Equinox Partners, L.P. - Q4 2021 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Equinox Partners rose +7.3% in the fourth quarter of 2021 and gained +57.0% for the full year.[1]

CENTRAL BANKS KEEP BUYING GOLD

2021 was a confounding year for gold investors. A forty-year high in inflation translated into a 3.6% decline in gold and 21.3% decline in the GDXJ gold mining index. In early January, The Economist declared that gold had not just lost some of its investment allure but was at risk of becoming irrelevant[1]. In reaching this conclusion, The Economist completely ignores one of the most bullish long-term factors in the gold market, the ever growing list of central banks buying gold.

The gold market simply cannot be understood without accounting for central bank participation. In 2021, central banks bought 463 tonnes of gold—13% of the 3,561 tonnes mined.[2] And 2021 was not an outlier. Over the past decade, central banks have purchased over 5,000 tonnes of gold—a total that understates the gold accumulation by Russia and China. The cumulative total also fail to capture the nascent trend of developed world central banks buying gold. Last year, for example, witnessed purchases by the likes of Singapore and Ireland. The question is, why are so many central banks buying gold?

In June of 2021, the World Gold Council conducted a survey asking central banks exactly this question. The responses were intuitive. Central banks are buying gold because of gold’s unique financial characteristics. Specifically, gold is the one asset on central banks’ balance sheets that is no one else’s liability. Consequently, gold may perform particularly well when their other assets do not. Left unsaid but implicit in the World Gold Council’s survey results is a concern that foreign central bank’s largest asset, the U.S. dollar, has lost some of its safe-haven status. According to some particularly astute market participants, the price action of U.S. Treasuries has been reflecting this concern since the spring of 2020:

[F]or 20 years, USTs have been the go-to asset of foreigners to hedge global portfolios with. In every case, whenever you had a problem in the equity market or in the world economy, they fled to USTs and they fled to the USD. Last spring, that was violated. Since then, they’ve continued to sell USTs.

- Stanley Druckenmiller on CNBC 5.11.2021

From America’s trillion-dollar trade deficit to the Fed’s loose monetary policy, there is good reason to be concerned about the dollar’s fundamentals. The mere possibility of dollar flight should be particularly worrying given the rapid deterioration in the U.S. net international investment position over the last decade. According to the Bureau of Economic Analysis, the U.S. net international investment position has deteriorated by $11.5 trillion since 2011. This massive deterioration in the U.S. net international investment position would make managing foreign capital flight a near impossible challenge.

Proliferation of foreign central bank gold purchases suggest growing central bank concern about the dollar. That said, what these foreign central banks will eventually do with the gold they are accumulating remains a mystery. No foreign central bank has announced any plans to use their gold for monetary purposes despite having accumulated several hundred billion dollars of the metal since 2008. Regardless as to what they eventually do with the gold they are accumulating, central banks certainly aren’t behaving as if gold may become irrelevant as

The Economist

suggests.

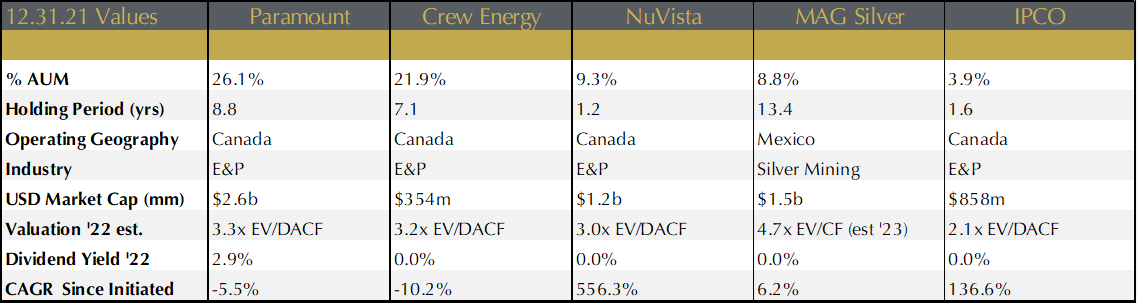

yearend Top-five holdings

The outperformance of our E&P companies and declines in our gold miners led to two changes in our top-five holdings. NuVista Energy and IPCO both became top-five positions as their share prices more than doubled in 2021. RTG and Bear Creek, on the other hand, both dropped out of the top-five after a year of disappointing results. Specifically, RTG’s continuing legal problems in the Philippines prevented the company from transitioning from an exploration company to a developer. RTG has a shovel-ready project with a high IRR. But until they resolve a legal dispute with their local partner the company cannot move forward. We remain optimistic that 2022 will be the year RTG begins mining, but this is not a foregone conclusion. Bear Creek’s Corani mine was a causality of the Peruvian presidential election. When Pedro Castillo was elected in July, Bear Creek’s Corani mine became unfinanceable. Peru will eventually recover from the Castillo presidency, but it may be several years.

Paramount Resources

In 2021, Paramount Resources put to rest any lingering questions about its financial stability. As of year-end 2021, the company had conservative leverage ratios. Specifically, the company’s net debt to cash flow declined from ~5x as of December 2020 to 1.3x in December 2021. The stock responded favorably to this deleveraging, increasing almost five-fold last year.

During the year, Paramount generated ~$450m of cash flow. This compares favorably to the ~$170m of cash flow it generated in 2020. After interest expense and cap ex, the company generated more than ~$100m of free cash flow from operations. The company also sold several non-core assets in the year to help lower its debt and fund production growth. Proceeds from these sales were $165m, allowing the company to decrease net debt by almost $300m.

In addition to lowering its debt, Paramount grew production 20% last year and is on track to grow production double digits again in 2022, from 82k boepd to 92k boepd. Paramount’s growth is coming from Karr and Wapiti, assets which comprise the vast majority of the company’s production and are among the highest returning energy assets in North America. At current energy prices, both Karr and Wapiti have paybacks for new wells in less than a year.

In 2022, we expect Paramount to generate over $1,000m of cash flow and over $500m of FCF at current energy prices. With a market cap of $3.5b, $300m liquid investments and $300m of net debt, the company trades at a depressed EV/CF multiple with a mid-teens free cash flow yield. We expect energy prices to stay strong and Paramount to continue to rerate.

Crew Energy

Crew Energy demonstrated its ability to rapidly deleverage its balance sheet in 2021 and is on the cusp of normal financial ratios. The company’s leverage ratio fell from 5x to 2.5x in 2021. With production up and cap-ex declining, we project Crew’s leverage will fall to close to 1x by the end of 2022. We believe that delivering a de-risked balance sheet will trigger a further rerating of the company’s shares. As it is, the company’s stock climbed five times in 2021.

Rather than shrink its production during the crisis of 2020, Crew Energy boldly adopted a plan to grow into its balance sheet and infrastructure. In the spring of 2020, CEO Dale Shewd announced a plan to grow production by 50% over the following 18 months. This countercyclical move came as commodity prices had barely recovered from their historic lows and most of Crew’s peers were still paralyzed by the volatility in the oil and gas markets.

Crew achieved its production goals at the end of 2021 and the rising commodity prices provided a welcomed tailwind. In 2022, the company expects to hold production flat around 32k boepd and generate $200m in cash flow while spending just $85m in cap-ex. The resulting $100m+ in FCF will be used to pay down debt and return Crew to financial normalcy. The continued deleveraging should also put Crew in a good position to refinance its $300m bond due in 2024. The bond currently trades at 99.6 on the dollar and suggests smoothing sailing.

Assuming $125m of FCF in 2022, Crew is trading at a 25% FCF yield. Moreover, the company holds several strategically important assets that generate little to no free cash flow. One of these assets is Groundbirch, a sizable natural gas play adjacent to Shell’s natural gas fields that will be needed to support the massive LNG Canada project. Crew drilled wells in Groundbirch in late 2021 with encouraging results. This asset can support growth for the company for many years into the future.

NuVista Energy

NuVista exited 2021 with strong free cash flows and reasonable leverage ratios. The company’s leverage ratio declined from ~4x in December 2020 to 2.5x at the end of 2021. With production up 20% in 2022, that ratio should fall to less than 1x by the end of 2022. The stock responded very favorably to this deleveraging, increasing over seven-fold in 2021.

We purchased NuVista in the fall of 2020 shortly after Paramount announced that it had acquired a 20% position in the company. It seemed to us that Paramount was angling to buy 100% of NuVista. The possibility of a bid from Paramount put a floor under the stock price despite the company’s leveraged balance sheet. To our surprise, the market did not react to the news of Paramount’s purchase, and we were able to build a position at very attractive prices.

Paramount knew exactly what they were buying when they acquired 20% of NuVista because the two companies have adjacent land packages. The Wapiti play which constitutes the majority of NuVista’s value is geologically identical to Paramount’s best asset. In addition to being a highly-informed buyer, Paramount’s investment all but guaranteed that John Wright and the management team at NuVista would stay on the straight and narrow to fend off a potential takeover bid from Paramount.

Since the summer of 2020 NuVista’s management has behaved exactly as we expected. They grew production and refinanced their debt, giving shareholders no incentive to sell to Paramount at a discounted price. The stock is up close to ten-times over the past 18 months but the company is still trading at a 20% FCF yield. When NuVista finishes growing into its delivery commitments next year it will have a FCF yield north of 30%.

MAG Silver

MAG Silver is the 44% owner of the high-grade, large-scale Juanicipio silver project in Zacateca, Mexico. The quality of the Juancipio project is beyond dispute, and Fresnillo—one of the world’s largest silver producers—is a proven operator. That said, the Juancipio JV has been plagued by a series of delays that have weighed on MAG’s share price over the past 18 months. In 2021, the stock was down 29%.

The Juancipio mine was scheduled to begin production in late 2020. Management now anticipates commissioning to start in mid-2022, bringing the project delay to over a year and a half. The latest setback is a result of the state-owned electric monopoly notifying Fresnillo that it was delaying the mine’s grid tie-in for six months.

While the JV is awaiting approval for the grid tie-in, Fresnillo has been processing a limited amount of material at two of its nearby mills. The cash flow generated from the milling will help mitigate additional costs from the delay. MAG still had to raise $46m of additional equity as well as take out a revolving debt facility in the fourth quarter to offset the delay. Post the capital raise, MAG has $75m in cash. This should be sufficient to fund the company through 2022, but the additional dilution was a most unwelcomed surprise.

Despite the growing number of setbacks, the Juancipio JV remains a top-tier silver asset that has the ability to increase production to 8,000 tpd within a few years of initial production. During 2021, the company released a few exploration holes on the JV property from its 2020 exploration program that confirmed the continued depth of two of the asset’s major veins. The JV has historically been very frugal with exploration dollars, but we expect the JV to continue to outline a pathway to a larger reserve base in order support an expansion to 8,000 tpd. At this point, we believe the JV’s mill must reach commercial production for the shares to rerate.

IPCO

An oil and gas company listed in Sweden, headquartered in Switzerland, and with most of its operations in Canada, IPCO is an odd duck. The company’s unique combination of attributes has all but assured that it gets overlooked by most investors. Even so, the stock was up over two times in 2021.

We are attracted to the company’s strong track-record of execution, high-quality asset base, and well-aligned management team. IPCO is a Lundin company, with the family owning close to 30% of the company’s shares. The Lundin family has a long history of investing in resource businesses, and we have invested alongside them as a minority investor in several other mining investments. As a result of the Lundin influence, IPCO has been a disciplined capital allocator. They have purchased assets counter-cyclically at attractive multiples and bought back shares when the price warranted it. Today, the share price is such that they can buyback the entire market cap in less than five years from its FCF. While they are unlikely to do this, the company has commenced a share buyback program in Q4 ’21 and is continuing it into 2022.

In addition to its FCF generation and prudent capital allocation, there is further upside in the stock in the form of an undeveloped but fully-permitted oil-sands asset. This asset has 1b barrels of resource vs. 300m for the rest of the company. Developing a greenfield oil-sands asset in today’s political environment is a nonstarter, but at the current valuation shareholders are not paying for this potentially significant upside.

Sincerely,

Equinox Partners Investment Management

[1] Sector exposures shown as a percentage of 12.31.21 pre-redemption AUM. Performance contribution is derived in U.S. dollars, gross of fees and fund expenses. Interest rate swaps notional value and P&L are included in Fixed Income. P&L on cash is excluded from the table as are market value exposures for derivatives. Unless otherwise noted, all company data is derived from internal analysis, company presentations, or Bloomberg. All values are as of 12.31.21 unless otherwise noted.

Endnote: Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, or independent sources. Values as of 12.31.21, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notic

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8