Kuroto Fund, L.P. - Q2 2023 Letter

Dear Partners and Friends,

PERFORMANCE

Kuroto Fund appreciated +6.5% in the second quarter and gained +9.7% in the first half of 2023.

Visit our performance page to view the Kuroto Fund, L.P. fund summary in more detail.

Generating returns in good and bad markets

In the initial eight-year period, our investment successes were straightforward. We bought stocks that appreciated rapidly and then sold them. For instance, we held positions in Namyang Dairy and Dabur for approximately three years during which they increased five-fold in dollar terms on average. Inco Indonesia, even more impressively, rose more than thirty-fold in just over three and a half years. We bought each of these companies at mid-to-low single-digit multiples of free cash flow and sold them at more reasonable multiples on much higher earnings.

The period from October 2007 to 2023 has been much more challenging. Over the past almost sixteen years, we had to work hard to generate modest returns. To illustrate how we achieved these returns since 2007, the following letter outlines our buy and sell decisions in four companies that have generated good IRRs and have made the greatest contribution to Kuroto Fund’s performance over that period.

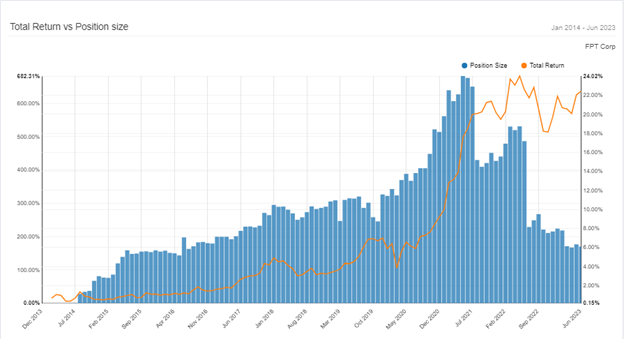

FPT

- First bought: June 2014 / Current 6% position

- Dollar contribution: $27.9m of period’s $34.6m / Avg. period AUM $181m

- Fund contribution: +33%

- Return of stock from initial purchase: +576%

- Return of fund from initial purchase: +81%

- IRR based on purchases and sales: +16%

We first purchased shares in FPT in 2014. At the time, FPT was a Vietnamese conglomerate with several business lines that didn’t fit together: the third largest local broadband cable company; the second largest cell phone retailer; an IT distribution company; and a small but quickly growing tech outsourcing business focused on Japan. While we were skeptical about the quality of some of FPT’s businesses, nevertheless we believed that FPT had a real competitive advantage as the only private broadband company in Vietnam. The meritocratic culture at FPT in which young people could join and rise through the ranks without connections struck us as obviously superior to the incentive structure at the company’s state-run competitors.

To our delight, FPT has outperformed our most optimistic expectations. Dr. Binh, the company’s controlling shareholder, turned out to be an excellent entrepreneur. He sold majority stakes in FPT’s two, low-quality businesses: the cell phone retailer and the technology distribution business. The broadband business, after a period of heavy investment, has compounded revenue at double digits and seen margin improvement, allowing earnings to grow faster than our expectations. But the real surprise has been the success of the education and global technology businesses.

Leveraging FPT’s brand as the country’s best place to work in technology, the company created FPT University, which has become one of Vietnam’s premier technology education institutions and presently enrolls over 100k students. This business is highly profitable and a meaningful contributor to the bottom line. Moreover, this business has provided a steady flow of new graduates for the global technology-outsourcing business. FPT’s global technology-outsourcing business has grown into the group’s biggest business by far. The business line has expanded from Japan to have a large presence in the U.S., Europe, and the rest of Asia. And, it has moved up the value chain from very low-end technology outsourcing to higher-end digital-transformation services. FPT now owns the country’s largest and most impressive technology ecosystem and is in a stronger position to grow today than it was when we initially invested.

As the chart above shows, we allowed the position size grow to over 20% of the fund, only meaningfully reducing the position as the opportunity to invest in extremely undervalued oil and gas businesses presented itself last year. Today, FPT is 6% of our fund. It trades at a mid-teens earnings multiple and is still growing earnings around 20% per year. Our investment success in FPT is proof that a strong corporate culture can help an organization overcome serious challenges and generate value for long-term shareholders.

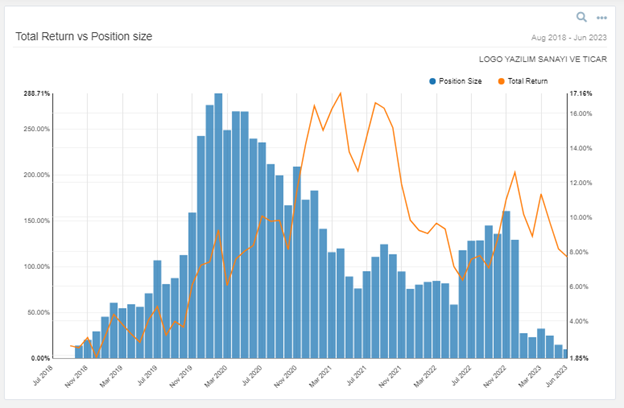

LOGO YAZILIM

- First bought: August 2018 / Current 2.4% position

- Dollar contribution: $9.6m of period’s $17.1m / Avg. period AUM $86m

- Fund contribution: +15%

- Return of stock from initial purchase: +67%

- Return of fund from initial purchase: +61%

- IRR based on purchases and sales: +47%

We purchased shares of Logo Yazilim in the summer of 2018 as the Turkish lira was in freefall and the U.S. government was threatening to destroy the Turkish economy with sanctions over the imprisonment of Pastor Andrew Brunson. We had been following Logo since 2014, had spoken to management several times, and had identified it as a business that we would love to own at the right price. The summer of 2018 delivered that price.

Logo was and remains the dominant enterprise resource planning (ERP) software company in Turkey for small-and-medium-sized businesses. By 2018, the company was well-positioned to navigate Turkey’s periodic macroeconomic and geopolitical storms and thrive in a more benign environment. Logo’s customers face enormous switching costs, so the company had the ability to increase prices in-line with inflation after a modest lag. In addition, ERP was very underpenetrated throughout the country, so the growth opportunity was large. Moreover, the company had little debt and traded at just 8x forward earnings estimates. Because of the high equity-market volatility caused by the crisis, we were able to buy over 5% of the company in a short amount of time and became one of the largest shareholders outside of the founder.

As Turkey’s 2018 crisis progressed and ultimately passed, Logo not only survived, but thrived. The ERP business grew substantially, its Romanian subsidiary turned profitable and became a meaningful contributor, and the company took advantage of a regulation change to ramp up a tax compliance software business that has grown from nothing to over 20% of the top line. By 2021, the market understood the quality of the business, and the shares re-rated to over 20x earnings. As a result, we reduced our position from a high of 17% of the fund to around 6%.

In 2022, the USD value of Logo’s shares declined significantly again as the stock was punished by a combination of the lira’s decline and a stock market derating as foreign investors fled the Turkish equity market. We increased our position as the shares declined, believing that we could again generate good returns owning Logo. This investment thesis worked for a while but we decided to sell most of our position in early 2023 as it became apparent that Turkey’s latest economic difficulties weren’t going to recede quickly.

Today, Logo’s shares have derated to 10x earnings. The business remains very resilient and the opportunity for growth in a better economic environment remains, but the company fundamentals are hard to forecast because of the macroeconomic environment in Turkey. With the political situation clarified, and Erdogan beginning to implement a more orthodox economic team, there is reason for hope. At the moment, we are waiting for a bit more clarity before adding to our Logo position. Today, Logo is a 2% position in our fund. Our successful investment in Logo reminds us of the importance of maintaining a buy list of well-researched businesses in case the opportunity presents itself.

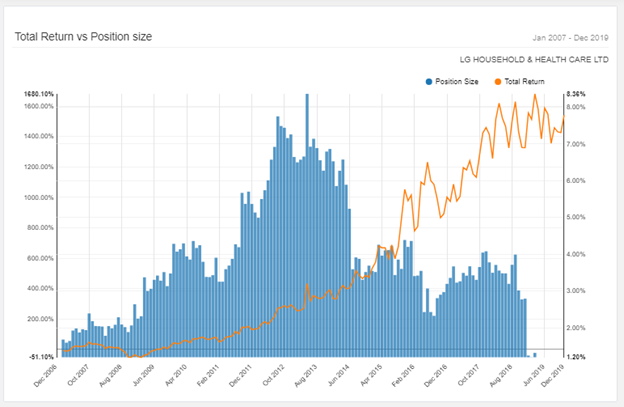

LG H&H

Metrics from inception of accounting system in 2007

- First bought: June 2003 / Last sold: March 2019

- Dollar contribution: $42.1m of period’s $226.4m / Avg. period AUM $337m

- Fund contribution: +14%

- Return of stock from 2007: +1680%

- Return of fund from 2007: +1205%

- IRR based on purchases and sales: +22%

LG H&H is an early vintage investment that we initially bought in June of 2003 and held through the Global Financial Crisis of 2008. After the Asian Crisis in the late 1990s, LG H&H had struggled with declining market share in their door-to-door cosmetics business, and the management team was not sure how to improve the company’s margins on its household branded products business. On top of these problems, LG H&H had a leveraged balance sheet following an acquisition spree in the mid-1990s.

The silver lining to all these problems was that the LG group parent company had recently hired an experienced Proctor & Gamble executive to be the new CEO of LG H&H and granted him relatively large amounts of autonomy within the LG chaebol. This meant that as minority shareholders we would benefit from Western style capital allocation and business rationalization at LG H&H. Furthermore, we were able to buy LG H&H preferred shares at a meaningful discount to the common shares even though they had the same economic characteristics. This was a quirk of the Korean market that allowed us to hold onto the shares for over a decade with a high margin of safety even as LG H&H’s common shares traded at a valuation that was close to fair value.

The turnaround of LG H&H worked much better than we expected. Management was able to stabilize the company’s market share in its high margin cosmetics business and turned around its home care product line. They rationalized SKUs and focused on the 20% of the brands that generated 80% of the profit. As a result, the company more than doubled margins, meaningfully grew the top line, and deleveraged its balance sheet. The company then launched an aggressive growth strategy in China that was incredibly successful.

The stock we bought re-rated from a mid-single-digit earnings multiple to a mid-teens multiple as LG H&H transformed into an easier to understand, high return on capital branded products business with a pristine balance sheet and a proven management team. The CEO from Procter & Gamble retired in 2014, and we continued to own the business until fully exiting in 2019 at what we believed was a full valuation.

Since our sale, LG H&H’s China business has collapsed and the company has struggled with COVID lockdowns, regulation, and poor brand mismanagement. The stock retraced back to where it was trading over a decade ago. While the current valuation is not demanding, the outlook is cloudy and the investment case is hard to underwrite. This result underlines to us the value-investing fundamentals of staying on top of a company’s competitive advantage, buying with a meaningful margin of safety, and selling when that margin of safety disappears.

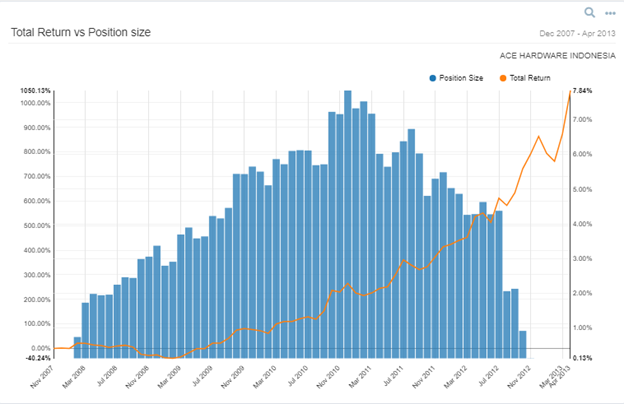

ACE HARDWARE INDONESIA

- First bought: February 2008 / Last sold: November 2012

- Dollar contribution: $34.1m of period’s $335.1m / Avg. period AUM $342m

- Fund contribution: +11%

- Return of stock from initial purchase: +792%

- Return of fund from initial purchase: +78%

- IRR based on purchases and sales: +45%

We bought ACE Hardware in Indonesia at a discounted valuation during the Global Financial Crisis of 2008. We liked the business’s strong balance sheet, high margins, and low valuation. Additionally, we felt that they had the special sauce of how to do retail in Indonesia. While the company was a licensee of the U.S. ACE hardware brand, they had changed their merchandising to fit Indonesian tastes. Instead of selling hammers and nails, the company was selling a high-margin product mix that included everything from children’s toys to fish aquariums. Although the product mix didn’t make much sense from an American perspective, it worked well in the Indonesian context. The company was rapidly growing both square footage as well as same-store sales. The result was a fast-growing company that spun off cash.

We had reservations about the durability of the margins, the sustained lack of competition, and serious concerns about a related-party distributor that was controlled by the family that also controlled Ace Hardware Indonesia. After digging deeper and conducting diligence on the controlling family, we were able to build conviction that the family was operating in an ethical—if not Western—fashion, and that the margins reflected the unique merchandising strategy of ACE that other brick and mortar retailers in Indonesia would find hard to replicate.

Over the course of our five-year holding period, the shares increased almost 9-fold. When the shares reached what we saw as a fair valuation and the Indonesia rupiah became relatively strong, we elected to exit. Now nine years after our exit, the shares are trading 30% below the price we achieved in our last sale. The company’s deteriorating fundamentals were largely driven by an increase in competition at the high end from IKEA and at the low end from an aggressive Malaysia low-priced brand. Additionally, online retail expanded rapidly in Indonesia. Ace’s growth has slowed dramatically and our concerns about the sustainability of its incredibly high margins are now shared by the market—it just took 15 years for the competitive dynamic that concerned us to play out. Our investment in Ace Hardware Indonesia highlights the importance of keeping a close eye on an investment’s competitive position and exiting a position when the margin of safety goes away.

Sincerely,

Sean Fieler Brad Virbitsky

[1] Please note that estimated performance has yet to be audited and is subject to revision. Performance figures constitute confidential information and must not be disclosed to third parties. An investor’s performance may differ based on timing of contributions, withdrawals and participation in new issues.

Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, FactSet or independent sources. Values as of 6.30.23, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notice.

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8