Kuroto Fund, L.P. - Q3 2018 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Kuroto Fund appreciated +1.3% for the year to date through September 30th and is up +1.0% for the year through October 31st. By comparison, the EM index was up +6.2% for the year to date through September 30th and was up +10.7% through October 31st.

[1]

Our flattish year-to-date performance belies the remarkable volatility of the underlying stocks we own (see scatter plot). As of the end of the third quarter, the average company in our portfolio (on an equal-weighted, absolute basis) had moved 16.8% since the start of the year.

turkey

As capital allocators to undervalued, better businesses in emerging markets, we are always looking for instances in which negative market sentiment overwhelms underlying financial and political reality. This past summer, as Turkey fell squarely into that category, we made our first investment there in more than a decade.

To be clear, Turkey has serious problems. After surviving a poorly conceived coup attempt in 2016, President Erdogan became increasingly authoritarian. He arrested large swaths of the opposition and reallocated local media assets to friendly hands. As his circle of trusted advisors shrunk, he leaned more heavily on his family. Most notably, he elevated his son-in-law to finance minister in July. This move and his administration’s ham-handed approach to the economic crisis greatly aggravated the situation. There is also the issue of Turkey’s unnecessary provocation of the United States. The arrest and inflammatory indictment of Pastor Brunson, money laundering for Iran, and purchase of Russia’s S-400 missile defense system are obviously all incompatible with Turkey’s sizable dollar-denominated foreign debt.

In short, Turkey’s bear case is tip of tongue for emerging market investors, which is why the Turkish lira was off 45% for the year to date by mid-August, and foreigners were aggressively selling obviously cheap Turkish equities. The rapid decline in the Turkish lira in turn produced inflationary pressures. At last measure, Turkish inflation was running at 25% year-on-year, and the monetary response to this spike in the price level has guaranteed a deep recession[2]. Local banks have raised their corporate lending rates in lira to 35%+[3] and are holding their loan books flat on an FX-adjusted basis.[4] At these interest rates, Turkish corporations are shrinking their balance sheets, reducing working capital, and preparing for a severe recession. And, while the Turkish economy has yet to formally tip into a contraction, the most economically sensitive sectors of the economy have already tanked: e.g. domestic tractor sales are down 45% year on year as of last count.[5]

While Turkey is certainly not on the right path, it is also not on the path to becoming the next Venezuela. There are significant domestic factors that militate against a collapse of Turkey economically or politically. First, it is worth recalling that Erdogan came to power 16 years ago as an economic reformer attacking a bloated secularist, socialist regime and embracing market-oriented reforms. Second, for all his bluster, Erdogan is no dictator. He leads a coalition government that depends upon the support of the National Movement Party to pass legislation, including the annual budget. Finally, by all informed accounts, Erdogan is a wily politician who is highly sensitive to public opinion. He is currently fixated on wining the municipal elections scheduled for April 2019 and has a demonstrated history of policy flexibility in order to stay in power.

There are equally significant external constraints helping to keep Turkey’s political and economic policies bounded. As a NATO member, Turkey is dependent upon U.S. support for much of its military capability. Most notably, Turkey’s maintenance of its fleet of over 200 F-16s demands continued military cooperation with the U.S. Turkey also depends upon an assortment of foreign banks—especially European and American banks—for its short-term dollar funding requirements. This dependence on Europe and America goes both ways. Most notably, the E.U. relies on Turkey to manage the flow of refugees from the Middle East into Europe, while the U.S. leans on Turkey to contain Russian influence in Syria. Without belaboring the obvious, Turkey is in a geopolitically important location and has a complex web of relationships with the world’s most powerful nations.

Given the sum total of positives and negatives, Turkey presents a challenging but not uninvestable environment for better-business value investors. Accordingly, we have taken three trips to Turkey in the last fourteen months as the Turkish stock market and currency fell. We began investing in late May and added significantly to our positions over the summer as local equity prices began discounting a near worst-case scenario.

Our investment focus has been on Turkey’s concentrated, well-run private banking sector. The sector’s combination of rational pricing, sound underwriting culture, and low leverage helped generate a track record of high, consistent returns. These same characteristics attracted strong, foreign partners over the years. Garanti Bank, for instance, was formerly controlled by GE Finance and is currently controlled by BBVA. As a result, their systems and processes are similar in quality to what we see in the best Brazilian and Indian private sector banks.

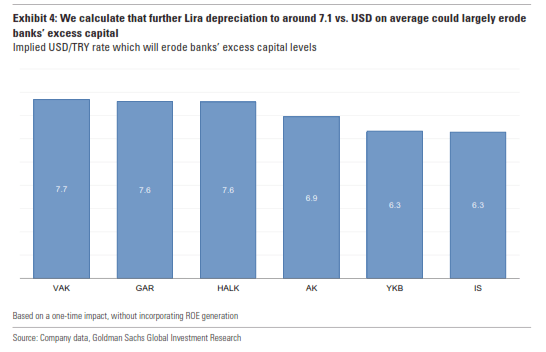

Banking, even very sound banking, necessarily involves leverage, and leverage poses a particular set of challenges in moments of economic crisis. This summer, after the Turkish lira dropped 20% in a single month, Goldman Sachs issued a research report detailing the resulting reduction in Turkish bank capital. In particular, Goldman’s report stated that a Turkish lira/USD rate of 7.1 would exhaust the excess regulatory capital at the big four banks, which is accurate. What the report failed to highlight is that even with no excess regulatory capital, the large Turkish banks were still very well capitalized by global standards. At the end of the third quarter, the four large

private-sector Turkish banks posted an average capital adequacy ratio of 11.7%, excluding regulatory forbearance measures.[6] By way of comparison, this is nearly 50% more capital than the 10 largest U.S. banks have in relationship to their assets.[7] Nevertheless, the solvency of the best Turkish banks had been called into question, and investors panicked.

This panic gave us the opportunity to buy shares in Garanti Bank at less than 50% of book value. Garanti Bank has the best loan book, the best technology platform, and the best underwriting standards of Turkey’s four principal private sector banks. With just 2% of their loan book exposed to the real estate construction sector that will likely be at the heart of Turkey’s looming non-performing loans cycle, we believe that Garanti will not just weather the economic downturn, but produce mid-teens ROE’s throughout. When the economy eventually normalizes, Garanti should again produce ROE’s in excess of 20%.

While the shares of Garanti Bank have rallied since our initial purchase, even at today’s valuation the bank trades at 70% of liquidation value and just 4 times this year’s earnings, making Garanti Bank one of the cheapest companies we own. The bank recently reported third quarter results: as expected, NPLs are up, but they still posted a 17% return on equity. When Turkish uncertainty subsides, we believe that this bank should once again trade on a high single-digit multiple to earnings and at comfortably more than liquidation value.

The Turkish lira has also recovered from its August lows of 7.4 to a current rate of 5.8. We anticipate significant further weakness in the Turkish economy after their municipal elections in April 2019. That said, we do not expect this future weakness to once again coincide with a sharp deterioration in U.S.-Turkish relations as occurred over the past summer. More broadly, we believe that the discounted valuations of our Turkish investments more than account for a very negative path forward for Turkey both politically and economically. Accordingly, Turkey now represents almost 8% of our portfolio.

organization

In September, Arthur Melkonian replaced Massimo Devellis as COO, and our CFO, Denise Alejo, assumed CCO duties. Arthur, who ran our middle office for the past seven years, has hit the ground running and already identified some operational efficiencies. We also recruited two new mining analysts to replace Marco Locascio. Stephen Saroki, a past summer intern, joined us in October, and we expect to add a Canadian mining specialist in January.

Both Massimo and Marco were long-standing partners, and we wish them the best in their new endeavors. Massimo has taken on an operations role at a multi-family office in New York, and Marco is now running a junior diamond mining company.

Sincerely,

Sean Fieler

Daniel Gittes

END NOTES

[1] Performance stated for Kuroto Fund, L.P. Class A on a net basis. An investor’s performance may differ based on timing of contributions, withdrawals, share class, and participation in new issues. Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, or Bloomberg. Company valuations and exposures as of 10.31.18.

[2] https://www.reuters.com/article/us-turkey-economy-inflation/turkey-inflation-surges-to-nearly-25-pct-in-sept-highest-in-15-years-idUSKCN1MD0TP

[3] WOOD company research, bank websites

[4] Garanti 3Q2018 Investor Presentation, pg 6, https://www.garantiinvestorrelations.com/en/images/pdf/3q18__BRSA_Unconsolidated_Earnings_PresentationV2.pdf

[5] Turk Traktor 3Q2018 Investor Presentation, pg 20, http://turktraktor.com.tr/pdf/7422018_3Q_eng.pdf

[6] Akbank, Garanti, Isbank, Yapi Kredi 3Q financial statements

[7] JP Morgan Perspectives: Ten Years after the Global Financial Crisis, pg 138, Figure 1

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8