Kuroto Fund, L.P. - Q4 2017 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

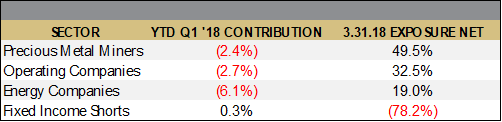

Kuroto Fund declined -1.3% in the first quarter of 2018. The EM index gained +1.4% over the same period. For the year to date through April 11, Kuroto Fund was up +0.4% with the index up +1.8%

discounting political change

In our third quarter 2016 letter, we noted that we were living through a still opaque turning point in history. Fifteen months later, it is clear that the post-Cold War status quo is over. The details of the change have been diligently chronicled in the press, but the larger implications have yet to be discounted in the market. The market’s hesitancy to factor in the fundamental alteration in the geopolitical landscape raises pressing questions for investors: What are the broad contours of these changes, and how will they effect the valuation of securities? While wrestling with these difficult questions, most investors have become skittish without fundamentally rethinking their investment strategy. This, we believe, is a mistake. Accordingly, we will outline our impressions of the geopolitical environment and the implications for our global portfolio of securities.

The election of President Trump structurally altered the geopolitical landscape. Under his leadership, America is treating China and Russia as strategic rivals in a way that the previous three American Presidents did not. So far, this means that America has ignored Chinese and Russian domestic political repression, but not their territorial expansion or mercantilism. President Trump, for example, congratulated President Putin on his reelection while simultaneously sanctioning Russian oligarchs close to President Putin, attacking Russian mercenaries in Syria, and expelling sixty Russian diplomats from the United States. The wisdom of this particular combination of policies is open for debate. But, together these actions reflect an effort on the part of the Trump Administration to delineate the geopolitical terms in which it wishes to engage with Russia.

Perhaps as important as Trump’s election and new policy direction is President Xi’s and President Putin’s successful consolidation of power domestically. In March, President Xi oversaw changes to the Chinese constitution that allow him to serve an unlimited number of consecutive terms, and President Putin won a rigged reelection with 80% of the vote and 67% turnout. In both cases, Xi and Putin have achieved a concentration of power that their countries have not seen in decades. Their successful consolidation of power begs the question: What will they do with it?

By all accounts, President Xi and President Putin have ambitions of leading their respective countries to their destiny. Each sees himself as the historic leader capable of delivering on those objectives. This shared ambition, however, is translating in to two very different paths forward. In China’s case, a continuation of their harmonious rise strategy remains the default setting. If China can avoid a domestic financial crisis, grow their economy, achieve technological parity with the West, and opportunistically assert their interests abroad, then they will likely rival, and perhaps surpass, America economically and militarily in the decades to come. Accordingly, China’s best strategy is to stay the course, grow, and avoid unnecessary confrontations with the West. This, not coincidently, is exactly the vision that President Xi laid out in his recent 3 hour and 23 minute speech this spring entitled, “Secure a Decisive Victory in Building a Moderately Prosperous Society in All Respects and Strive for the Great Success of Socialism with Chinese Characteristics for a New Era.”

President Putin’s ability to deliver on Russia’s ‘destiny’ as a first-tier world power is less straightforward and more problematic for America in the short run. With low growth, catastrophic demographics, and almost no appetite for the potentially destabilizing effects of economic reform at home, it is difficult to see how Russia can achieve its destiny by rising harmoniously. Instead, Russia’s most realistic path to a stronger geopolitical position involves America losing power. While logical, Russia’s zero-sum view of its rivalry with the United States is also problematic. This particular competitive framework, for example, lends credibility to the rumors that Russia helped North Korea achieve its improbably quick mastery of multistage missile technology.

The rapidly unfolding geopolitical competition amongst America, China, and Russia, and the newly important personal dynamics amongst Presidents Trump, Xi, and Putin, leave little doubt that we are living in a fundamentally changed environment. Gone are the days in which Russia was able to retake Crimea and China could militarize the South China Sea without risking a direct conflict with the United States. Going forward, the geopolitical competition amongst the United States, Russia, and China promises to generate significantly more geopolitical friction. For not only is Russia strategically incentivized to disrupt the status quo, but so too is the Trump Administration. Specifically, we expect America will look for tactical opportunities to challenge China. American tariffs on Chinese goods are just the first salvo of what will likely be a multipronged strategy. We, for example, would not be surprised if the U.S. Navy becomes significantly more aggressive in its freedom of navigation operations in the South China Sea.

Today’s over-leveraged world seems particularly ill-suited for a return of this sort of geopolitical brinksmanship. With China’s debt to GDP having skyrocketed to 295% and much of the developed world reporting even higher figures, it does not take much imagination to envision how the pricing-in of geopolitical risk could quickly translate into financial stress. While this risk is obvious, market participants have remained surprisingly blasé about the shifting geopolitical landscape. We believe the market’s misplaced confidence comes from a combination of the lingering effects of one of the longest running bull markets in history as well as the related belief that policy makers will act to preserve the financial status quo if need be.

Put bluntly, the past thirty years of financial history have instilled investors with a deep confidence that the world’s central bankers will do whatever it takes to preserve stability. The almost unthinkable alternative of central bankers standing aside while the market metes out rough justice would constitute a complete repudiation of the central banker consensus regarding crisis management. Although the long-run costs of episodic, but ever larger, interventions may eventually outweigh the benefits, we know of no currently serving central banker willing to stay on the sidelines and make that argument. Accordingly, we expect that the cost of preserving financial stability will need to be clearly prohibitive before central bankers will convincingly back away from their strategy of what still appears to be successful market manipulation.

The more proximate short-term risk to financial stability, as we’ve attempted to lay out in this letter, is that other policymakers do not share central bankers’ strong preference for stability. Specifically, as we game out the newly minted geopolitical landscape, we are struck by the extent to which the fate of the world lies in the hands of Trump, Xi, and Putin, rather than the world’s central bankers. We are equally struck by the reality that ever-higher financial asset prices are a means to an end, not the actual end sought by Presidents Trump, Xi, or Putin. All other things being equal, each would prefer ever-ascending financial asset prices. But, all other things are never equal.

In today’s particular geopolitical and financial context, we believe that our portfolio is well positioned geographically, fundamentally, and in terms of valuation. We continue to own a geographically diverse collection of 27 companies, only 3 of which are included in the EM index. Furthermore, these businesses have idiosyncratic risks and opportunities which should be the drivers of their intrinsic value, and are largely insulated from growing geopolitical volatility between the US, Russia, and China. Finally, we have increased the fund’s cash position in order to take advantage of any buying opportunities that may arise.

Sincerely,

Sean Fieler

Daniel Gittes