Equinox Partners Precious Metals, L.P. - Q3 2017 Letter

Dear Partners and Friends,

purchases and sales

There were a few substantial developments in the portfolios in recent months. In May and June, in light of the dislocation caused by the rebalancing of the GDXJ index (see the attached letter), we added to positions in Bear Creek Mining and Beadell Resources. In addition, we initiated new positions in Sandstorm Gold, a diversified gold royalty company, and West African Resources, an exploration company in Burkina Faso. Sandstorm is currently a 4.9% position and West African is 3.9%.

To fund these purchases, we reduced positions in Aurico Metals, Fortuna Silver, MAG Silver, Premier Gold, Roxgold, Tahoe Resources, and Torex Gold.

Tahoe Resources’ recent trading is particularly noteworthy. The company’s shares sold off substantially in July when a court in Guatemala suspended their license to operate the Escobal mine. However, just yesterday that court reinstated the license and the stock rallied strongly on the news. We added about $1.5 million to the position in July after the news first broke. After today’s rally, Tahoe is 5.2% in the WP account and 5.0% in the SL account.

royalty companies, mag silver, and the case for sandstorm

Our initiation of a position in Sandstorm Gold was driven by the selloff of the stock on the heels of the GDXJ rebalancing and the company’s concurrent announcement of the acquisition of Mariana Resources. After several conversations with management, we became convinced that the transaction was a smart deal and that the company was undervalued—offering a rare combination of limited downside and good upside. But to fully understand the case for Sandstorm requires a discussion on the gold royalty companies more broadly.

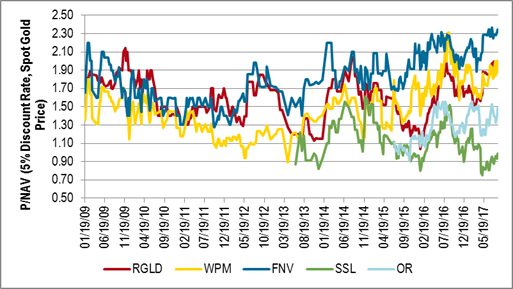

Royalty companies tend to trade at a substantial premium to producing companies. We have historically owned them in the rare instances in which they have traded at reasonable valuations. Royalty companies get their premium by offering investors exposure to gold while avoiding the some of the pitfalls of mining companies. While there are many reasons one could cite, we believe the main ones are as follows:

1) Fixed Costs – Because they get a percentage of the revenue generated by the mines in which they have a royalty interest, the cost structure for royalty companies is fixed. Therefore, their margins and cash flow are substantially more predictable than the miners.

2) No Capital Spending – They are also beneficiaries of ongoing capital spending by miners to extend their reserves and increase production. These activities grow the NAV of royalty companies for free. As a result, whereas mining companies seem to be endlessly recycling their cash flow back into capital spending, royalty companies generate large amounts of free cash flow.

3) Diversification – By owning a portfolio of royalties, they reduce the risk of any given asset and thereby reduce the volatility that scares many investors away from owning mining companies.

4) Cost of Capital – As a result of their premium multiples, royalty companies have a low cost of capital compared to miners. This allows them to continually grow their portfolios by leveraging their cost of capital advantage.

Since there are substantial economies of scale in the royalty business, the companies to not need to increase headcount as their portfolio grows. It has therefore tended to be a consolidated space, dominated by Franco-Nevada, Royal Gold, and Wheaton Precious Metals. However, occasionally new companies, like Sandstorm, enter the space.

Nolan Watson, the CEO and founder of Sandstorm, was previously the CFO at Wheaton Precious Metals (then called Silver Wheaton). Nolan helped pioneer metal streaming at Wheaton, which he went on to replicate at Sandstorm. A metal stream is economically similar to a royalty, but it is generally more tax-efficient since the companies take possession of the metal and domicile their trading operations in low tax jurisdictions. Therefore, streaming has become an important business segment for all royalty companies. Using the knowledge he developed at Wheaton, Nolan started Sandstorm in order to focus on junior mining companies. We have followed Sandstorm for a number of years and have owned it in the past in Equinox Partners.

While Nolan was initially successful building a portfolio of streams on assets owned by junior companies, this model revealed some substantial flaws as the market turned down in 2013. As gold prices declined, Sandstorm’s counterparties found their margins squeezed and balance sheets stretched, and the largest producing asset in the portfolio eventually shut down as a result. Combined with investments in development assets that did not turn out well, these issues caused the company’s shares to decline dramatically. From a peak above $14 per share in late 2012, the stock fell all the way to $2. The uncertainty in the portfolio and volatility in the stock price contradicted the primary reason investors look to own royalty companies in the first place.

In response, Nolan and his team took steps to stabilize the portfolio. They acquired new, producing streams and royalties with better counterparties to bring stability to the portfolio. While these transactions were lower return, they were probably a necessary evil in order to put the company on a better footing. Nolan also significantly revamped the technical team responsible for due diligence, seeking to avoid some of the costly technical mistakes that had plagued earlier deals.

By late 2016, Sandstorm had largely stabilized and emerged with a stronger portfolio with less risk. As a result, the discount to its royalty peers began to close. However, Sandstorm is the only one of the group in the GDXJ and was thus affected by the rebalancing that was announced in April and took place in June. With investors already skittish due to this overhang, the company announced the acquisition of Mariana Resources.

Mariana owned a minority stake in the Hot Maden deposit in Turkey through a joint venture controlled by a Turkish mining company, Lidya Madencilik. Hot Maden is one of the most impressive discoveries made in the last few years, boasting extremely high grades of both copper and gold. Despite the fact that few dispute the quality of the asset, Mariana traded at a discount to the value of its stake in the JV due to the market’s unease with Turkey as a jurisdiction and concerns about the ability of management at Mariana to navigate the development of the deposit successfully.

The market’s reaction to the Mariana deal was not favorable despite seemingly accretive economics. The cost of the acquisition represented about 25% of Sandstorm’s market value, but once the asset goes into production, Sandstorm’s cash flow should more than double. However, Mariana’s interest in Hot Maden is not a royalty or stream. Investors viewed the deal as outside the bounds of what royalty companies are meant to do. While the upfront capital required to build Hot Maden is easily covered by Sandstorm’s existing cash and future cash flow, the market seems to be punishing Sandstorm for this future spending commitment.

To us, Mariana was reminiscent of another asset we have owned for nearly a decade, MAG Silver. MAG similarly owns a minority stake in a JV where the underlying asset is world class. We have argued for years that MAG effectively owns a silver stream: since the base metal by-products will more than cover the cost of production, MAG’s share of silver production is effectively free. We see a similar story at Hot Maden, where it is expected that copper revenue will more than cover the cost of mining.

While the market is presently concerned about permitting and development risk, we believe the risks are more than justified by the price Sandstorm paid. Because royalties are so attractive, and because the companies that own them receive high multiples, they tend to transact at high prices. Typical IRRs for large streaming or royalty deals tend to be around 5%. By comparison, even though Hot Maden is several years away from production, we estimate the IRR on this transaction to be better than 30%.

At the time we bought the position in Sandstorm, it was trading at a low teens cash flow multiple on the existing portfolio, accounting for the dilution to acquire Mariana. Most of the other royalty companies trade above twenty times cash flow. Furthermore, Sandstorm has by far the best growth prospects in the space, with some growth coming over the next few years before the big increase upon Hot Maden going into production. We would argue that at the current share price Sandstorm itself already makes a compelling acquisition target for the other royalty companies. With a stable portfolio underpinning this cash flow stream, we see little down side. But, if Hot Maden delivers, this will be a truly exceptional investment. Enticingly, Nolan is also exploring ways to convert the JV interest into an actual stream, which would simplify the operating structure for Lidya, may have tax benefits, and would address some of the lingering concerns other investors have about the transaction.

Sincerely,

Sean Fieler