Equinox Partners Precious Metals Fund, L.P. - Q2 2023 Letter

Dear Partners and Friends,

PERFORMANCE

The Equinox Partners Precious Metals Fund, L.P. declined -6.6% in the second quarter and was down -0.9% in the first half of 2023.

Visit our performance page to view the Equinox Partners Precious Metals Fund, L.P. fund summary in more detail.

OUR BEST INVESTMENTS IN A BEAR MARKET FOR MINERS

Equinox Partners Precious Metals Fund, L.P. is down -30% since the start of the fund in January 2021. The passive Van Eck Junior Gold Miners ETF (GDXJ) is down -32% over the same period.

Historically, the performance of our gold miners hasn’t been this closely tethered to the GDXJ. We run a concentrated and high active share portfolio (85% active share as of June 30th, 2023) and there is a wide distribution of outcomes in the gold mining sector. Over time, these factors should generate differentiated performance.

We attribute our high correlation with the GDXJ over the past two and a half years to a suffocating bear market in gold mining. Persistent sector-wide declines have made it very difficult to generate our desired returns, particularly in smaller, pre-revenue companies. Exit opportunities at attractive valuations have become increasingly rare as the value of undeveloped ounces has declined. Economic but undeveloped ounces in desirable jurisdictions once traded between $100 to $200 per ounce, and now we see comparable assets valued between $10 and $20 per ounce.

The valuation compression in companies with undeveloped assets has weighed on our fund’s returns. However, rather than shift out of these companies into the larger, higher-multiple cash flowing companies, we have been adding to our holdings of companies with undeveloped assets with the view that the forthcoming strong market for gold and silver mining will see these companies rerate upwards dramatically. Accordingly, our allocation to undeveloped and unfinanced assets has risen from 8% to 15% since the beginning of 2021.

At the same time, the majority of our fund remains invested in companies that are currently cash flowing and/or are in construction. Our top three contributors since the fund’s inception, Bellevue Gold, Emerald Resources, and Endeavour Mining, each fit at least one of these two descriptions. Bellevue is building its first asset which is slated to go into production later this year. Emerald has successfully developed one cash-flowing asset and is now developing a second. Endeavour is a large, profitable senior gold miner that is growing while simultaneously generating and returning free cash flow. This letter will review each of these successful investments in more detail.

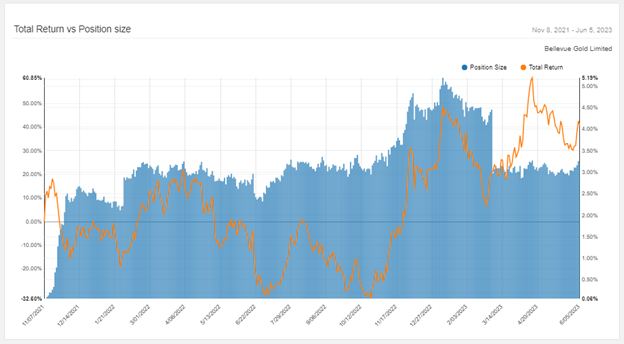

BELLEVUE GOLD

metrics from inception of position

- First bought: November 2021 / Current holding

- Dollar contribution: $0.3m

- Fund contribution: +1.1%

- Return of stock from initial purchase: +34%

- Return of fund from initial purchase: -22%

We invested in Bellevue four years after the company’s greenfield discovery in Western Australia. At that time, the market had lost interest in the company despite the increasingly attractive economics of the Bellevue deposit. By the spring of 2021, Bellevue had both a feasibility study and a 2.7m ounce resource at 9.9 grams per tonne. The quality of the management team was also a clear positive. Several members of Bellevue’s management team previously worked for Northern Star, a successful Australian producer with high insider ownership, underground mining expertise, and a culture of delivering on goals.

In 2022, Bellevue secured a $130m debt facility from Macquarie at attractive terms (~8.5% interest) and began construction. The mine is on budget, on schedule, and the first-gold pour is expected by the end of 2023. Once in production, Bellevue’s mine will average ~200,000 ounces of production over the first five years at an all-in sustaining cash cost of just $660-730 per ounce, making Bellevue one of the highest margin gold producers globally.

Despite the rerating that has occurred since 2021, we believe there is still significant upside in Bellevue. The company’s 50,000m exploration drill program is likely to sketch out additional resources. The Bellevue deposit is essentially open along strike and at depth, which makes it probable that the drilling campaign will be able to significantly extend the current 10-year mine life.

We sold half of our position this spring when one of the company’s founders and managing director, Steve Parsons, resigned and sold much of his stock. We are still unclear why he left and why he sold so much of his stock in the middle of the construction process. Despite that worrisome data point, we expect the company to reach commercial production in the first half of 2024 and the stock to rerate upwards. Evidence of this re-rate potential was demonstrated by the stock’s performance when the company announced a tolling agreement which generates ~$17m and de-risks the balance sheet future.

*Note: above financial metrics converted from $AUD denominated metrics to $USD metrics at an 0.66 $AUD/$USD exchange rate.

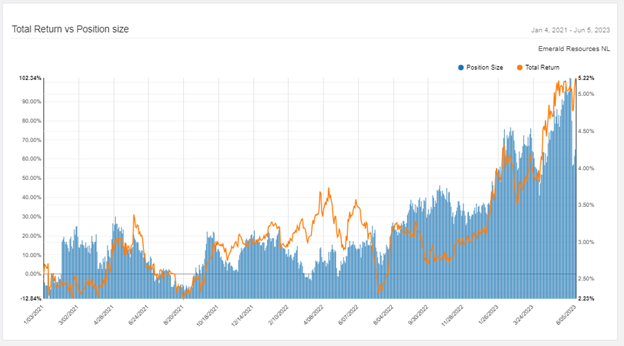

EMERALD RESOURCES

metrics from inception of position

- First bought: January 2021 / Current holding

- Dollar Contribution: $0.5m

- Fund Contribution: +2.2%

- Return of stock from initial purchase: +108%

- Return of fund from initial purchase: -29%

We took a position in Emerald in large part due to our confidence in the Managing Director (CEO) Morgan Hart. Morgan had an outstanding operational track record as COO of Equigold and Regis Resources. Additionally, Morgan and his team made sizeable purchases of Emerald stock with their own money.

We were also attracted to the economics of Emerald’s high-grade, open-pit mine in Cambodia: the Okvau project. With its attractive grade and strip ratio, it was obvious to us that Okvau would be highly free cash flow generative. The final outstanding question in our due diligence was in regards to Cambodia. While Cambodia had no history with foreign mining companies, Morgan had shown an ability to advance a project and obtain permits quickly. Accordingly, we participated in the construction financing in 2020 across our other funds.

Thus far, our confidence in Morgan has been well rewarded. Morgan and his team built Okvau on time and under budget, a particularly impressive feat given most of the construction took place during COVID. With an all-in sustaining cost of ~$800 per ounce, Okvau is among the lowest cost mines in our portfolio. Given the significant exploration potential both at depth and near the mine at Okvau, we are confident that there are many more years of mine life at Okvau that haven’t yet been formally placed in the mine plan.

Beyond Okvau, in May of 2022 Emerald made a strategic investment in Bullseye Mining Limited of Australia. Emerald currently owns ~60% of the company and is in the process of consolidating their ownership by buying out the remaining shareholders. Once Emerald gains a larger equity ownership of Bullseye, we expect it to begin developing a high-grade, open-pit mine and aggressively begin exploring the Bullseye land package in Western Australia. As the market has started to give Morgan and his team more credit for their serial success, we recently reduced our position as the stock rallied.

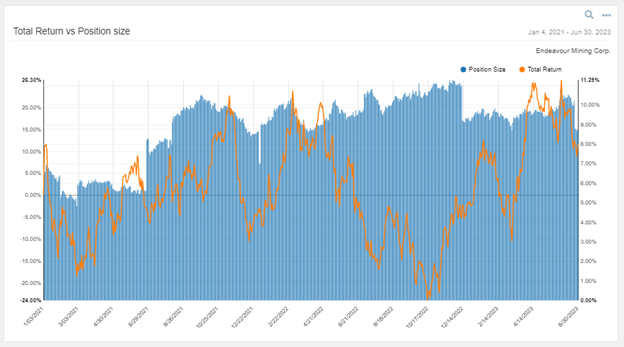

ENDEAVOUR MINING

metrics from inception of position

- First bought: January 2021 / Current holding

- Dollar contribution: $0.2m

- Fund contribution: +0.8%

- Return of stock: +12%

- Return of fund: -29%

Endeavour Mining is a well-run gold mining company focused on the underexplored geology of West Africa. This focus on scaling in West Africa has given the company a durable competitive advantage in its ability to add new mines with industry leading economics. CEO Sebastien de Montessus and his management team have executed on ambitious growth plans and Endeavour today produces over 1 million ounces of gold annually. Naguib Sawiris, the company’s largest shareholder and a non-executive board member, has also played a critical role keeping the company strategically disciplined.

In addition to Endeavour’s West African geographic focus, the company further defines its strategy as a portfolio of assets with 10+ year mine lives, targeting sub-$1000 per ounce AISC, and the ability to unlock growth organically through exploration. The company has consistently delivered on these objectives while maintaining a strong balance sheet and shareholder-capital-return policy. In pursuit of this strategy, the company has made well-timed acquisitions and divested older, higher-cost assets. More recently, Endeavour’s strong performance has been a result of its exploration success and its ability to execute construction of new projects on-time and on-budget.

Since 2016, the company has discovered 15m ounces at a discovery cost of less than $25 per ounce. Many of these ounces have been brownfield ounces which has helped extend mine lives and bring forward higher grade production at a rapid pace. In 2021, the company outlined its plan to discover another 12-17 million ounces over a five-year period. Success on this plan will ensure Endeavour’s portfolio is set-up to operate for many years to come and will generate strong free cash flow from those ounces.

Endeavour has also demonstrated its ability to find and advance greenfield assets: in 2023 the company presented its discovery of Tanda-Iguela in Cote d’Ivoire. The company staked this land package for minimal amounts of upfront capital and has gone on to find over 3m ounces at a cost of less than $10 per indicated ounce. These types of discoveries make Endeavour unique in its ability to simultaneously optimize the current portfolio of producing assets while also growing the pipeline for the next decade of production.

Lastly, Endeavour is intent on returning capital to shareholders, maintaining both a clear dividend policy and flexible share buyback program. Since the company originally outlined the policy in 2021, Endeavour has bought back over $235m in stock and paid $340m in dividends. If the gold price remains above the $1,500 per ounce level, shareholders can expect $150m paid in dividends annually, representing an approximate 3% dividend yield at the current share price. We expect these payouts to increase substantially once the company wraps up ongoing, large capex projects that are diverting some of its current cash flow.

Sincerely,

Equinox Partners

[1] Please note that estimated performance has yet to be audited and is subject to revision. Performance figures constitute confidential information and must not be disclosed to third parties. An investor’s performance may differ based on timing of contributions, withdrawals and participation in new issues.

Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, FactSet or independent sources. Values as of 6.30.23, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notice.

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8