Equinox Partners Precious Metals Fund, L.P. - Q3 2023 Letter

Dear Partners and Friends,

PERFORMANCE

Equinox Partners Precious Metals Fund, L.P. declined -13.6% in the third quarter of 2023 and is down -14.3% for the year to date through September 30th, 2023.

Visit our performance page to view the Precious Metals Fund strategy summary in more detail.

bear market in Gold Mining

Since peaking on August 5th, 2020 at $65.95, the GDXJ Junior Gold Mining ETF is down 48%. Even this decline understates the extent of the bear market for most junior gold mining companies. Smaller gold mining companies, which constitute the majority of the publicly listed gold miners, have experienced a much more severe bear market over the past three years. Of the 654 publicly listed gold miners in August 2020 with a market cap between $250m to $10m, the median company—which today has a market cap of just $30m—is down 69.8% from the August 2020 peak.

As small gold mining companies have gone bid wanted over the past three years, we’ve been buyers of their deeply discounted shares. Since the fund’s inception in January 2021, we’ve invested $7m in exploration-stage gold and silver mining companies. Most of this capital has been allocated to companies with market caps of less than $100m. Through these purchases we have maintained a 28% portfolio weighting to these smaller companies despite the relentless decline in share prices.

Small, pre-production mining companies have been particularly hard hit by the increases in permitting timelines, costs, and discount rates. Each of these headwinds merits analysis:

Permitting: A growing number of regulatory hurdles are making it increasingly difficult to translate a discovery into a mine. According to Scotiabank, on average, whereas it took roughly 9 years from discovery to production twenty years ago, it now takes 15 years to go through the same process. This longer timeline is the result of increasingly onerous environmental regulations and political headwinds that have slowed mine development globally.

Costs: On average, the cost to build and operate a gold mine has risen by more than 20% over the past three years. These costs vary materially by region and type of mine. Nevertheless, the general direction of costs is up substantially. While some inputs, most notably steel, have retraced much of their post COVID runup, other costs, most notably labor, have continued to rise. Rising costs and a flat gold price have combined to make undeveloped gold mines less valuable, all other factors being equal.

Discount Rates: Since the summer of 2020, the yield on the 10-year U.S. Treasury has risen from 0.64% to 4.8%. Accordingly, market participants are using a higher discount rate to value future free cash flows. This discount math has a particularly negative impact on pre-revenue mining companies with free cash flow in the distant future. Eventually, a higher gold price should more than offset these higher discount rates, but that has not happened yet.

This headwind trifecta has made it hard to sell unpermitted mining projects at attractive prices or even fund the drilling, engineering, and environmental work necessary to progress these projects though the permitting process. As a result, a growing number of unpermitted deposits linger on the balance sheets of junior gold mining companies and are valued at less than they cost to discover. Put bluntly, exploration companies are now being punished for their exploration successes as well as their exploration failures. The stock market has effectively issued a cease-and-desist order to junior gold miners.

While the fundamental headwinds facing undeveloped deposits are real, the decline in the share prices of junior gold miners has become irrational and indiscriminate. At this point, sector specialists continue to sell, not because of the poor fundamentals, but because they are facing redemptions. Likewise, potential acquirers are not on the sidelines because they find the explorers financially unattractive, but because the market will likely punish them for making non-cash-flowing acquisitions. From our perspective, this is the perfect time to load up on high-quality undervalued companies that should trade at multiples of their current market caps if and when larger mining companies eventually decide to replenish their inventory of projects or grow through acquisition.

Our purchases

Since January 2021, we’ve added 12 exploration companies to our portfolio. Specifically, we’ve bought: Azimut, Borealis, C3, Dore Copper, Gelum, GoGold, Great Pacific Gold, HighGold, Integra, Japan Gold, Thesis, and Wolfden.

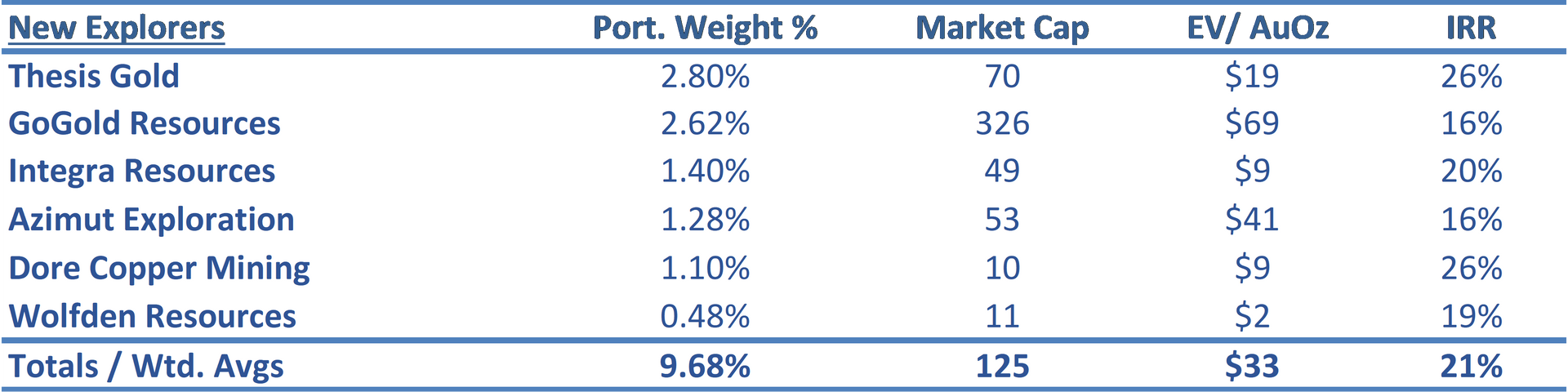

On portfolio weighted average basis, the exploration companies for which we have metrics collectively trade at $33 per ounce of gold and have an average IRR of 21% at spot gold prices based on our analysis.

Estimates based on internal analysis. Valuations based on comparable transactions per ounce using likely economic ounces (i.e. “Measured and Indicated” ounces) from company-specific technical studies.

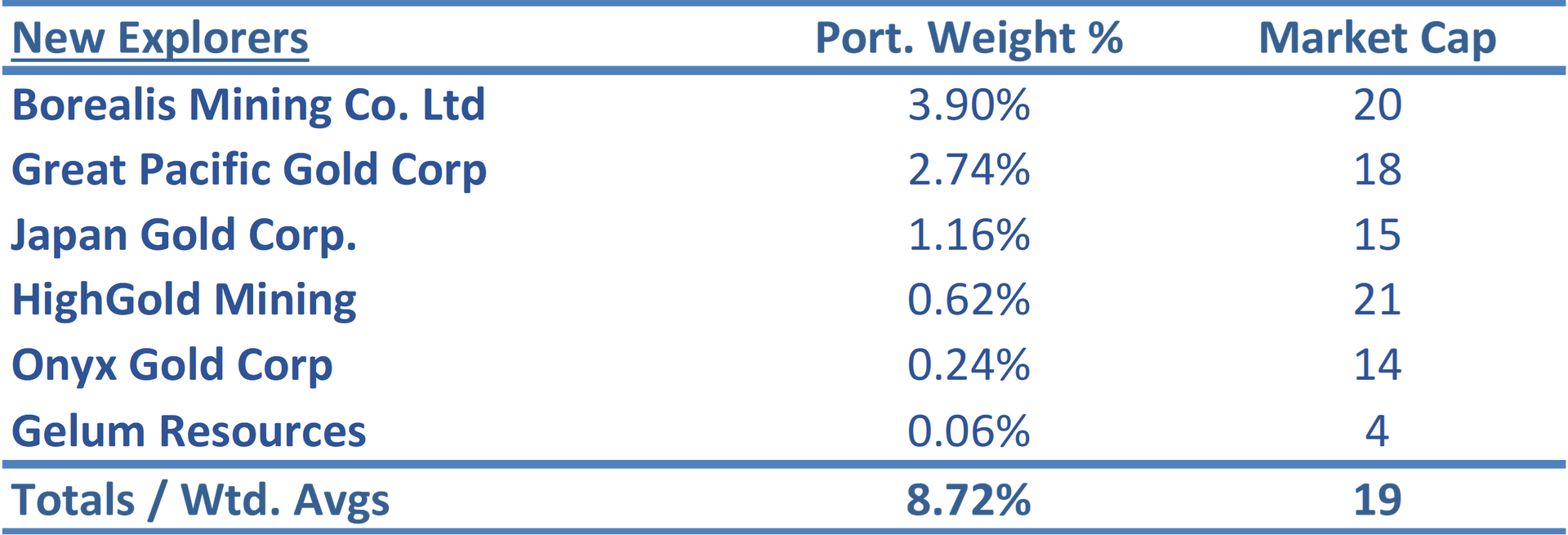

We also have ~8.7% of partners’ capital invested in earlier-stage gold mining companies that haven’t published enough data for us to reasonably calculate their IRR. We believe these companies are severely undervalued, but we can’t clearly express this view with a uniform metric of valuation like IRR.

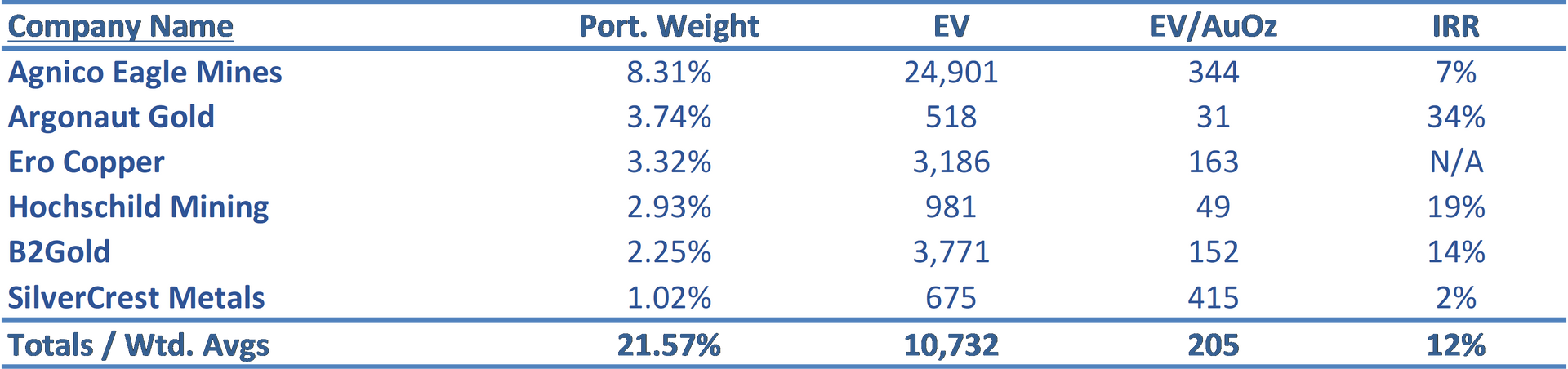

Investments in producing mining companies remain the largest component of our gold mining portfolio, accounting for a 61% weighting in the fund. Over the past three years we’ve initiated new positions in six producers: Agnico Eagle Mines, Argonaut Gold, B2Gold, Ero Copper, Hochschild Mining, and SilverCrest Metals. On a weighted-average basis these companies trade at $205 per ounce, compared to $33 per ounce for our new explorers. These producing companies offer an IRR of 12% at spot gold based on our analysis. Importantly, these companies don’t entail the same permitting and financing uncertainty of our exploration companies.

To date, our countercyclical investment in explorers has been painful. Our explorers are down on average 73% from the Jan 2021 fund inception, i.e. they have performed almost exactly in line with the 654 publicly listed gold miners that had a market cap between $250mm to $10mm in August of 2020. By comparison, our producers are down 23% over the same period. It has been a challenging three years for almost all gold miners, but exploration companies have been hardest hit, ours included.

Countercyclical Investing

Most dedicated gold-mining investors allocate capital pro-cyclically, buying as prices rise and selling as they fall. They tend to have investment horizons that are shorter than the gold cycle and take in capital as valuations rise and return capital as valuations fall. Needless to say, buying high and selling low makes it very difficult to add value over a full cycle. A better strategy is to invest when capital is fleeing the space at low prices and exit at attractive prices as capital pours in.

To take advantage, rather than be a victim, of the cycle in the gold mining space is easier said than done.

Countercyclical gold mining investing requires asset managers with a clear view of the gold price and like-minded clients. In our case, we believe that our long-term view of gold and our high-conviction clients give us this opportunity. Accordingly, when capital dries up in the gold mining sector and gold miners go bid wanted, we seek to judiciously increase our exposure to the most depressed segments of the market, just as we have over the past three years. During periods such as these, the unfinanced gold miners tend to offer the best opportunity to own high-quality assets at deeply discounted valuations.

But, even for very long-term investors, the critical variable to keep in mind when countercyclically investing in pre-revenue companies is time. When will this asset generate cash flow or be sold at an attractive price? What dilution will you suffer in the interim? Will the company be forced into an undesirable transaction while you wait? Taking account of these various factors is best done in an Internal Rate of Return (IRR) rather than a Price to Net Asset Value (P/NAV) framework.

IRR instead of P/NAV

IRR methodology captures the timing uncertainty that characterizes pre-revenue mining projects. If the years of drilling and studies are going to become a decade, the IRR calculation can accurately quantify that risk whereas the more conventional P/NAV methodology tends to underestimate the cost of lengthy project delays. Similarly, should years of forced dilution precede a construction decision, an IRR distills that risk much more accurately than the P/NAV conventional metric used in the gold mining sector today. The IRR calculation is, of course, only as good as the quality of the assumptions used. And, in those cases in which a company’s only plausible path to value realization is to sell the company, healthy skepticism needs to be applied to the numbers as such transactions are rare.

Despite all the challenges facing junior mining companies and all the necessary caveats about investing in pre-revenue companies, at today’s extraordinarily low valuations, the likely returns are eye-popping in our view. Importantly, these IRRs assume a continuation of the existing environment in which capital is very expensive for the sector and the exit price is a fraction of what it has been historically. If the gold price were to rise and the stocks of these companies were to follow suit, the IRRs would rise rapidly as these companies’ cost of equity capital would decline.

An Example: Thesis Gold

Thesis Gold, a 2.8% position in Equinox Partners Precious Metals Fund, L.P., typifies the combination of a growing intrinsic value and a declining share price that we find so attractive. Despite the company’s consistent exploration success, the company’s market cap has been cut in half since August of 2020.

In August of 2020, Thesis Gold had a resource of just 570,000 ounces and a massive drilling program ahead of it. Following a $60m CAD drilling campaign and the acquisition of an adjacent high-grade gold resource, the company has defined 3m ounces of gold and has a clear path to outline 5m ounces by mid-2024.

When in production, we expect Thesis to deplete at 3.9m ounces over 12 years, achieving an annual production of ~300,000 ounces at an all-in-sustaining cost of $1,200 per ounce. With an initial capital expenditure of ~$600m CAD, the company offers a potential acquiror a mid-teens IRR even after paying twice the current share price. Moreover, there are only a handful of undeveloped, potential +300,000 ounce per year assets globally, and none, in our opinion, of this quality in Canada.

According to our estimates, Thesis Gold will generate a 26% IRR for current shareholders. The company currently trades at a ~50% discount to the ~$135m CAD the company spent to define its resource. The market is saying that one of the most successful drill programs in Canada over the last decade destroyed roughly half of the capital spent. This is not only unreasonably pessimistic, but an exceptional investment opportunity in our opinion.

Sincerely,

Equinox Partners

[1] Please note that estimated performance has yet to be audited and is subject to revision. Performance figures constitute confidential information and must not be disclosed to third parties. An investor’s performance may differ based on timing of contributions, withdrawals and participation in new issues.

Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, FactSet or independent sources. Values as of 9.30.23, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notice.

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8