Equinox Partners, L.P. - Q4 2017 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

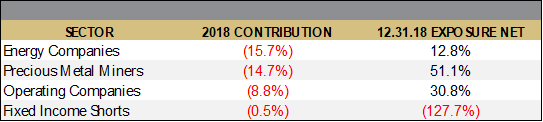

Equinox Partners declined -0.8% in the fourth quarter of 2017 and gained +11.5% for the full year. Through January 19, the fund is down -0.8% for the year-to-date 2018.[1]

Our global operating businesses and precious metals miners were responsible for more than all of our gains last year. Our operating companies appreciated 41% in 2017 while our mining companies were up 14.5%. Our fixed income shorts generated a small loss while our E&P companies declined 19%. The price of our E&P companies fell sharply as their multiples compressed and the price of natural gas in Western Canada fell.

Throughout the year, we actively sold shares in our best performing companies as they approached full value. We redeployed this capital into significantly undervalued companies as well as new short positions. As a result, we reduced our weighting in global operating businesses from 43% to 33%. Our E&P weighting also declined from 29% to 21% despite our purchases in the sector. We increased our weighting in gold and silver mining from 41% to 46%. And, on the short side, we increased our short bond positon from 77% gross to 83% gross, inclusive of our corporate bond shorts.

We sold significant portions of two of our largest positions during the year, Aramex and Ferreycorp. As a result of these sales, Aramex is no longer a top five position. Amongst the positions in which we invested additional capital, Crew Energy topped the list. Crew remains one of our largest long positions, and we invested aggressively in this company as its share price fell last year.

TOP-FIVE HOLDINGS

With our four largest equity positions accounting for 32% of partners’ capital and our fixed income short position equivalent to -68% (net), this top-five letter offers insight into our decision-making process as well as the portfolio as a whole. With the exception of Aramex, the portfolio’s top positions are the same as last year. We did not, however, include our fifth largest long equity position, Bear Creek, but instead included a write up of our short fixed income position which is, on an absolute basis, our largest position.

Mag Silver - 9.5% of the fund

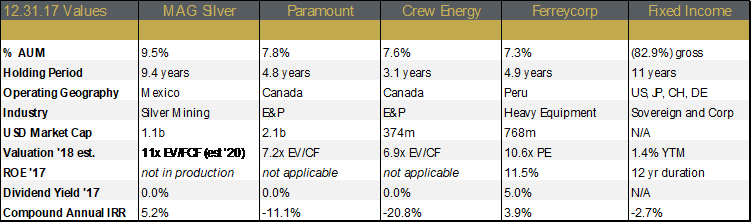

MAG Silver, through their JV partnership with Fresnillo, is the 44% owner of the best undeveloped silver mine in the world. Juanicipio is among the highest grade deposits in the world as shown in the graph below.[2]

Last fall, MAG announced the expansion of the Juancipio mine plan from 2,400 tonnes per day to 4,000 tonnes per day. This rightsizing of the mine incorporates the expanded orebody while preserving a 19-year mine plan. While this expansion is an enormous positive development, the updated feasibility required the companies to push back the construction timeline by six months. Under this new timeline, we expect the Juancipio feasibility study to be released early in 2018 and a construction decision in the first half of 2018. More importantly, the Juanicipio mine is on track for production by early 2020.

MAG’s preliminary economic assessment demonstrates the value of its stake in the Juanicipio JV. This study incorporates the exploration success of the last few years and shows a resource 250% larger than the previous study released in 2012. There are now 172m oz of silver and 600k oz of gold in the joint venture mine plan. The study estimates that MAG will receive just over $100MM in the early years of the project at current silver prices. Accordingly, with a market valuation of just $1 billion, we think MAG remains undervalued.

The higher throughput for the Juanicipio mine increased the initial capital required for the project. As a result, the MAG board elected to raise an additional $48MM in equity in order to fully fund their portion of the development capital. While we believe the company could have raised the capital more cheaply had they waited until construction began, we continue to hold MAG’s board in high regard.

Going forward, we expect the Juancipio orebody will grow further and that new mineralization will be discovered on the MAG-Fresnillo joint-venture property. With decades of free cash flow ahead from Juancipio and the likelihood of new investment opportunities, we are encouraging the company to communicate a clear capital allocation policy for the future. We believe that a clear articulation of MAG’s corporate position as an investor, not an operator, of high-quality assets is the best way for the company to obtain the premium valuation it deserves.

Paramount Resources - 7.8% of the fund

Paramount entered 2017 with a large, high-quality land package, 12k bpd of production, and a $566MM cash balance. As of the end of 2017, Paramount was producing 95k bpd and carrying more than $500MM of net debt. As its strong share price suggests, Paramount’s rapid transformation occurred on incredibly favorable terms.

Having entered last year in a position of extraordinary financial strength, Paramount was perfectly positioned to take advantage of the distressed market for E&P assets. The result of their effort was two major transactions. First, Paramount purchased Apache’s Canadian operations for just 3.3x annualized cash flow. Paramount followed up this purchase by merging with its sister company, Trilogy, which held assets adjacent to the property sold by Apache. Simultaneous to these two transactions, Paramount began to develop some of its own high-quality acreage.

Paramount is now on track to grow its production to over 200k bpd by 2021 while reducing financial leverage. This desirable combination of growth and deleveraging is possible because Paramount’s mix-shift towards more liquids production will drive corporate margins higher. This year, we expect liquids will account for three-fourths of Paramount’s total revenue. As a result, when production doubles, the company’s cash flow should triple. Through Paramount, we own self-financing high-rates of production growth trading at 6.4x estimated 2018 cash flow and 2.4x cash flow at 200k bpd.

Given the challenges of going to scale, Jim Riddell, Paramount’s CEO, has rightly focused his attention on improving Paramount’s operational performance. Jim has brought in young talent with experience in the U.S. and has revamped the team structure so as to better incentivize performance and innovation. Thus far, the drilling results have been solid. While the company’s stock has performed well on a relative basis, the transformation at Paramount has yet to be fully recognized by the market.

Crew - 7.6% of the fund

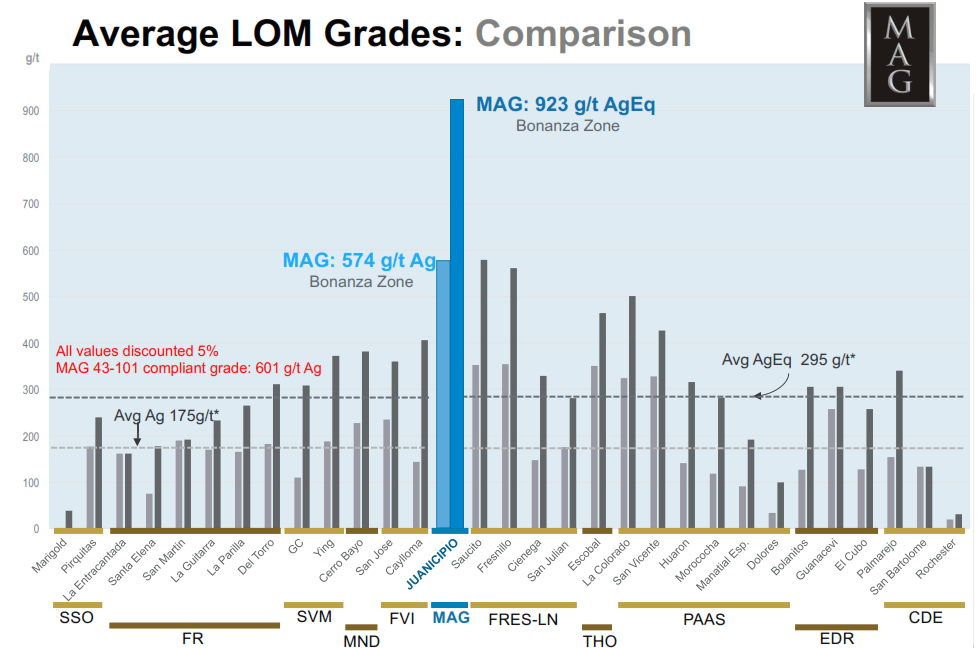

In the fourth quarter of 2017, the futures contract for 2018 AECO natural gas was basically cut in half. At current AECO prices, Crew cannot internally finance production growth and will struggle to maintain its 2017 exit rate of production.

AECO gas prices have long traded at substantial discounts to Henry Hub and other North American markets. The differential from Canada to the U.S. has historically been less than $1/mcf. More recently, this differential has widened to almost $1.80/mcf as shown in the graph below. This widening is a result of insufficient local natural gas infrastructure.

To address this infrastructure bottleneck, TransCanada has scheduled an expansion of takeaway capacity which, in the short-term, has resulted in periodic shutdowns of the system. While these efforts will improve the gas price differentials over time, they have substantially widened the differential in the short term. With the precise timing of a remedy uncertain, the future price of gas in Western Canada is reflecting a never-ending series of repairs.

The market is also ignoring the growing likelihood of Canadian LNG as a response to these price differentials. Two projects, one led by Shell and another by Chevron, are nearing their final investment decision, and we should know as early as this year whether they will go ahead. If just one project goes ahead, it has the potential of reversing the discount Canadian producers receive, thereby increasing their cash flows tremendously. Even without LNG, several new pipelines are slated to be built in the coming years, which will result in more capacity and improved pricing.

Crew’s short-term situation would have been far worse had the company not systematically diversified their end markets for gas and improved their capital structure. As a result of these steps, less than half of Crew’s gas is directly impacted by the AECO differential, and $300MM of their $340MM of debt is in the form of a covenant-lite bond that is not due until 2024. The remaining $40MM of debt is a result of their partial drawdown on a $235MM bank line. Even at today’s gas prices, Crew’s overall debt to cash flow of just under 3x is not problematic.

Rather than simply waiting for their realized gas prices to improve, Crew is in the process of divesting several non-core properties to fund profitable growth. We believe the undeveloped assets the company could sell are alone worth more than the entire market cap of the company. Accordingly, were they to even partially monetize their land portfolio, we believe the market would quickly revalue the company. In addition, Crew is wisely focusing its capital spending on the most liquids-rich opportunities in the Septimus area, which generate north of a 50% IRR at current prices. By focusing exclusively on these high IRR liquids-rich wells, Crew can return to growth even at today’s depressed natural gas prices, albeit at a much slower pace than envisioned previously.

Going forward, Crew stands to gain from both the company’s own efforts to unlock value and from the closing of the differential for Canadian gas.

Ferreycorp – 7.3% of the fund

Ferreycorp is the exclusive Caterpillar dealer in Peru. The company boasts high market share in its core product categories, an extensive distribution and support network, and a highly profitable parts and services business. We estimate that the company’s earnings were essentially flat in 2017. While a rebound in commodity prices saw some improvement in sales of mining trucks, political infighting in Peru prevented a material increase in infrastructure spending and dampened private-sector construction demand. Heavy flooding in March of 2017 further weighed on economic activity in the country. In light of Ferreycorp’s strong share price performance, lack of earnings growth, and outsized weighting in the portfolio, we sold approximately half of our Ferreycorp position in October.

Over time, we expect the political situation in Peru to improve and the mining investment cycle to turn. While the failed effort to impeach President Pedro Pablo Kuczynski late last year highlights the current fractious state of Peruvian politics, the Peruvian economy remains fundamentally sound. Moreover, Ferreycorp’s opportunity to grow earnings and improve returns on capital by cutting costs and selling non-core assets is largely independent of the political and macroeconomic environment in Peru.

In our first quarter 2017 letter, we detailed the significant changes shareholders made to the board of directors at Ferreycorp last March. Over the past nine months, the board and management began to take important steps in the right direction. While the progress with respect to capital allocation has been slower than we had hoped, the company has stopped selling its treasury shares into the market. This was a highly visible decision and clear evidence that the new directors are committed to improving capital allocation at Ferreycorp.

Going forward, we expect the new directors will push the company to deemphasize less profitable businesses, streamline the balance sheet, and drive returns higher. With their strong market share, a large, recurring service business, and the strength of the Caterpillar brand, we believe that Ferreycorp can achieve a high-teens ROE. We hope to see further evidence of these improvements in 2018 which should lead to both growth in earnings and a higher multiple on those earnings.

Bond Shorts – (68.4%) net of the fund

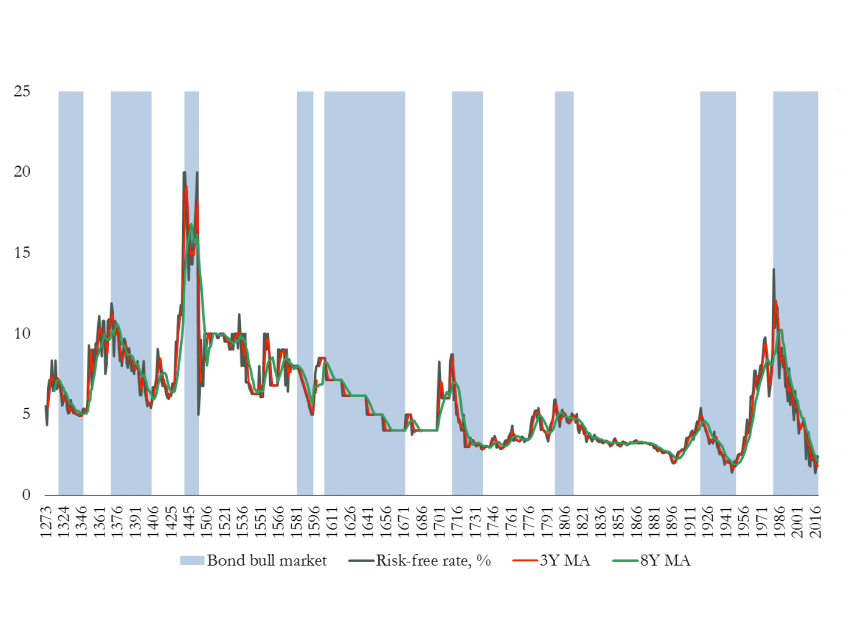

As the bond bull market enters its 34th year, it is shocking to put the length of this rally in historical context. Recently published research from the Bank of England shows that we are living through the second longest bond bull market in recorded history and the longest since the 17th century.[3]

Despite offering low or nonexistent returns and with no guarantee that current exceptional monetary conditions will persist, government bonds at the center of this bull market are still regarded as a safe haven. Investors’ continued willingness to own these bonds under such conditions reflects a combination of excessive faith in the power of central bankers and a lack of experience with bond bear markets.

By way of preview of what a worldwide reversal of the current bull market in bonds might look like, we believe 1965-1969 provides a useful guide. There are striking parallels between the monetary environments of the mid-1960s and today. First, inflation was low and stable in the mid-sixties, hovering around 1.5% through the end of 1965. Second, the unemployment rate slid from 5.5% at the end of 1963 to 4% in 1965 and just 3.6% by the end of 1966, with active debate about the degree of remaining slack along the way. Third, the Kennedy tax cut enacted in February 1964, Great Society programs of 1965, and the Vietnam War produced an ill-advised fiscal stimulus. Fourth, the Federal Reserve raised rates tentatively.

It is worth emphasizing that in the period leading up to 1965, inflation estimate trends were stable and only began rising sharply in 1966. One of the more notable features of narrative accounts from the 1960’s is just how suddenly the public’s confidence in price stability was lost. Given the popular complacency regarding pent-up inflationary forces, we believe that conditions are present for a significant depreciation in the price of Treasuries, analogous to what happened in the late 1960s. And, given that the market is still pricing in a perfect execution of QE unwinding by central banks, the sovereign bond shorts remain a top 5 position.

We recently added a handful of corporate bonds to what remains our largely government bond short position. This addition reflects our expectation that not only will rates raise, but corporate spreads will increase as well. Given that the Federal Reserve’s bond buying led to tighter corporate credit spreads, it stands to reason that the Fed’s plan to shrink its balance sheet by ~$400 billion in 2018 will likely lead to wider corporate credit spreads. Moreover, corporate credit spreads are extraordinarily low. Using broad measures, investment grade spreads are back to 1997 levels. But, this is not a like-for-like comparison as a much larger fraction of today’s investment grade index is composed of BBB credits than in the past. These low-yielding, barely investment grade credits, have been the focus of our expansion into corporate bond shorts.

Sincerely,

Sean Fieler Daniel Gittes

END NOTES

[1] Exposures as a percentage of 12.31.17 pre-redemption AUM. All values as of 12.31.17 unless otherwise noted.Performance contribution derived in US dollars, gross of fees and fund expenses. Interest rate swaps notional value and P&L included in Fixed Income. P&L on cash excluded from the table as are market value exposures for derivatives. Unless otherwise noted, all company data derived from internal analysis, company presentations, or Bloomberg.

[2] Mag Silver Company Presentation September 18,2017

[3] Bank of England.

Staff Working Paper No. 686.