Equinox Partners Precious Metals, L.P. - Q3 2022 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

In the third quarter of 2022, Equinox Partners Precious Metals, L.P. declined -12.0%. For the year to date through September 30th, the fund declined -30.3%.

Visit our performance page to view the Equinox Partners Precious Metals, L.P. fund summary in more detail.[1]

the gold price

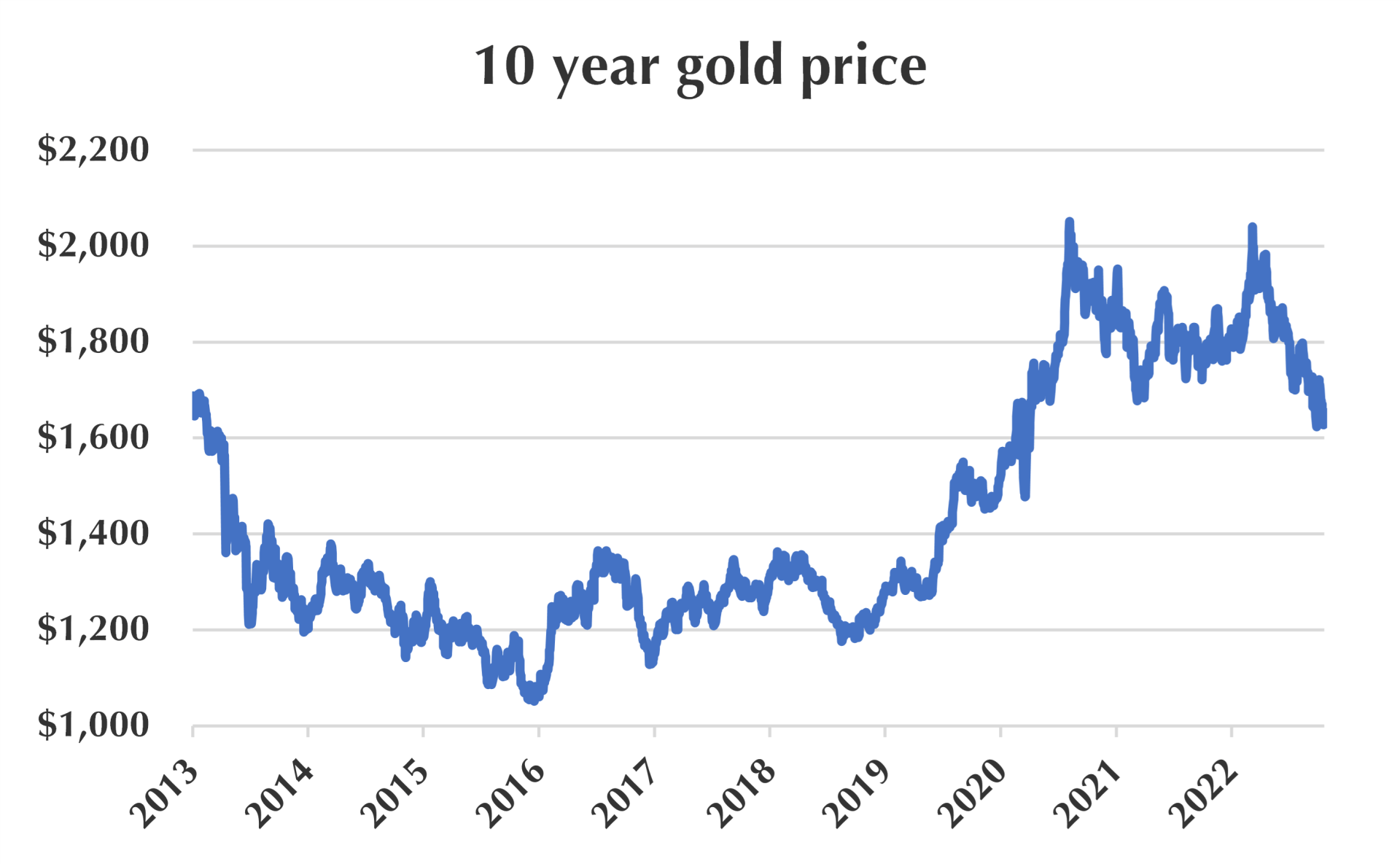

Gold trades at roughly the same price it did a decade ago. This is a wildly disappointing outcome given the last decade seemed to be the perfect setup for gold. Since the fall of 2012, we’ve witnessed a massive spike in U.S. debt, trillions in quantitative easing, the highest inflation rate in 40 years, persistent geopolitical instability, and consistent central bank gold buying. Having reflected on the combination of these seemingly bullish factors and an unchanged gold price, we think it necessary to rearticulate what factors we believe are necessary to drive gold prices meaningfully higher.

In our opinion, the two critical ingredients for a bull market in gold are a diminution of the Federal Reserve’s creditability and/or strong physical gold demand.

Notably absent from our list are three factors upon which gold investors are fixated: the Federal Reserve’s policy rate, the trade-weighted U.S. dollar index, and the Federal Reserve’s balance sheet. To be clear, these three factors are relevant to the price of gold. But as the past decade has shown, by themselves these factors are neither decisive nor consistently correlated with the gold price. Rather, the significance of these factors is dependent upon the extent to which they reflect the Federal Reserve’s credibility.

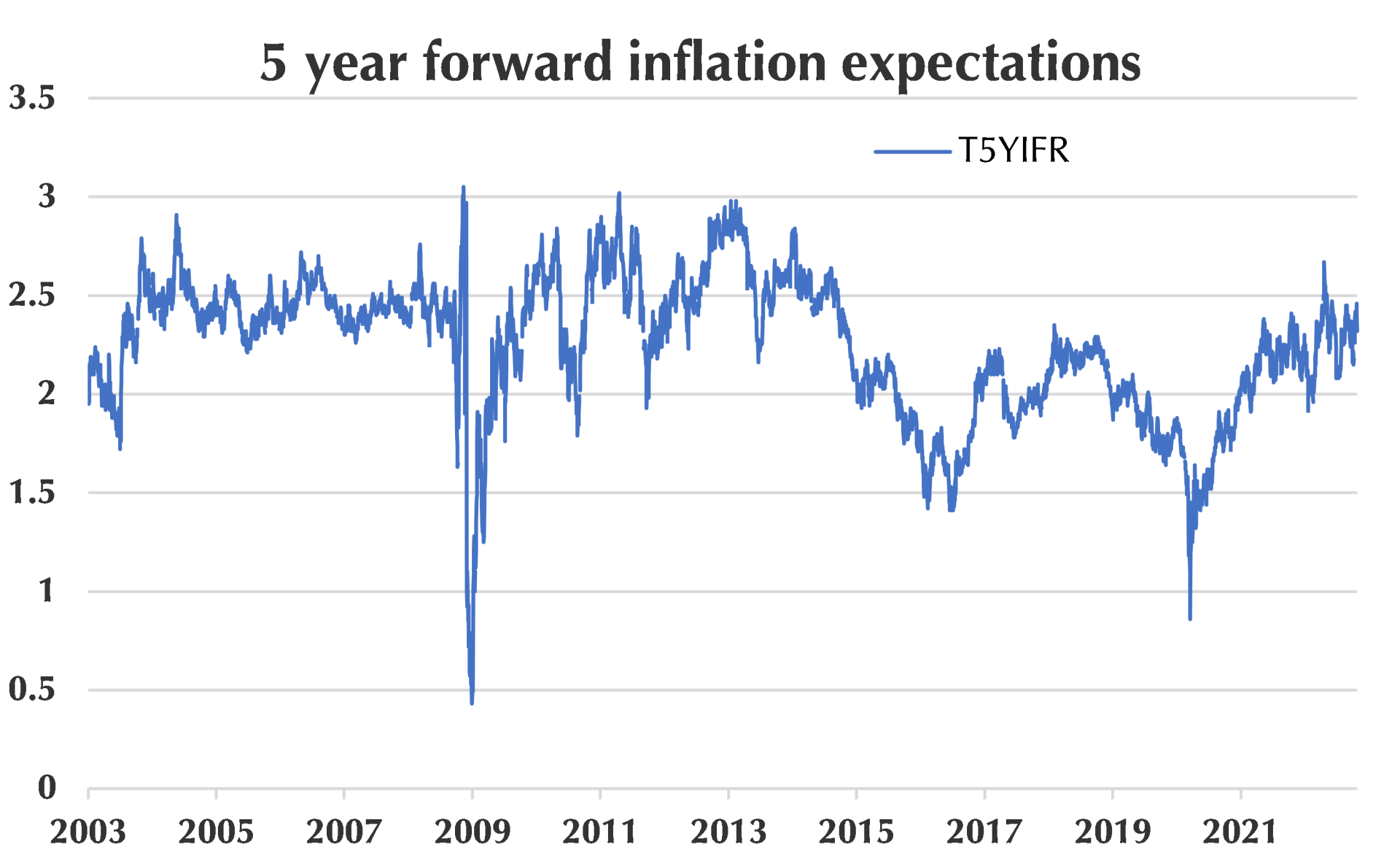

Real rates, by contrast, have historically correlated more reliably with the gold price. That said, real rate estimates are only as good as the inflation expectation data they use. As the graph below shows, the 5-Year Forward Inflation Expectation Rate as calculated by the St. Louis Federal Reserve is exactly the same as it was a decade ago. In our opinion, real rates that assume no uptick in long-term inflation are not credible, and it is not surprising that the historical correlation between the price of gold and real rates broke down this year. The other factor that could theoretically be largely independent from the Federal Reserves’ credibility and move gold prices meaningful higher is physical gold demand.

The Fed Fund’s Rate, the U.S. dollar, and Quantitative Easing

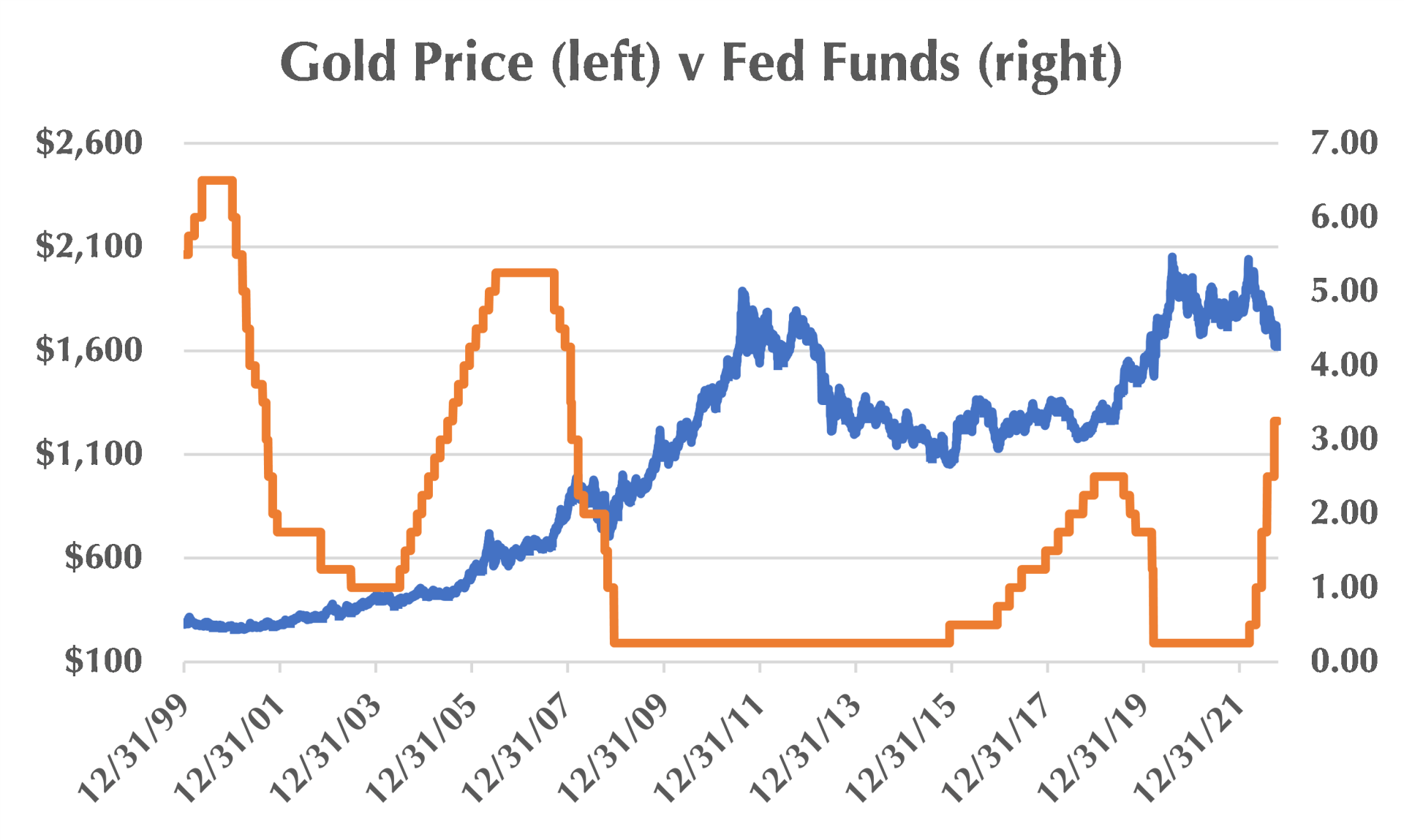

While gold has declined 7% this year as the Fed’s policy rate has risen rapidly, the inverse correlation between the Fed’s policy rate and the gold price has not held in the previous two rate-hiking cycles. Gold rallied from 2004 to 2006 and again from 2015 to 2019 as the Fed raised rates. So, while Fed policy rates clearly play a role in the gold price, it should be equally clear that a higher nominal policy rate will not necessarily lower gold prices. Similarly, rate cuts are not always bullish for gold. From 2007 to 2009 the Fed aggressively cut rates, and again from 2019 to 2020. In the 2007 to 2009 period, gold fell, while in the 2019 to 2020 period, gold rose.

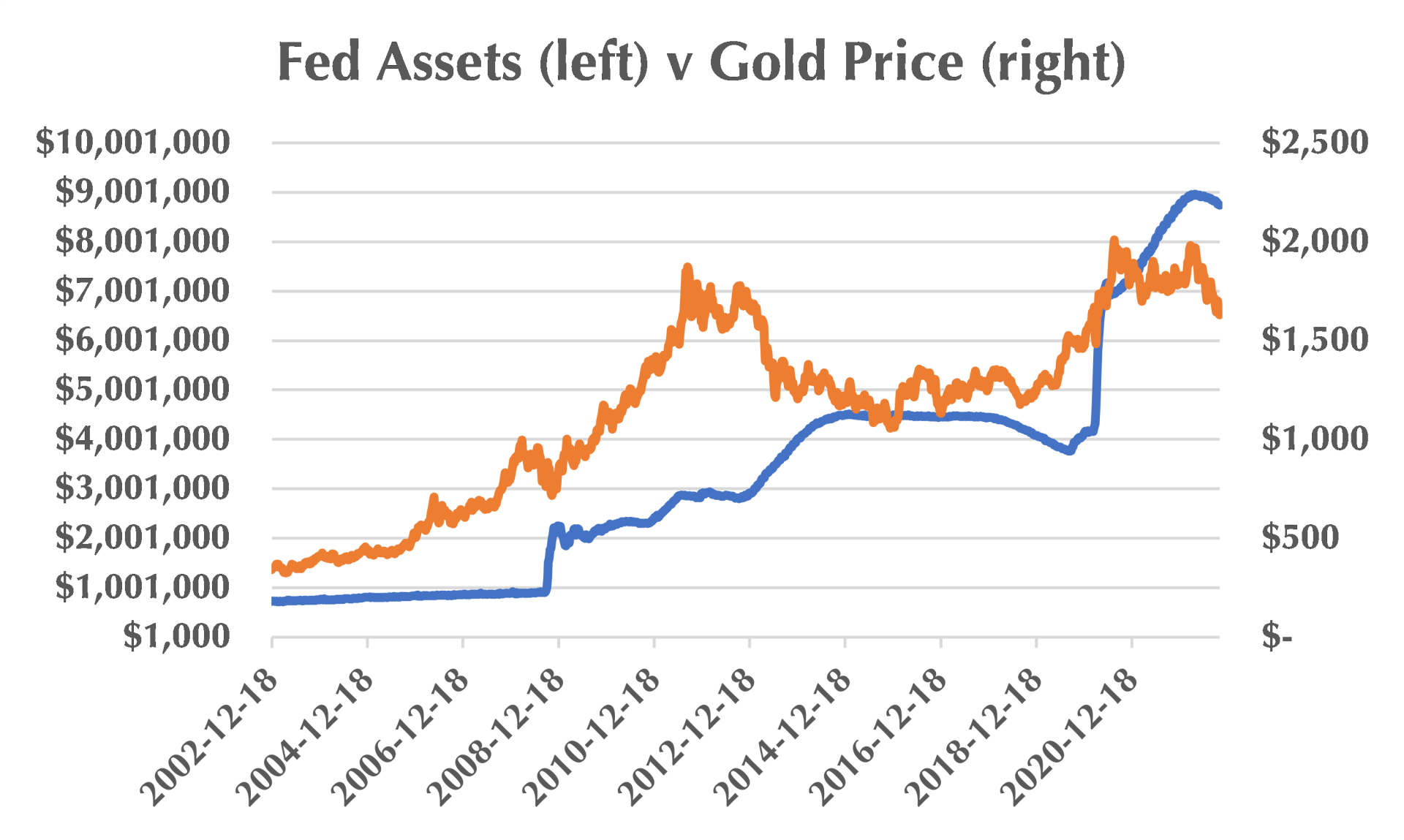

The same weak correlation holds true for quantitative easing and the gold price. The Federal Reserve’s balance sheet was $2.8 trillion a decade ago when gold was at $1,700 per ounce. The Federal Reserve’s balance sheet today stands at $8.7 trillion dollars while gold is at $1,650 per ounce. This is not to say that there is no relationship between QE and the gold price. Gold rallied when QE began as the markets expected inflationary consequences beyond the control of the Fed. However, after years of QE failing to either move CPI or inflation expectations, the market came to believe that QE was relatively benign, and the correlation between the size of the Fed’s balance sheet and gold prices broke down as a result.

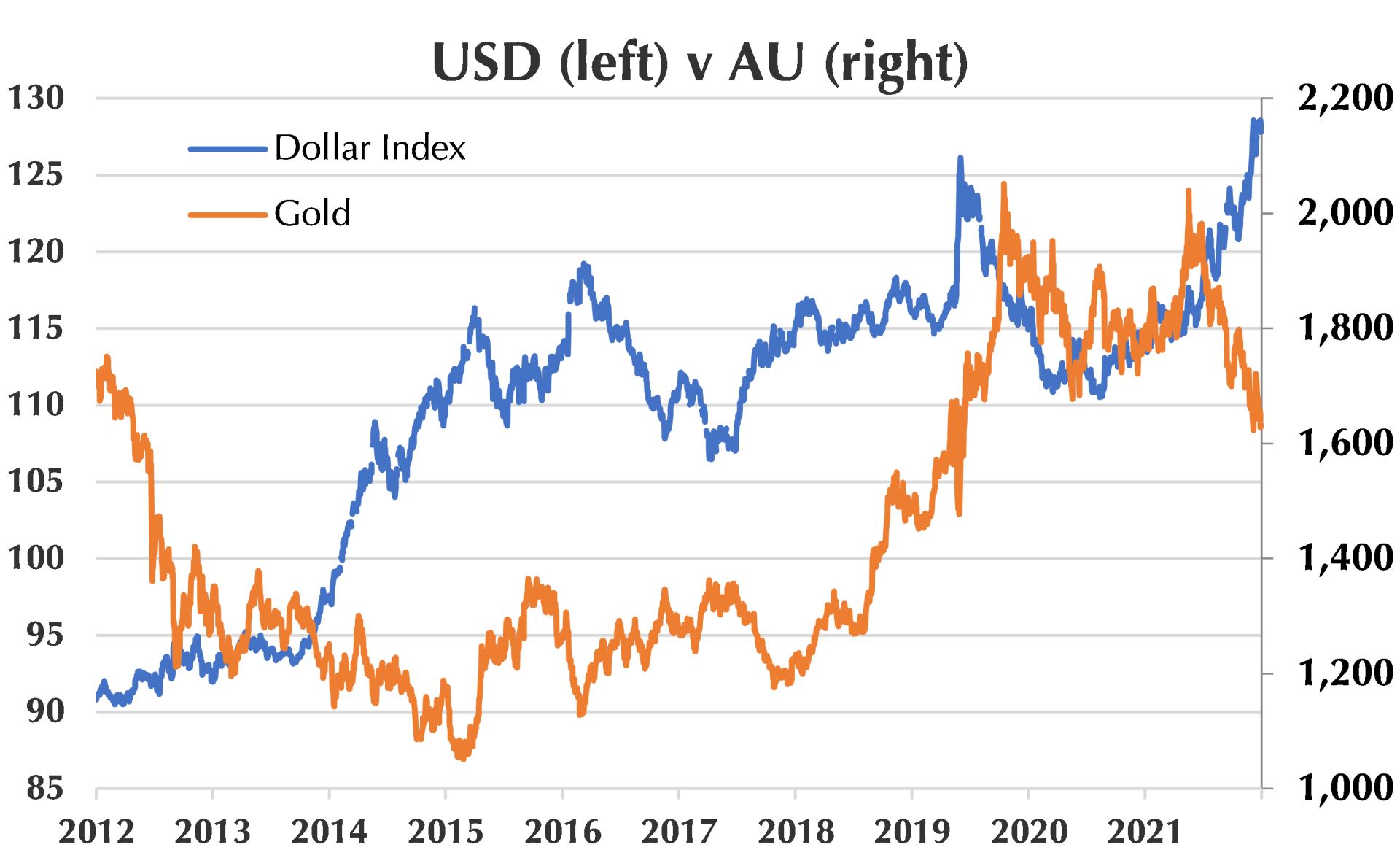

The trade-weighted U.S. dollar index also has limited long-term value as a predictor of the price of gold. While the strong dollar has been a negative for the gold price in 2022, the U.S. dollar index and gold were positively correlated in 2019 and 2020. Fundamentally, the U.S. dollar index fails to capture the extent to which central banks are collectively debasing their currencies. With negative real rates having become the norm in an overindebted world, the U.S. dollar index could prove stable as all currencies decline in real terms.

Real Rates

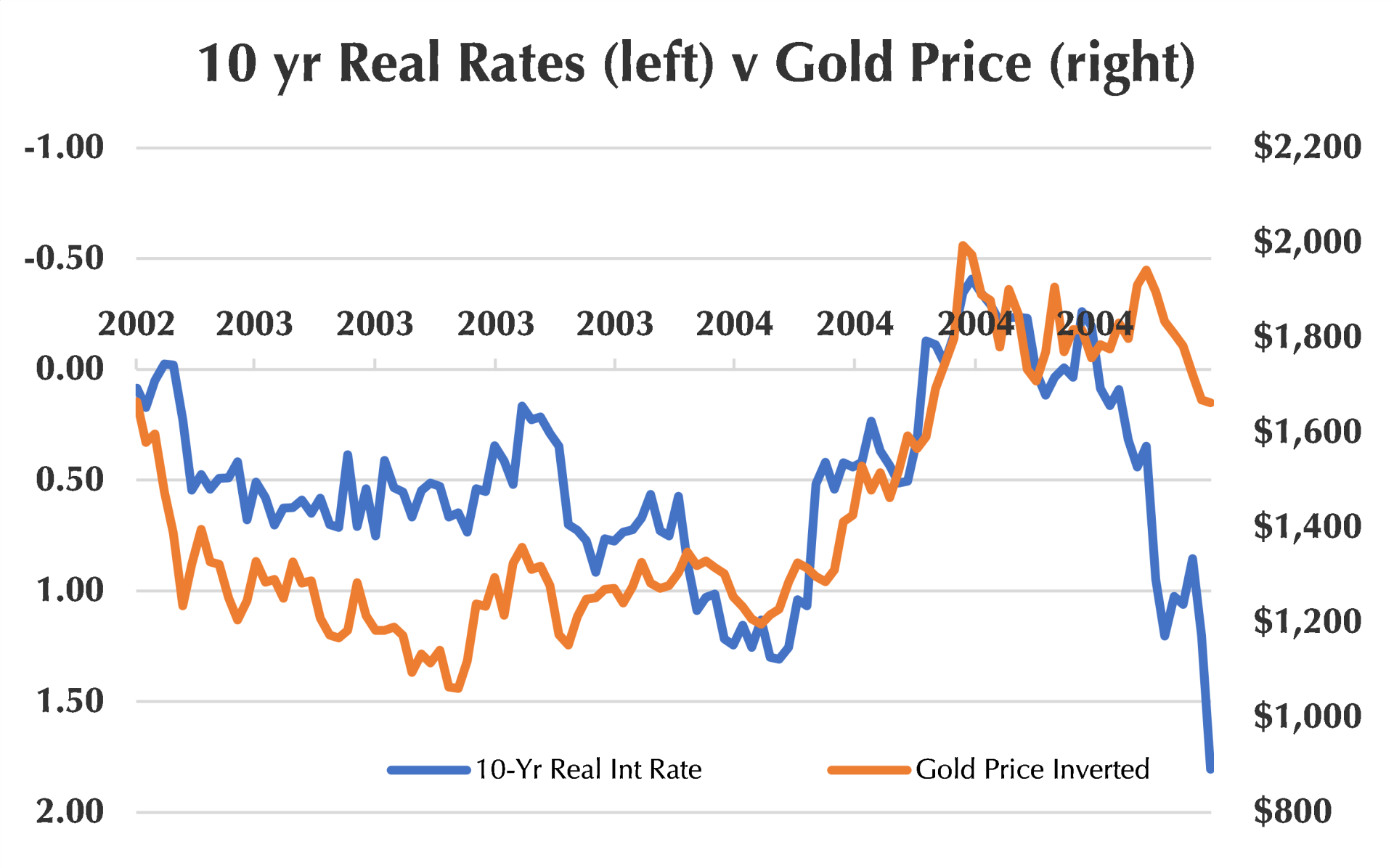

Real interest rates have historically offered investors a far better guide to the gold price than the nominal Fed policy rate, the U.S. dollar index, or the Fed’s balance sheet. The most relevant real yield for gold is calculated by subtracting estimated future inflationary expectations from the 10-year Treasury yield. As the graph below makes clear, this year the projected real yield has risen precipitously as 10-year rates have increased quickly and long-term inflationary expectations have remained anchored. The October implied 10-year forward real rate is 1.8%, the 10-year yield of 4.1% less the 10-year future expected inflation rate of 2.3%.

The problem with the above real rate calculation is that it uses an improbably low 2.3% 10-year inflation expectation. This 2.3% expectation is disconnected with both our current inflationary experience and our past experience of getting inflation under control. While the Federal Reserve has adopted an aggressive stance since August, it is not at all clear that their policies will be enough to subdue inflation even temporarily, let alone control it for a decade. To quote Stan Druckenmiller: "Once inflation goes above 5%, it has never come back down without the Fed Funds Rate exceeding the CPI."

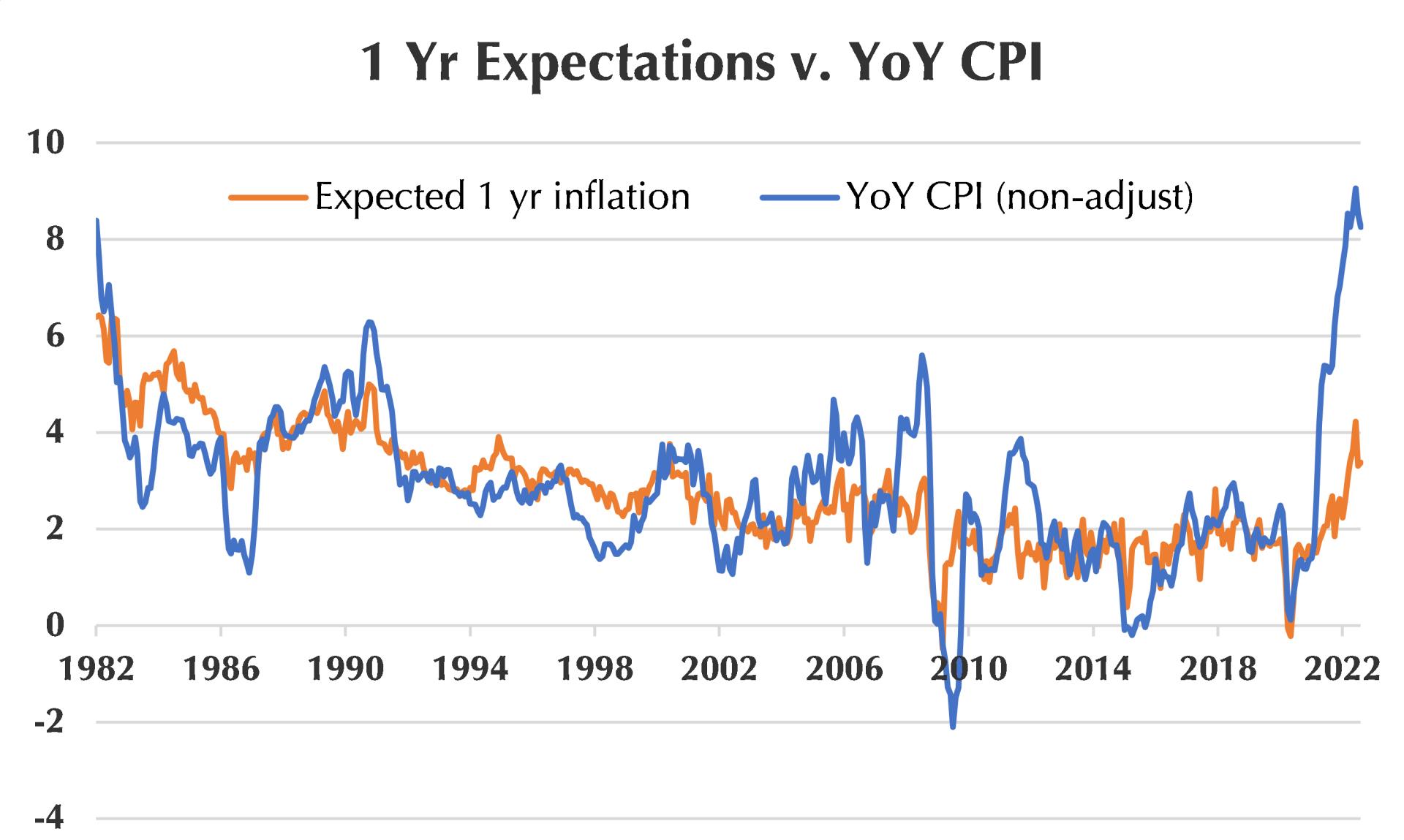

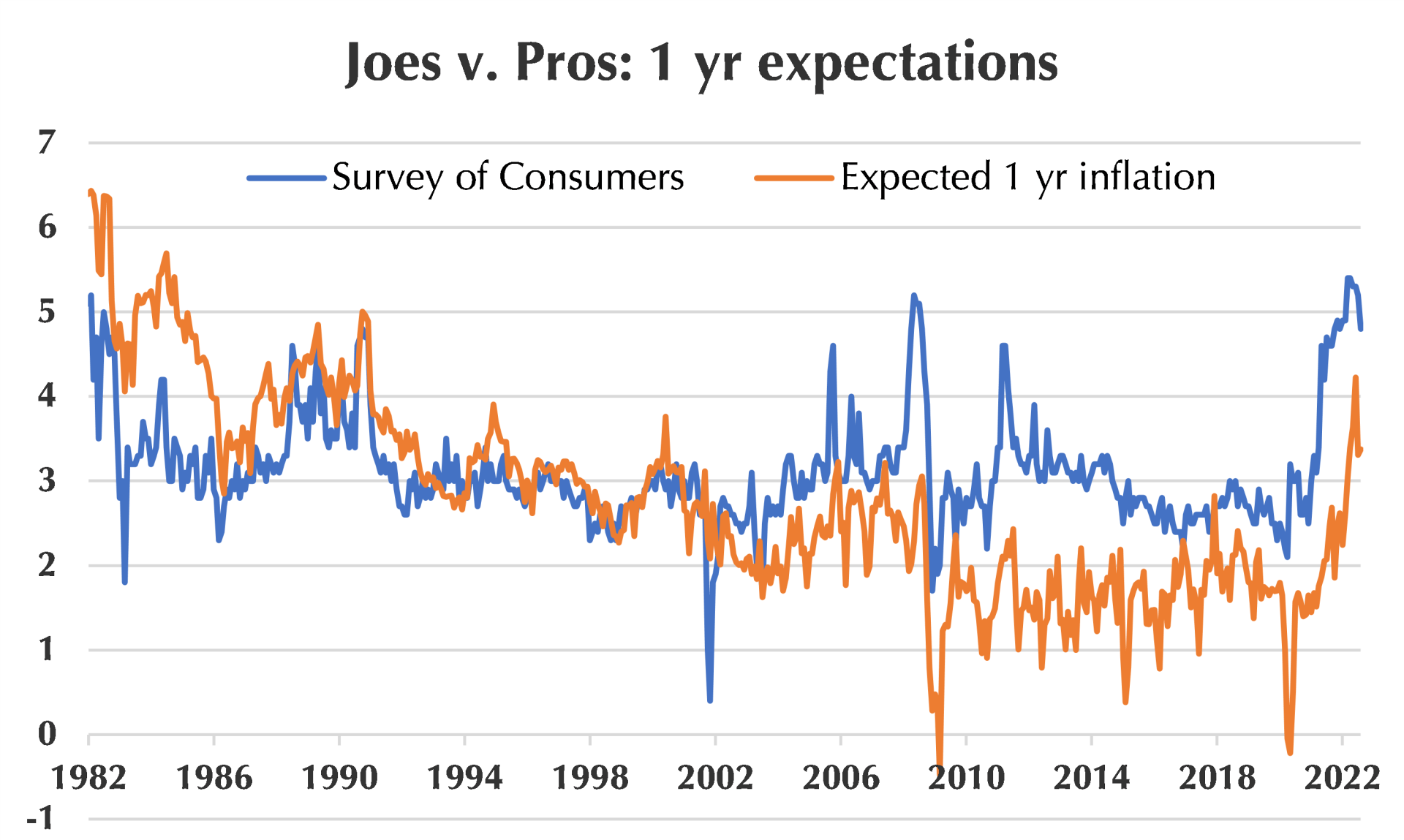

It turns out that such constrained future inflation expectations give a lot of weight to some pretty flimsy data points. Specifically, the implied future inflation expectations in the last two graphs are computed by the Cleveland Fed using Blue Chip economic forecasts, the forecast of the Survey of Professional Forecasters, and inflation swaps pricing. The results of these surveys and pricing of inflation swaps are neither robust nor transparent. Moreover, there is a troubling conflict of interest, given that the Fed is compiling, calculating, and calibrating the data that are assessing its own credibility.

There is also good reason to believe that the Cleveland Fed’s expected inflation calculation contains a downward bias. This bias can be partially observed through the spread between the inflation expectations of consumers conducted by the University of Michigan and the inflation expectations of professional forecasters used by the Cleveland Fed. The one-year rolling spread between consumers and forecasters over the last two years of 2% is the largest on record going back to 1982.[1] Notably, a close second was in 2008 before the GFC. This is particularly relevant, because over that time, the average Joe has been better at predicting actual CPI than the professional forecaster. Specifically in 2021, consumers expected an average 4% inflation in the year ahead while forecasters guessed 2%. Actual CPI in 2022 has averaged 8%.

[1] Specifically, as of August, the average American is expecting inflation of 4.8% over the next twelve months. Professional forecasters, on the other hand, are expecting one-year inflation to average just 3.4%. Notably the period around the GFC had similar consumer forecasts, but inflation did not meaningfully materialize like it has now.

Physical Gold Demand

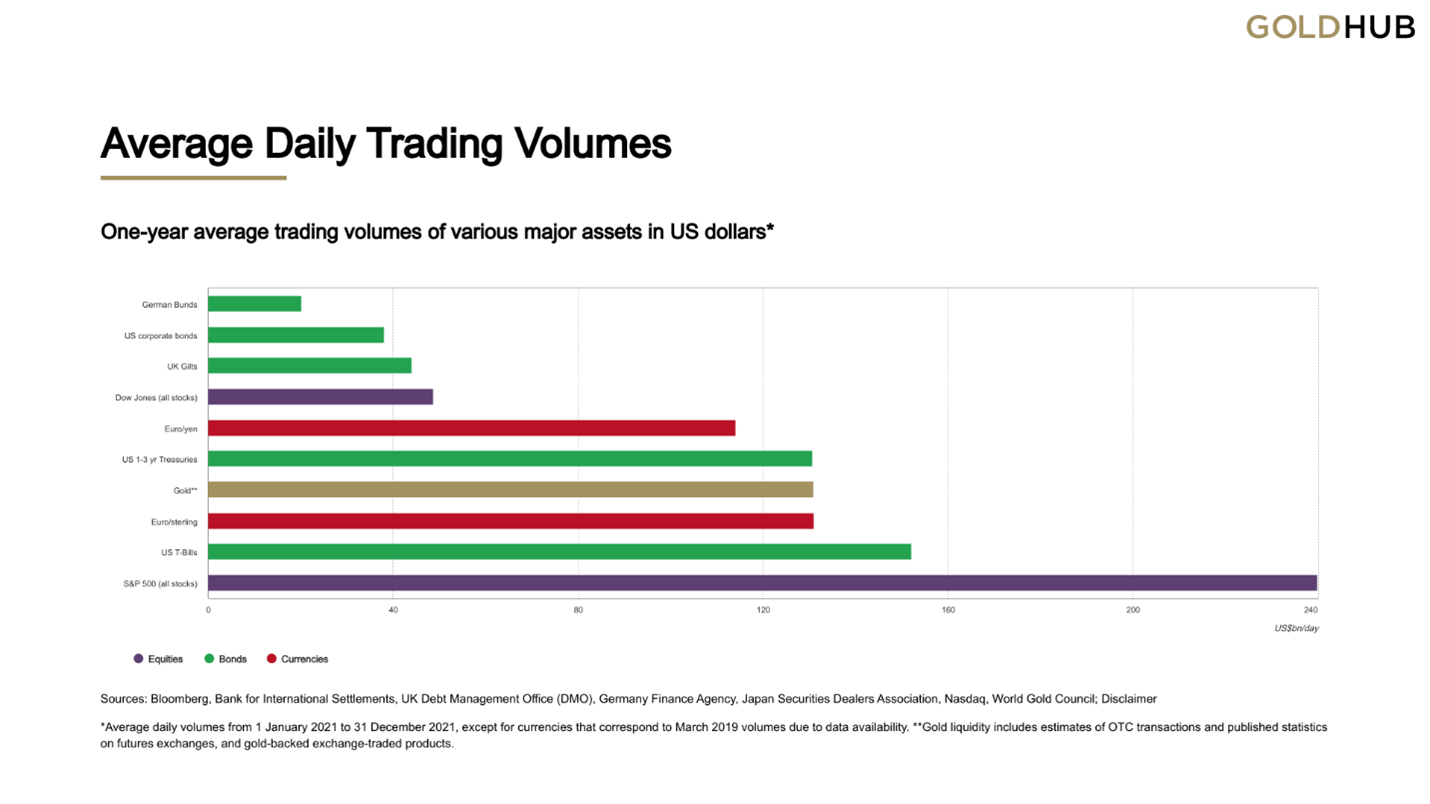

Gold is one of the largest markets in the world. When the measure of gold’s liquidity includes the physical market, derivatives, futures, and exchange-traded products, gold’s daily turnover rivals the market for U.S. Treasuries.

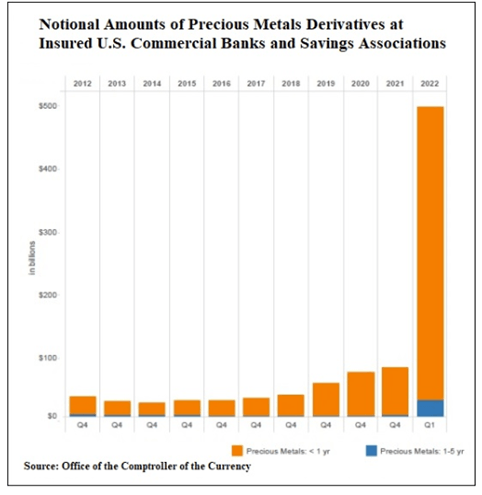

While gold may seem irrelevant to some, there is no sign of gold’s irrelevance in its trading activity. There is also ample institutional demand for gold-linked products as can be seen in the over-the-counter derivative market. As of the last report from the Office of the Comptroller of the Currency, insured U.S. financial institutions are party to over $400 billion of gold derivatives. While the graph below overstates the actual growth because of a report change, it nevertheless illustrates that the amount of such derivatives is sizable and growing.[1]

[1] “Beginning January 1, 2022, the largest banks are required to calculate their derivative exposure amount for regulatory capital purposes using the Standardized Approach for Counterparty Credit Risk (SA-CCR). Under SA-CCR gold derivatives are considered precious metals derivative contracts rather than an exchange rate derivative contract resulting in an increase in reported precious metals derivative contracts compared to prior quarter...”

That the increase in demand for gold derivatives has corresponded with a weak gold price can be seen as a positive or a negative for gold investors. On the one hand, it reflects gold’s continued relevance to institutional financial market participants. On the other hand, it shows that there is ample paper gold ready to meet this financial demand for gold-linked products. Given the surprising, but apparently limitless supply of paper gold, we believe investors' growing preference for physical gold is particularly important.

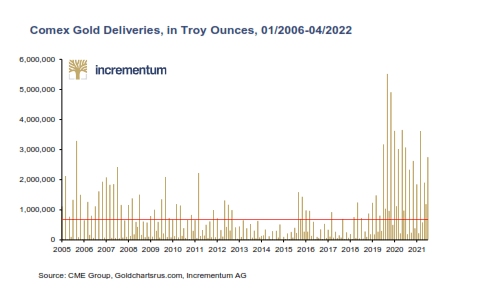

One such shift from paper gold to physical gold can be observed through COMEX delivery data. Since the onset of the Covid pandemic, a sizable number of COMEX gold (and silver) futures contract owners have stood for delivery. Given that the paper market for both gold (and silver) dwarfs the size of the physical market, any shift from paper to physical demand is a positive. Increased premiums on coins and bars also corroborates that physical demand is increasing.

One of the largest buyers of physical gold remains central banks. The extent of central bank physical purchases remains opaque. We don’t, for example, know the extent to which central banks are buying pooled or allocated gold: “the gold bar weight lists of central banks are never published, as their publication would reveal that much of their gold is not sitting in unencumbered storage in London, but has long been lent out.”[1] That said, it is clear that a growing number of central banks are not only buying gold, but choosing to take delivery as well. This list includes China and Russia, as well as Poland, Hungary, Brazil, and India.

If we are right and either a decline in the Federal Reserve’s credibility or an increase in physical demand is necessary to trigger a bull market in gold, there is good reason to be hopeful. As we write, the Federal Reserve’s credibility and the physical gold market are both under considerable pressure. If the Fed cannot get inflation convincingly under control soon, their credibility will inevitably decline. Likewise, if retail and central bank gold demand continue to grow, the constraints of the physical market could very well dictate the gold price.

[1]Bullion Star Blog

Sincerely,

Equinox Partners Investment Management

[1] Sector exposures shown as a percentage of 9.30.22 pre-redemption AUM. Performance contribution is derived in U.S. dollars, gross of fees and fund expenses. Unless otherwise noted, all company data is derived from internal analysis, company presentations, or Bloomberg. All values are as of 09.30.22 unless otherwise noted.

Endnote: Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, or independent sources. Values as of 9.30.22, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notice.

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8