Equinox Partners, L.P. - Q2 2017 Letter

Dear Partners and Friends,

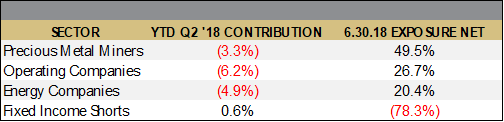

PERFORMANCE & PORTFOLIO

Equinox Partners declined -2.1% in the second quarter of 2017. For the year to date through July 31, our fund was up +9.2%.[1]

Since the end of the first quarter, we’ve taken several steps to optimize our portfolio. Most notably, we’ve sold shares in Paramount Resources to fund purchases of Crew Energy. Both remain large positions, but at current valuations we believe Crew is the superior investment. We’ve also exited our two positions with direct Russia exposure, ITE and Moscow Exchange. Finally, we’ve spent approximately 1% of partners’ capital on out-of-the-money S&P put spreads.

Silver

Silver accounts for 42% of our metal exposure through our miners. This compares to the 15% silver weighting in the junior mining index (GDXJ). We have taken such an outsized position in silver miners because we expect silver to significantly outperform gold during the next bull market in precious metals. Our expectation of silver’s outperformance is based on silver’s peculiar supply and demand dynamics. Specifically, silver’s dual nature as both an industrial and monetary metal keeps physical inventories contained while preserving a potentially large monetary demand for silver. This unique combination makes silver a particularly attractive investment when gold prices rise.

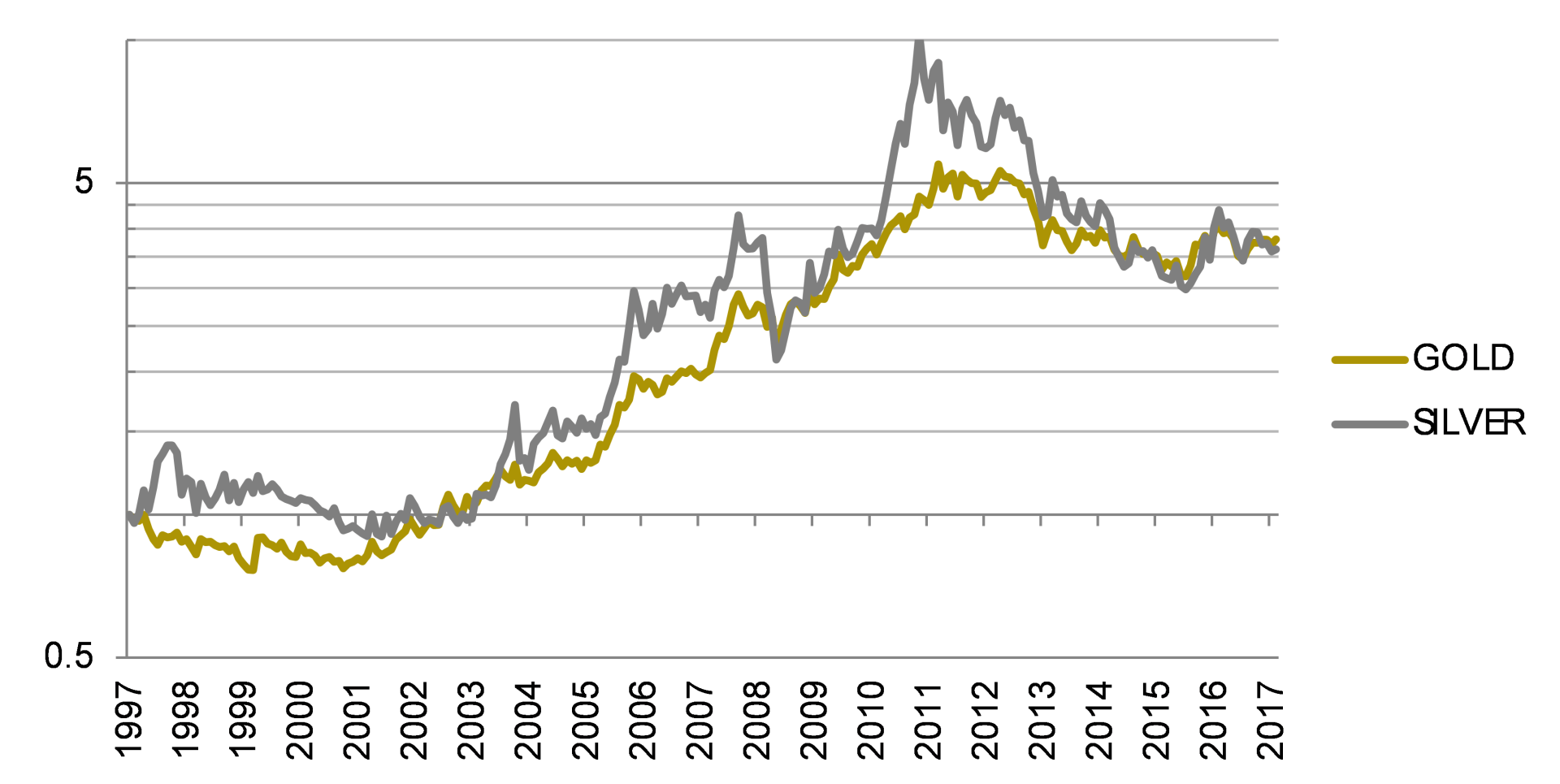

The logarithmic graph on the prior page shows silver’s tight, twenty-year correlation with gold. Over this period, the monthly correlation between the two metals is .73. The next most correlated metal with gold over the same period is platinum at .57, after which the correlation of other metals to gold falls off dramatically. Given significant structural differences in the mining, use, and storage of gold and silver, their tight price correlation appears to be almost entirely attributable to the highly-correlated investment demand for the two metals. Interestingly, the general correlation between gold and silver has strengthened over the past twenty years. With global debt rising ever upward, it should come as no surprise that the similarities of gold and silver as monetary alternatives are increasingly outweighing their differences.

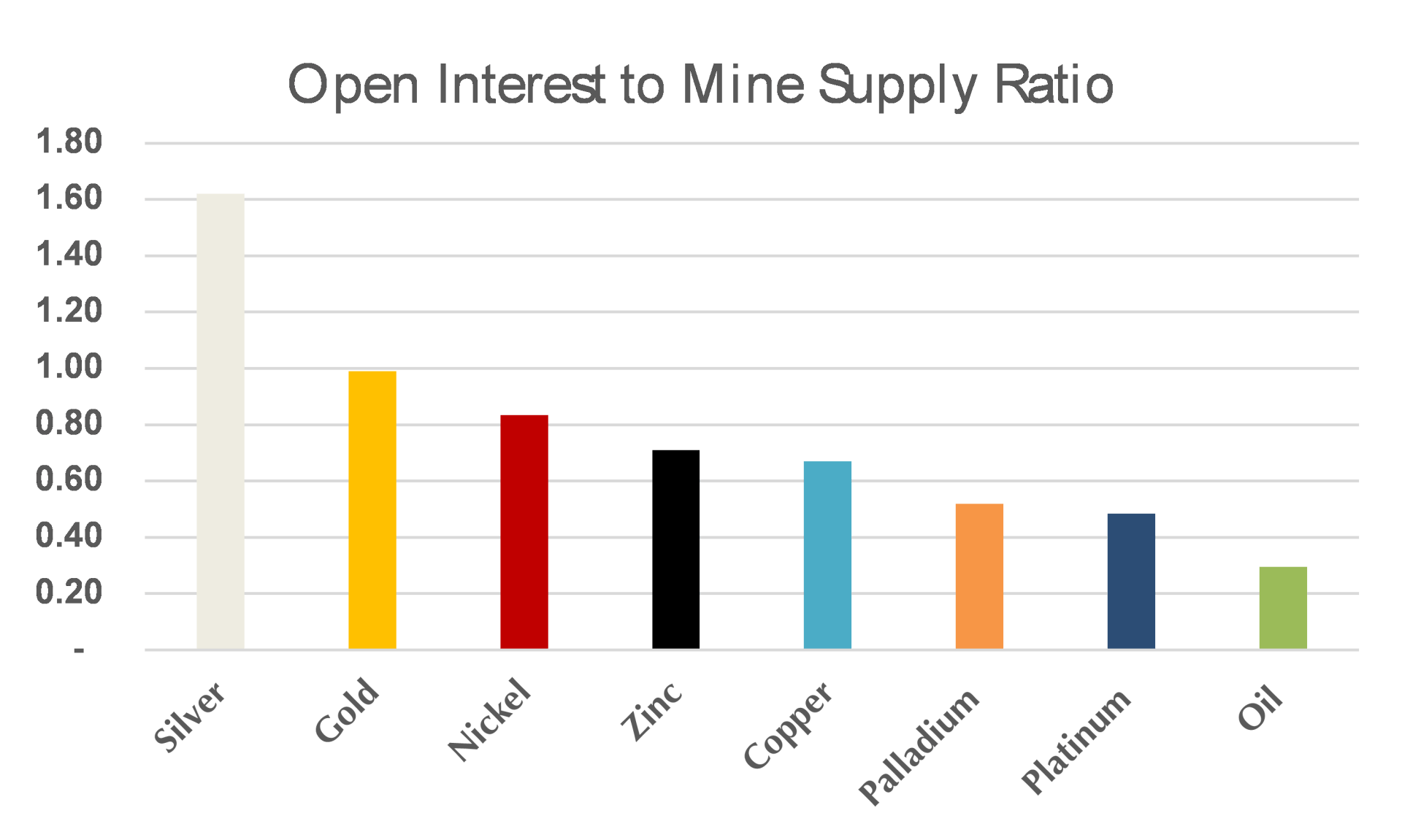

Similar demand characteristics for gold and silver are also clearly observable in the outsized paper markets for the two metals. While the contours of the paper market for these metals remain troublingly opaque, publicly available information makes clear that the paper markets for gold and silver are both particularly large. The graph below uses open interest on the world’s largest commodity future exchanges as a proxy for the size of the underlying paper market. Open interest is shown in relationship to annual supply. In the case of both gold and silver, the sizing of the paper to the physical market is notably larger than that of other commodities.

That the vast majority of the silver mined historically is no longer available for delivery at any price makes the size of the paper market for silver all the more extraordinary. According to the London Bullion Market Association’s (LBMA) July 31, 2017 press release, members of their custodial vault network held just over 1 billion ounces of silver available for good delivery as of March 31 of this year.

This is equivalent to one year’s supply and, more importantly, is just a fraction of the financial positions in silver. There are, of course, sizable inventories of silver outside of the LBMA, most notably in China and Singapore. The more distant the inventories are from the liquidity of the LBMA, however, the less likely they are to be mobilized by modest moves in the price of silver, in our opinion.

Investors have long been aware that silver’s diminutive inventories and variable investment demand can be a particularly volatile combination. It is for this reason that the Hunt brothers attempted to corner the silver market in 1979, and in doing so capped-off a more than ten-fold, decade-long rise in the silver price. Interestingly, the last silver bull market, ended in 2011, which lacked the speculative drama of the Hunt brothers, also resulted in over a ten-fold appreciation in the metal. This tendency of the silver price to increase so dramatically is surely why there’s often a crazy looking old guy on TV telling you that silver is going to $100 per ounce. Crazy as it may sound, the math of limited inventories and highly variable demand is a reality.

Lest we sound too much like the guy on a late-night TV infomercial yelling at the camera while standing in front of boxes of silver coins, we are at pains to point out that the supply of silver has often proven far more elastic than the physical market would suggest. In today’s market, not only do many financial investors have no interest in taking physical possession of the metal they own, but they also actually perceive physical metal to be more cumbersome and therefore more risky than paper claims. Such investors demand a credible counterparty, not physical metal, to meet their demand. As a result, banks can and have provided a surprisingly elastic supply of paper metal tightly linked to the physical market in price but not in quantity.

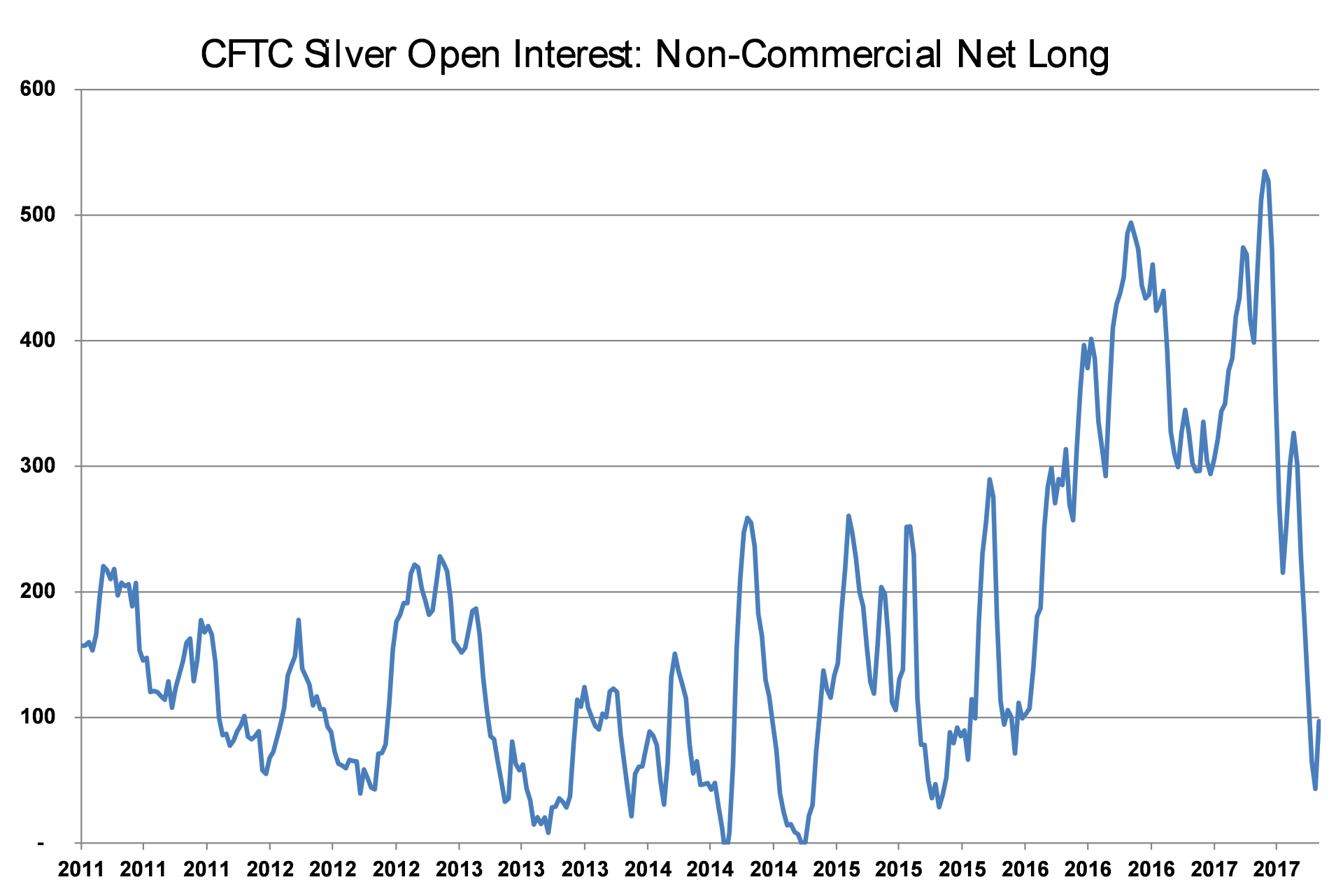

In this environment, investment demand for silver has been able to ebb and flow wildly with relatively little effect on the price of silver. Just look at the movement in the silver futures position this year in the graph above. From mid-April to mid-July, investment managers reduced their net silver futures position by an astonishing five-hundred million ounces while the silver price declined a surprisingly modest 12%.

Some industry participants have begun to realize that the silver market is not well served by the market organizers’ penchant for opacity. Why invest in a market in which the supply, demand, trading and inventories are opaque and, consequently, insiders have a huge informational edge over other participants? The LBMA’s new president, recognizing that the association’s long-standing strategy of providing no data was neither defensible nor desirable, successfully twisted the arms of LBMA members to declare their inventory levels for the first time ever this summer. Detailed reports on daily trading will follow before year end:

“Publication of physical holdings represents a further step towards improved transparency of reporting for the London precious metals market…Publication of aggregate physical holdings is the first step in reporting for the London precious metals market. The next step is trade reporting.”

- Ruth Crowell, LBMA[2]

In addition to the enlightened self-interest of silver-market participants, increasing regulatory scrutiny is also driving more transparency in the silver market. For ostensibly very different reasons, the Federal Reserve and the European Commission have both proposed higher capital requirements on banks’ precious metal positions, as well as absolute limits on metals positions in relationship to bank capital. The result of these measures remains indeterminate, and the related lobbying remains intense. That said, several banks have taken steps to limit their exposure to or exit commodity markets in recent years. Most notably, the bank-managed London silver fix has been replaced by a more transparent electronic auction platform with increased regulatory oversight. [3]

In our opinion, greater transparency and a reduced role of bank intermediaries will not only lead to a clearer relationship between silver demand and silver prices, but greater transparency will also make silver a more attractive monetary alternative for a broader spectrum of market participants. Done correctly, transparency could definitively position silver as part of our financial future once again, not just as part of our financial past. The resulting interest in silver as a monetary alternative would not just trigger a speculative spike in silver prices, but it should sustain higher silver prices over a long period of time.

Finally, it is important to point out that we own silver miners, not the metal itself. We believe that the bear market in silver combined with the bear market in miners has produced a particularly attractive investment opportunity. In this environment of compounding bearishness, we own undervalued silver mining companies that generate good returns on capital at today’s silver prices. MAG Silver is a case-in point. At $17 silver, their Janacipio JV will generate a 10% free-cash flow yield and a 40% IRR when it goes into production. In addition to our portfolio of silver miners that are economic at current prices, we own one silver miner that needs higher silver prices, Bear Creek Mining. That we are paying well below $1 per ounce of silver for Bear Creek’s reserves more than compensates us for this risk and creates eye-popping upside potential for the company in the next bull market for silver.

Organization

Over the past year, we’ve made several changes to our team that merit comment. Beginning with the research team, we hired Amy Sheng and Nick Engel as Kevin Gallagher and Andrew Koger moved on to the next phase of their careers. Amy Sheng, a Yale graduate in math and philosophy and native of China, joined our firm last year following her internship with us the prior summer. Nick Engel joined us full-time in January following his internship with us last fall and the completion of his doctorate in philosophy from Columbia. We wish our departing analysts, Kevin and Andrew, the best in their new endeavors. Kevin is pursuing an MBA at Columbia, and Andrew has taken a job with Alibaba’s Southeast Asia e-commerce platform in the Philippines. We also upgraded our operational staff when Stephanie Tran joined us last August. With a degree from Holy Family University and impressive experience at several small businesses, Stephanie has our office running more smoothly than ever. The entire team is now thirteen: seven in operations and six in investments.

Sincerely,

Sean Fieler Daniel Gittes

END NOTES

[1] Sector exposures calculated as a percentage of 6.30.17 pre-redemption AUM. Performance contribution derived in US dollars, gross of fees and fund expenses. Interest rate swaps notional value and P&L included in Fixed Income. P&L on cash and short proceeds and market value exposures for derivatives excluded. Sector performance Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, or Bloomberg. All values as of 6.30.17 unless otherwise noted.

[2] Crowell, Ruth, “Leadership, Integrity and Trust,” The Alchemist, May 10, 2017, 29.

[3] Christian Berthelsen, “As U.S. Banks Exit Commodities, an Australian Rival Takes Over,” The Wall Street Journal, June 9, 2016.

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8