Equinox Partners, L.P. - Q2 2023 Letter

Dear Partners and Friends,

PERFORMANCE

Equinox Partners declined -1% in the second quarter and was down -5.2% in the first half of 2023.

Visit our performance page to view the Equinox Partners, L.P. fund summary in more detail.

investing through bull and bear markets

We recently reviewed our best ideas over Equinox Partners’ 28-year history. Our long-term performance can be divided into two distinct periods: the fifteen years prior to 2011 and the twelve years since. During the fifteen years from 1994 fund inception to the end of 2010, Equinox compounded at 20.4% per year. Over the past twelve years, Equinox has compounded at 3.0%, bringing our 28-year annualized return after all fees to 12.6%.

Our best investments prior to 2011 are easy to identify. We took meaningful positions in undervalued companies, and they appreciated dramatically. For example, we bought RJR near its lows in 2000. Over the next two and a half years, the stock more than trebled. Even more impressively, Inco Indonesia, which we purchased in early 2003, increased almost fifteen-fold by the fall of 2006. We didn’t trade around these positions, nor did we need to. Our good stock picking was quickly rewarded as capital regularly flowed into the sectors in which we were invested.

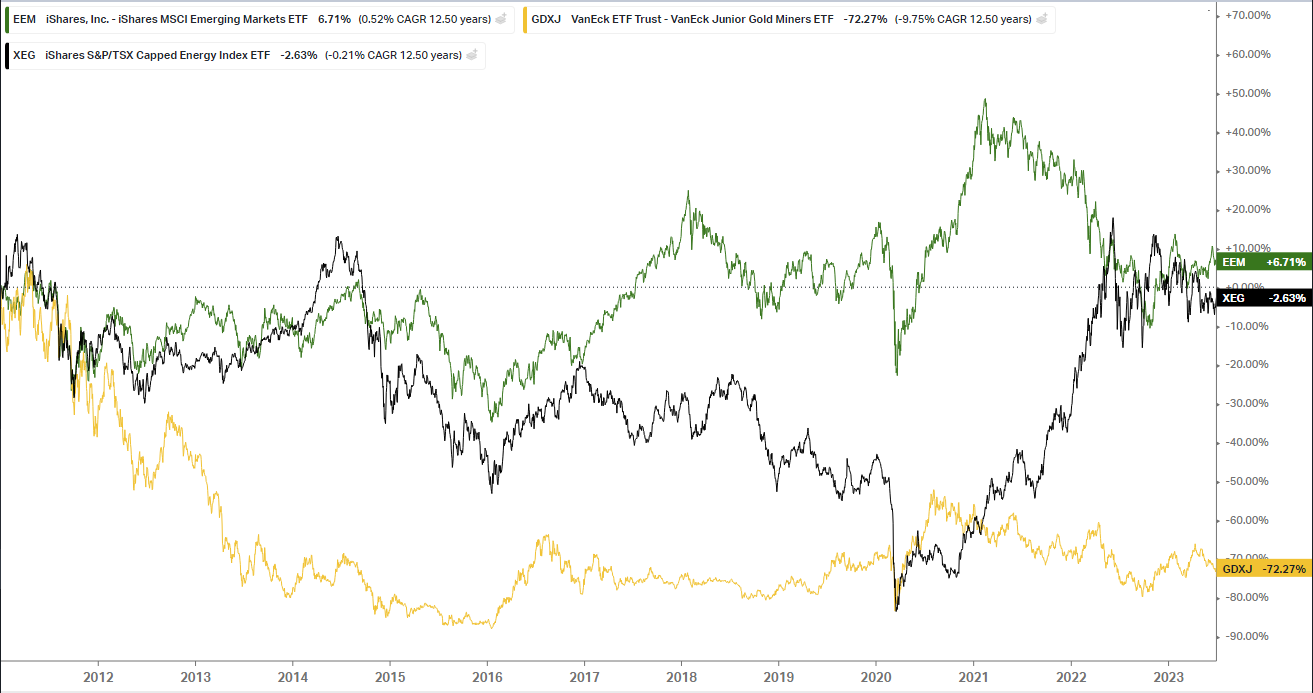

Our experience since 2011 has been the exact opposite. Over the last twelve years, gold miners have been in a deep bear market, oil and gas companies declined then recovered, and emerging markets have drifted sideways (see below). As capital has sought returns elsewhere, our best performing investments in this period have not been buy-and-hold. Instead, our returns over the last twelve years have largely come from our ability to add to positions when companies become particularly cheap and exit those positions when they rerate.

To illustrate how we have achieved positive, albeit modest, returns in these challenging markets, we’ve reviewed four investments that have generated a meaningful P&L and made a sizable contribution to our fund’s performance since 2011. We’ve constrained the P&L to the period from January 1, 2011 to June 30th, 2023, and selected companies that provide a representative sample of the markets in which we’ve been most actively invested. Specifically, we selected two energy companies, a mining company, and an emerging market company for our case studies.

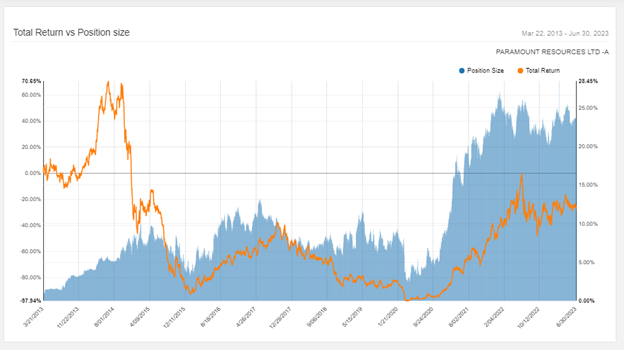

PARAMOUNT RESOURCES

metrics from inception of position

- First bought: March 2013 / Current top 10 holding

- Dollar contribution: $10m

- Fund contribution: +27%

- Return of stock from initial purchase: -24%

- Return of fund from initial purchase: +75%

When we invested in Paramount in 2013, we were already very familiar with the company’s assets and management. We owned the company previously and a colleague had served on the board for years. As a result of our experience and long-standing connection with the company, we had a favorable opinion of Paramount’s assets and the Riddell family, Paramount’s controlling shareholder.

Despite our deep knowledge of the company, our 2013 investment was particularly ill-timed. We failed to appreciate the extent of OPEC’s strategic response to the rapid growth of U.S. shale production. Accordingly, when OPEC let the oil price fall to prevent market share gains by North American shale producers, our investment in Paramount suffered. In addition to our serious miscalculation about the global oil market, we had not grasped the extent to which growing natural gas production in Canada’s Western Sedimentary Basin would overwhelm the takeaway capacity in the region and depress Paramount’s realization on its sale of natural gas.

Recognizing the flaws in our original investment thesis, we reduced our position size by 53% when Paramount’s stock rallied in late 2016 and 2017. This sale reflected our miscalculation about both the oil market and gas markets as well as our frustration with Jim Riddell’s growing pains as a Paramount’s new CEO. While the Riddell family was exceptionally well aligned with shareholders, Jim was still learning how to be an effective executive. The execution of his team at Paramount was clearly not what it needed to be, as the company regularly missed guidance due to operational issues.

By the time the price of oil collapsed in 2020, Jim had grown as a CEO. He remained strategically focused on long-term value but had also put in place a team that could execute at a high level. Confident that Paramount’s assets were being grossly misvalued by the stock market and that oil prices would rebound to more sustainable levels, we increased our shares held by 120%. Our decision to buy Paramount shares near their lows in the spring of 2020 transformed a bad long-term investment into a good one.

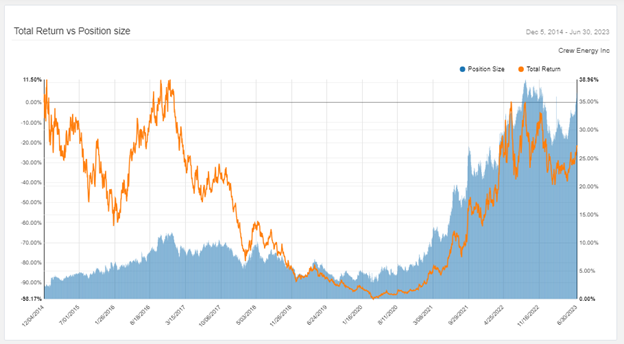

CREW ENERGY

metrics from inception of position

- First bought: December 2014 / Current top 10 holding

- Dollar Contribution: $43m

- Fund Contribution: +34%

- Return of stock from initial purchase: -30%

- Return of fund from initial purchase: +111%

Our experience investing in Crew is similar to our decade-long investment in Paramount, only better. Whereas we purchased Paramount prior to the OPEC-induced oil collapse of 2014, we bought Crew afterwards. At the time of our investment in Crew, we were attempting to take advantage of the precipitous declines in oil and gas companies and were particularly attracted to Crew’s superior long-lived assets with sizable natural gas exposure.

Following five years of marginal economics and lackluster returns, Crew’s shares declined another 67% from February 2020 to April 2020 during the 2020 COVID crisis. The market’s longstanding frustration with Crew’s inability to generate free cash flow quickly turned to panic over the company’s leveraged balance sheet. While Crew’s debt load was problematic if the low commodity prices of 2020 persisted for years, the market was missing two important facts. First, and most obviously, gas and oil prices could not remain at unsustainably low prices for very long. Second, and more importantly, Crew’s debt mainly consisted of a $300m bond that had a 2024 maturity. So, while the company’s debt ratios were certainly stressed in 2020, Crew did not have a liquidity problem.

As a result of our conviction about Crew’s liquidity position and the quality of its assets, from August 2019 to April 2020, we increased the quantity of shares held in Crew by 120%. These timely purchases, some of which occurred at stock prices as low as 15 cents CAD per share, transformed an underperforming position into a substantial contributor to the fund’s performance.

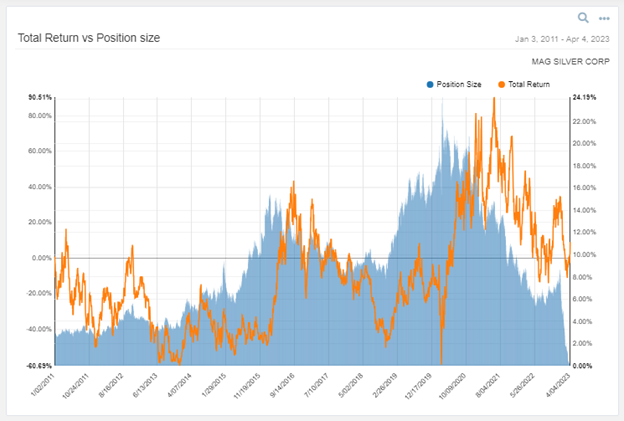

MAG SILVER

Metrics from 2011 to exit

- First bought: July 2008 / Last sold: April 2023

- Dollar contribution: $6m

- Fund contribution: +24%

- Return of stock: +9%

- Return of fund: +49%

In 2011, MAG was recovering from a hostile but unsuccessful takeover bid from its joint venture partner, Fresnillo. While we were pleased with the efforts of MAG’s board to prevent a takeover at an unattractive price, we were concerned about the company’s corporate governance. In particular, we were concerned that the board would not be able to move beyond the confrontation and develop a productive relationship with Fresnillo.

We also were concerned about MAG’s strategy of diversifying away from its world-class Juanicipio joint-venture asset through periodic capital raises and exploration spending. As a result, we formed a group called “Mining Investors for Shareholder Value” to improve the board at MAG. Our efforts resulted in the removal of one board member and the addition of Peter Barnes and Rick Clarke to the board in October 2012.

As our confidence in the governance of MAG grew, so too did our position size. We bought shares several times in the three years after the changes to MAG's board, and by the first quarter of 2016, MAG was the largest position in Equinox Partners. Our sales from the 2016-2018 period reflected declines in our assets under management rather than a change in our optimism about MAG. We remained substantial shareholders through the construction of the company’s flagship Juanicipio mine.

Unfortunately, the completion of the Juanicipio mine and resulting free cash flow generation did not deliver the rerating we expected. The problem with our investment thesis was two-fold. First, following the election of Lopez Obrador in 2018, the Mexican government has become increasingly hostile to mine development and imposed an unnecessary one-year delay on the project’s startup after construction was completed. This politically motivated delay sent a signal to the market that President Obrador’s administration did not view the development of this asset favorably. Second, the state of Zacatecas in which the joint venture asset is located, had become increasingly dangerous as local cartels fought for control of the state.

As a result of these two headwinds, we fully exited MAG in the spring of 2023. At the time, the company had completed the construction of the Juanicipio mine, but given the permitting problems in Mexico and security issues in Zacatecas, the company had no realistic prospect of expanding the mine or constructing other mines on the highly prospective joint venture property.

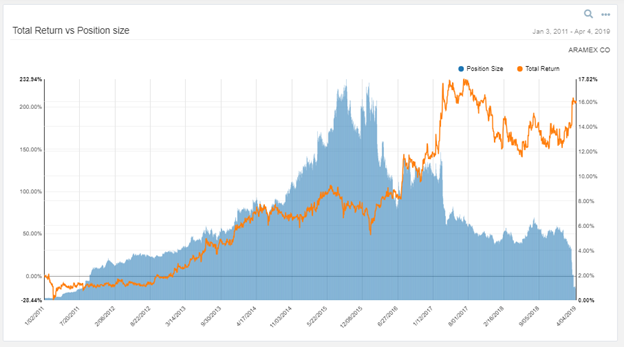

ARAMEX

Metrics from 2011 to exit

- First bought: May 2010 / Last sold: April 2019

- Dollar contribution: $54m

- Fund contribution: +11%

- Return of stock: +212%

- Return of fund: -44%

We first invested in Aramex in May of 2010. Later that year, the Arab Spring broke out. When Aramex shares traded off, we added to our position. The company’s performance in subsequent years made it one of our best performing investments since 2011. By 2013, Aramex was one of our top-five positions.

At the time of initial our investment, Aramex dominated the domestic delivery business in both Saudi Arabia and the UAE with a 50%+ market share in each. The resulting network effects enabled the company to generate a 50% adjusted ROE (ex-cash and goodwill) while undercutting its international competitors on price.

We were particularly impressed with the founder and chair of Aramex, Fadi Ghandour. Fadi had returned to Saudi with a degree from George Washington University and the intention of creating the FedEx of the Middle East. He did exactly that. Not only did Fadi mimic the business model of Fed Ex, but he also incorporated Western notions about business practices into the culture of Aramex. As a result, the company was particularly meritocratic. This internal system of rewarding hard work and competence was obvious throughout the organization, including the C-Suite. Hussein Hachem rose to become the CEO of Aramex in 2013. He had started off as a country manager for Kuwait: a small, bordering on irrelevant, market for Aramex. Hussein proved himself, was repeatedly promoted, and rose to CEO. Given the quality of the business and management, we knew that Aramex should not trade at half the multiple of Fed Ex and UPS.

After the initial phase of the Arab Spring passed, it became clear that neither Saudi Arabia nor the UAE were likely to undergo a political revolution similar to what occurred in Tunisia and Egypt. As the political uncertainty receded, the shares of Aramex rerated upwards. Given the quality of the business, management, and growth prospects, we could have owned the company for several more years. Our eventual decision to sell in 2017 was not driven principally by valuation, but by concerns regarding the departure of the CEO and share sales by founder. With the shares at a reasonable multiple and the incoming controlling shareholder not having demonstrated a clear commitment to Western notions of corporate governance, we elected to exit the majority of our position by 2017 and exited entirely in early 2019.

Conclusion

Despite wild fluctuations in the investment environment over the past 28 years, we’ve remained consistent in our approach to better business value investing. Simply put, we seek to own great businesses at low valuations for long periods of time and short overvalued securities facing serious headwinds. Our focus on valuation has prevented us from becoming disoriented during even the most turbulent markets. Our focus on quality ensures that our companies tend to grow their intrinsic value over time.

While our consistent approach has not generated consistent returns, we’ve had excellent performance when commodities and emerging markets have been strong. We’ve even generated very modest, long-term returns when the commodity cycle and emerging markets have gone against us. The combined result is a respectable, but not extraordinary, long-term compounded annual return of +12.6% net of all fees.

The future of financial markets is by definition uncertain. Nevertheless, it is worth noting that we’ve survived twelve extraordinarily challenging years in both commodities and emerging markets. Today’s combination of overextended valuations in large-cap U.S. companies and depressed valuations in our sectors suggest to us that we are on the cusp of a return to a more favorable period for our style of investing. Specifically, our gold miners which trade at a steep discounts to their intrinsic value should rerate dramatically as markets come to appreciate gold’s long-term role as a dollar alternative. Oil and gas companies should also rerate as markets realize that demand for hydrocarbons is not shrinking. And, finally, emerging markets should rerate as dollar denominated stocks and bonds struggle to generate positive returns.

Sincerely,

Equinox Partners

[1] Please note that estimated performance has yet to be audited and is subject to revision. Performance figures constitute confidential information and must not be disclosed to third parties. An investor’s performance may differ based on timing of contributions, withdrawals and participation in new issues.

Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, FactSet or independent sources. Values as of 6.30.23, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notice.