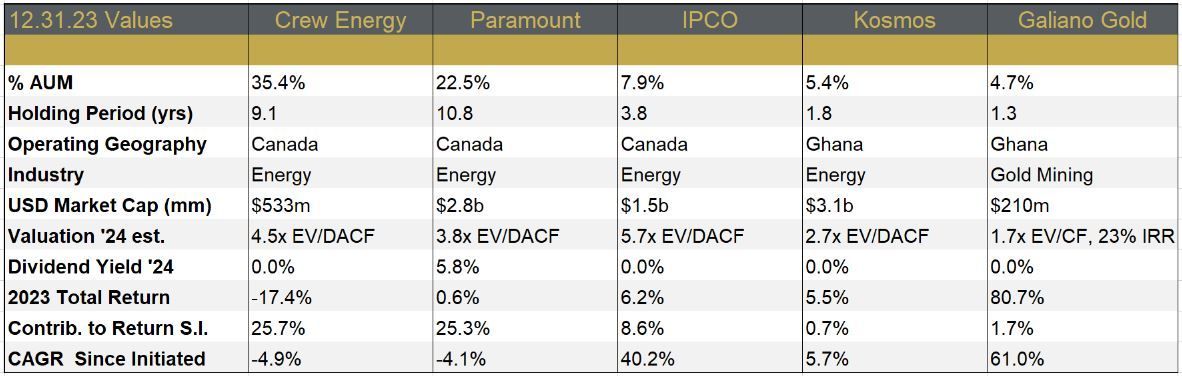

Crew Energy Inc.

Crew Energy, an oil and gas company based in British Columbia with over 2,700 identified potential drilling locations in the Montney, is a likely takeover target as LNG Canada ramps up and expands.

The LNG Canada export facility should begin receiving gas later this year and reach full capacity in 2025. At full capacity, LNG Canada will takeaway 2bcf/d of British Columbia’s 6bcf/d of gas production. Should LNG Canada expand its capacity by twinning its existing pipeline, LNG’s offtake capacity will grow to 4bcf/d. Crew controls perfectly located natural gas assets that can help meet the incremental gas demand from LNG Canada.

To maximize Crew’s value in a transaction, management would like to buildout the company’s infrastructure and grow production as quickly as possible. That said, management and the board will not over-lever the company to finance this expansion. Accordingly, in 2023, as gas prices and cash flow fell, the company simply maintained its production and advanced some of the less capital-intensive parts of the expansion plan, i.e. permitting and plant design. If gas prices rise, Crew will expand more aggressively.

In today’s low gas price environment, Crew is working to prove up as much of its acreage as it can. This is a relatively low-cost way to add value in a transaction. To put Crew’s resources potential value in context, at the end of 2022, Crew held $1.4bn CAD of proved and probable reserves. This figure, which is twice the company’s $700bn CAD enterprise value, only includes 198 drilling locations.

Paramount Resources Ltd.

Paramount Resources is an oil and gas company based in Alberta which produces ~100k barrels of oil-equivalent per day. At $70 oil (WTI) and $3 natural gas (AECO), the company will generate 10%+ production growth and a 5% dividend yield. At $80 WTI, the total return (growth + free cash flow) will comfortably exceed 20%.

Paramount budgeted for 15% production growth in 2023 but delivered 9%. The 2023 production shortfall is a result of a third-party processing facility and is unlikely to reoccur. In 2024, we expect Paramount to grow production 16% while spending well within cash flow. We also expect the company to pay out $220mn CAD in dividends, a 5.8% yield on the current share price.

Paramount’s principal growth driver over the next five years is in the Willesden Green area of the Duverney Shale Basin. Paramount is positioned to grow production in this area to 50k barrels of oil equivalent per day by 2028. The Willesden Green project will generate significant additional free cash for the company and should provide attractive full-cycle returns given the company’s relatively low cost of entry to the play.

Finally, it is important to note that Paramount is likely in the process of bidding on Chevron’s Duverney assets. The Riddell family, which controls Paramount, has an outstanding track record of counter-cyclical value creation. Given that Chevron is a motivated seller and there are few qualified buyers, we expect Paramount to submit a very disciplined bid. The rumored price of the deal is $900MM USD. At that price, the deal should be highly accretive to Paramount.

International Petroleum Corporation

International Petroleum Corporation (“IPCO”) is an upstream oil and gas company with assets in Canada, Asia and Europe. The business went from strength to strength in 2023 as they beat production guidance, made a final investment decision on its 1.3 billion barrel of oil equivalent Blackrod field , elevated a member of the company’s controlling shareholder to CEO, and bought back 7% of the shares outstanding.

IPCO’s ability to make so much strategic progress in a weak oil market is a testament to the company’s strong cash generation. At $75 WTI, the company’s existing portfolio of assets generates a 14% FCF yield. This predictable cash generation enabled the company to both commit to the development of the Blackrod project in Alberta while returning over $100 million USD to shareholders through share buy backs in 2023. IPCO’s combination of rapidly growing production and a shrinking share count is unique in our portfolio of oil and gas companies.

With over 1.3 billion barrels of oil recoverable and an initial production of 30,000 boepd, the Blackrod project will almost double IPCO’s production. Blackrod already accounts for a majority of the company’s 2P reserves and is far and away IPCO’s most valuable asset. Importantly, with 65% of the construction costs locked in, IPCO will be able to internally finance the project even in a weak oil price environment.

The company’s ability to both move forward with Blackrod, while at the same time buying back stock, testifies to the Lundin Group’s smart capital allocation decisions. We expect the first oil at Blackrod in late 2026, and when the project completes the ramp-up, Blackrod will boost IPCO’s production and free cash flow generation significantly.

Kosmos Energy Ltd.

Kosmos Energy is an offshore oil and gas company with assets in the Gulf of Mexico and off the west coast of Africa. The company is in the final stages of a multi-year growth plan that will take production from ~60k to ~90k boepd by mid-2024. At $70 Brent and ~90k boepd, Kosmos will generate ~$500 million USD per year in free cash, a 16% free cash flow yield. At an $80 Brent oil price, the free cash likely grows to $750mn, or a 24% free cash flow yield.

The centerpiece of the company’s growth plan is the Tortue field located off the coast of Mauritania and Senegal. This multi-billion-dollar development is a 50/50 partnership with the supermajor BP. The Tortue field, which is estimated to hold more than 15 trillion cubic feet of gas, will begin producing ~2.5 million tons of natural gas this year with an estimated 30 years of reserve life. Importantly, the Tortue field is just one part of the significant acreage Kosmos holds in Mauritania and Senegal where their total estimated inventory ranges from 50-100 tcf of gas. Kosmos plans to bring additional LNG projects online from these fields every couple of years over the next decade.

The development of such a massive LNG project requires a world-class team. BP is the operator, but Kosmos discovered the assets and is working closely on all aspects of the project. Kosmos’ close partnership with BP is a testament to the quality of the team that Kosmos’ CEO, Andy Inglis, has built. Andy, the former head of BP’s global exploration and production business, has been able to attract top tier talent as the supermajors de-emphasized deep water exploration.

Andy also understands the importance of generating a rapid payback on Kosmos’ investments. Accordingly, he has organized the Kosmos portfolio around existing infrastructure, allowing for quick and cheap tiebacks in the case of exploration success. Once Kosmos’ first LNG project is online next year, we expect Kosmos to re-rate significantly. Longer term, we expect Kosmos to continue to grow by bringing their already discovered resources online with internally generated capital.

Galiano Gold Inc.

Galiano Gold Inc. is a single asset gold producer that operates and manages the Asanko Gold Mine in Ghana. The Asanko Gold Mine went into production in January 2016 and had historically been a 45%/45% joint venture between Galiano and Gold Fields, with the Government of Ghana owning the remaining 10% equity interest.

On the 21st of December 2023, Galiano announced a binding agreement to purchase Gold Field’s 45% interest in the Asanko Gold Mine for US$20 million in shares, a 1% royalty on up to 447,000 ounces, and future cash considerations of up to US$85 million. This transaction is immediately accretive to Galiano on a cash flow basis and puts a 2.1 million ounces of proven and probable reserves on Ghana’s highly prospective Asankrangwa gold belt entirely under the control of Galiano Gold. Pro-forma, the company has no debt, ~$130 million in cash and a market capitalization of ~$230 million – a valuation which still doesn’t remotely capture the value of the asset.

While this transaction has been discussed for years, it appears that the internal politics at Gold Fields dictated the final timing of the deal. It is noteworthy that this agreement was struck just prior to Michael Fraser’s accession to Gold Field’s CEO role on January 1st, 2024. With this deal now inked, Michael will be free from time consuming JV decision-making process that the historic ownership structure produced.

The transaction is structured to ensure Galiano’s successful expansion, with the timing of future cash payments coming after the cash flow of the asset increases. We expect Galiano’s technically strong management team will waste no time increasing the company’s production to ~240,000 oz per year.

Organizational Update

In December, we parted ways with Daniel Schreck and Stephen Saroki.

Daniel joined Equinox Partners in 2009. Over the past 14 years he worked closely with our clients, cultivated new prospects, and oversaw a significant upgrade in our client communications. Daniel’s client responsibilities have been assumed by Kieran Brennan, who joined us in January 2021 and has been working with Daniel for the past 3 years.

Following a summer internship in 2016, Stephen Saroki joined our team as a full time research analyst in 2018. While a generalist by training, Stephen spent most of his time analyzing gold and silver miners. His company coverage has been picked up by Coille, Alfredo, and Sean.

We wish both Daniel and Stephen well in their next endeavors. Our team of 11 professionals now consists of six investment professionals and five in operations.

Sincerely,

Equinox Partners Investment Management

[1] Please note that estimated performance has yet to be audited and is subject to revision. Performance figures constitute confidential information and must not be disclosed to third parties. An investor’s performance may differ based on timing of contributions, withdrawals and participation in new issues.

Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, FactSet or independent sources. Values as of 12.31.23, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notice.

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8