Kuroto Fund, L.P. - Q1 2019 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Kuroto Fund appreciated +3.8% in the first quarter of 2019 and is up +3.0% for the year through May 8. By comparison, the EM index is up +9.4% for the year through May 8. [1]

Avoiding CHINA

For 20 years we have avoided China. Our decision to eschew sizeable investments in China is in part a product of our experience making small investments in China. In almost every case, we were surprised by the opaque influences on our companies, and when things went wrong, we found ourselves wading through spin and obfuscation.

Given this experience, it would be easy for us to write-off China as simply too political and too opaque for investors focused on business quality and governance. This conclusion, however, fails to capture what we find so uniquely problematic about China. After all, we are invested in Turkey and Vietnam: two highly political economies in which the lines between corporate activity and the government are often far from clear. So, we thought it would be useful to distill down exactly what we find so uniquely unattractive about China.

When an emerging market goes wrong, the local stock market and currency typically become volatile and unpredictable but the overall framework for the country’s macroeconomic success or failure tends to remain surprisingly straightforward. Turkey, for example, borrowed way too much money from abroad, unwisely channeled much of that capital into a domestic real-estate bubble, and has been using a variety of tricks to delay the fallout from their economic mismanagement. Aspects of Turkey’s crisis management have been orthodox, including higher interest rates, while other measures, such as overstating foreign currency reserves and price controls, are unorthodox but not entirely surprising. It remains to be seen if Erdogan’s half measures and survival instincts will be sufficient to prevent a deepening of the current economic and political crisis in Turkey. But, at least we can track the variables: e.g. tight monetary policy good, redoing the election in Istanbul bad.

Vietnam is not facing anything like the crisis in Turkey. Instead, they are wrestling with a more typical emerging market scenario. The country’s policymakers are attempting to contain inflation and manage their currency without slowing GDP growth too much. To achieve the desired mix of outcomes, the government has not been above using its influence over utilities to hit topline inflation targets. That said, Vietnam’s policy makers are clearly reluctant to use these controls and have been liberalizing the economy over time. Most notably, the government of Vietnam has sold off several sizable state-controlled enterprises. As a result of this overarching trend, we can both track their progress and backsliding: e.g. privatizing state-owned enterprises good, copying China’s great fire wall bad.

China, like Turkey and Vietnam, wants to deliver a desirable combination of growth, inflation, and asset price stability, but unlike Vietnam or Turkey, China is a superpower. Accordingly, China has the ability to influence not just the domestic but the global framework through which its policies are evaluated. Well informed people often cooperate with China’s spin on things out of self-interest. As a result, the internal tensions in the Chinese economy are much more difficult to pin down. The last three years provide a useful case-in-point.

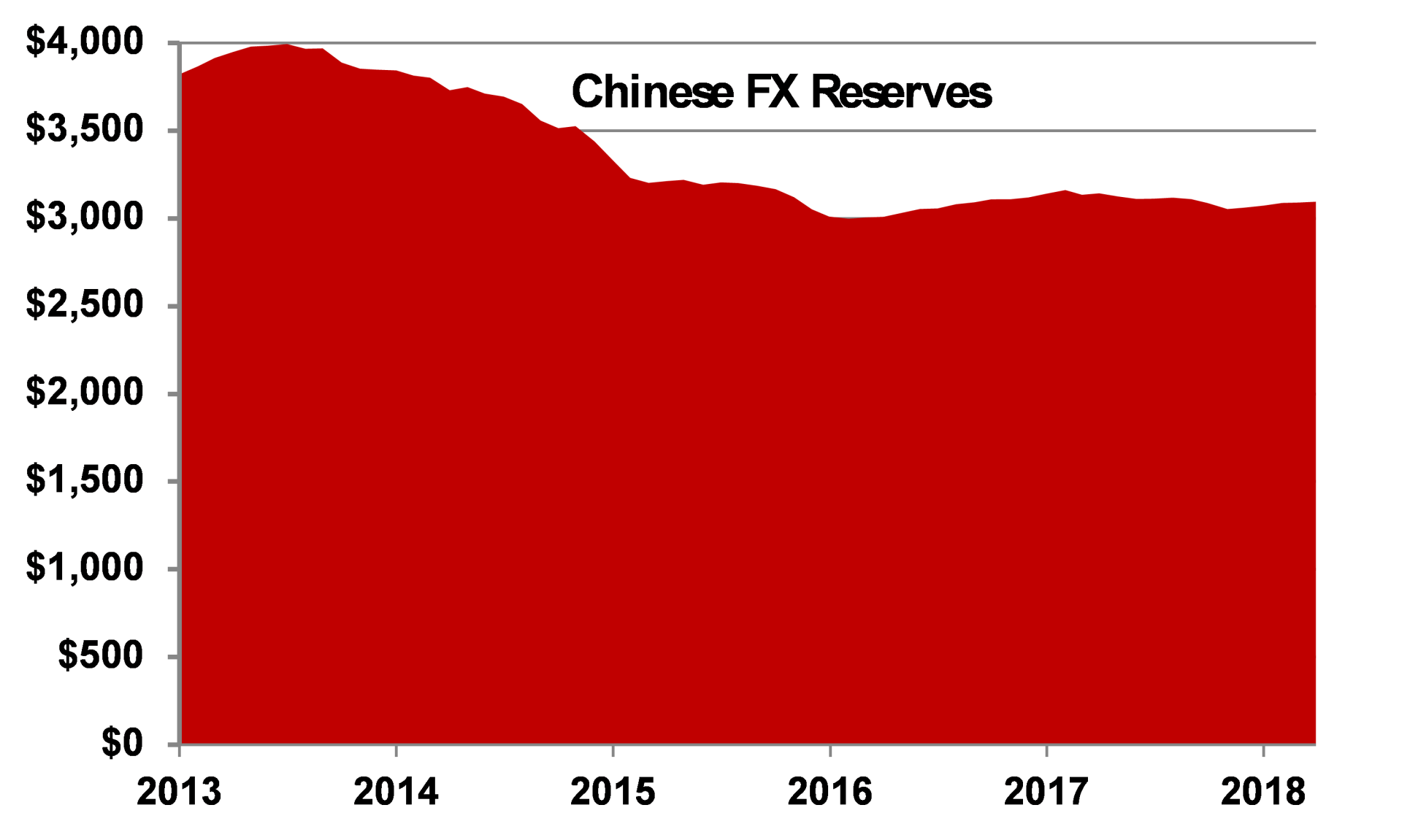

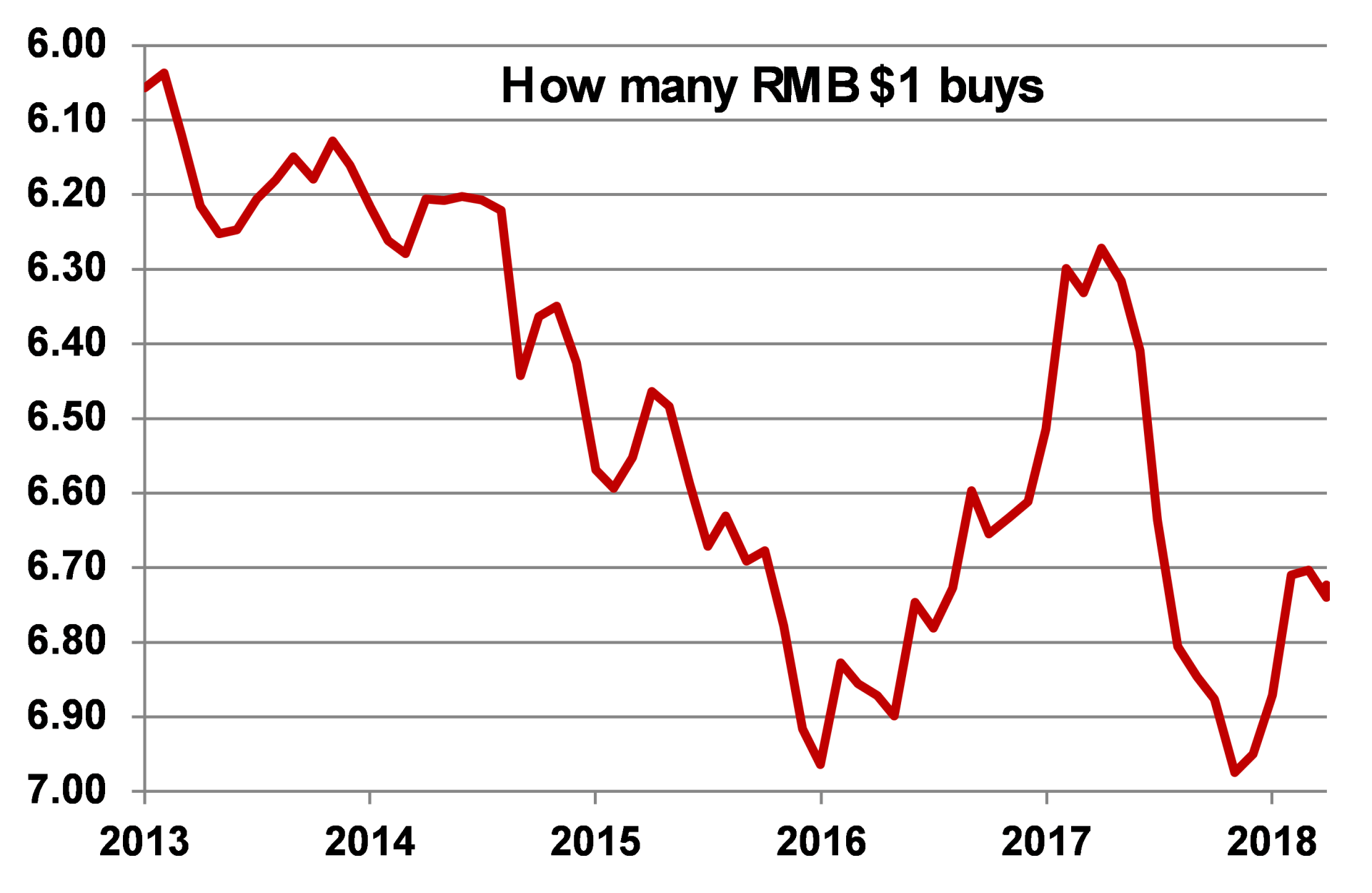

By late 2016, China appeared to be on the verge of a macroeconomic and political meltdown. The RMB had fallen 10% from its 2015 peak, and China had lost $1 trillion USD in FX reserves in two years. China responded to this crisis with further restrictions on their capital account. But, with domestic debt having increased rapidly, it was far from clear that the Chinese economy and RMB would stabilize.

Adding to the crisis, the looming 19th Party Congress set for the fall of 2017 promised to test the remaining strength of the Jiang Zemin faction against the growing power of President Xi Jinping. A disorderly outcome from the Party Congress raised the real possibility of a political as well as economic crisis. While China’s high-stakes political contest was decisively resolved in President Xi’s favor, what is less clear is why the pressure on the RMB went away.

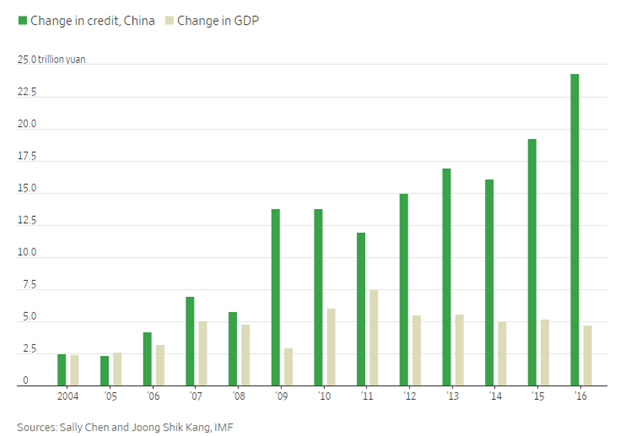

Not only have the factors which caused the RMB’s depreciation not been addressed, but they seem to have worsened over the past two years. According to Bloomberg Magazine, “China’s total debt has increased sevenfold since the crisis [of 2008]. It accounts for more than half the outstanding debt of the entire emerging world, while its private sector has accounted for 70 percent of all new debt taken on anywhere in the world since the crisis.”[2] China perma-bulls don’t even bother to address this issue.

Andy Rothman recently made the ridiculous argument that the “biggest weakness in China last year was poor sentiment among the country’s entrepreneurs and investors.” But, several long-time China bears have also gone quiet recently. This unsatisfying outcome typifies our experience in China. Opinions change even though the underlying facts remained the same.

Perhaps the tendency to oscillate between optimism to pessimism on China is a natural outcome of the irreconcilable reality of China itself. China’s economic achievements are impossible to ignore, but so are its problems. The complete absence of any check on the power of the Chinese Communist Party has led to policy extremes that are hard to fathom. And, the fallout from these policies—from Huawei to the Uighurs—is so polarizing that market participants tend to ignore them. We take a more holistic approach and hold that not only can the worst policies of the Chinese Communist Party not be cordoned off from the positive aspects of their regime, but that they make the Chinese regime inherently unstable.

The disorienting spin that engulfs China is also at play within individual Chinese companies, and the ways in which politics impact Chinese companies are far more nuanced than what we see in other emerging markets. Take Jack Ma’s surprise resignation from Alibaba last year. This man, who was powerful enough to sell Alipay to a related company of his in 2011 and had scrupulously avoided politics in public, appears to have been forced to resign. Why? The most common explanation is that he was asked to step down by the Chinese Communist Party. Unfortunately, with the absence of a free press, the truth of the matter is not something that we are likely to find out any time soon.

We fully concede that those who have the inside track on Chinese policy can navigate the local market and that China has amazingly skilled technocrats who have been able to manage through a daunting sequence of crises in recent years. That said, investing in China will likely become more, not less, political in the future; we are avoiding investments in China.

organization

We continue to right-size our business to correspond with the ~$500m of assets we have under management. In January, we replaced our trader, Gerald Kane, with Nicholas Engel, an existing analyst and experienced trader. The change was made possible by the implementation of a new order management system that greatly reduces the time required to execute and settle trades. Nick is able to better integrate our research and trading activities, which is an obvious advantage. At the end of April, we parted ways with Dan Gittes, a partner of 15 years who joined us straight out of Williams College in 2004. During his time here, Dan accumulated broad experience in emerging markets. We wish both Dan and Gerry well in their next endeavors. Our team of 11 people now consists of six investment professionals and five in operations.

Sincerely,

Sean Fieler

END NOTES

[1] Performance stated for Kuroto Fund, L.P. Class A on a net basis. An investor’s performance may differ based on timing of contributions, withdrawals, share class, and participation in new issues. Unless otherwise noted, all company-specific data is derived from internal analysis, company presentations, or Bloomberg. Company valuations and exposures are as of 3.31.19.

[2] Bloomberg Magazine, April/May, page 60

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8