Equinox Partners Precious Metals, L.P. - Q3 2020 Letter

Dear Partners and Friends,

corporate capital allocation: From Asia to mining

Over the past quarter century, we’ve managed through a variety of sectors in which corporations systematically misallocated capitol. Emerging Asia, pre-Asia Crisis, still tops that list. Asian companies circa mid-1990s were maniacal about growth. From a capital allocation perspective, this meant investing all the capital they generated and sometimes all the capital they could borrow to drive the topline. The result, predictably, were businesses that could not withstand a downturn.

In years following the Asia Crisis as we aggressively allocated capital to companies in emerging Asia, we encountered a series of corporate insiders still resisting change. We literally had managers tell us that they viewed returning capital to shareholders as an admission of failure. But with shareholders overwhelmingly insisting on capital discipline, insiders eventually compromised. Dividends were increased, stock buybacks were announced, a few shares were even repurchased, and capital allocation slides began to appear in pitch decks. That said, it was clear to everyone involved that insiders were responding to pressure and had not internalizing a thoughtful capital allocation policy.

Gold and silver mining companies are in a similar situation today. Insiders are talking about capital discipline, but their commitments are for the most part superficial. Most mining company insiders still don’t have shareholders’ interest at heart, and it shows. What shareholders want are companies that have internalized a rational capital allocation framework and can take advantage of the mining cycle to create value. Since the distinction between a superficial and a sound capital allocation framework is difficult to tease out in the abstract, we offer two case studies: Dundee Precious Metals and Pan American Silver. The recent capital allocation decisions of these two companies captures the value of thoughtful capital stewardship as well as the frustrations of dealing with insiders that lack capital allocation clarity.

dundee precious metals

In June of 2018, we wrote to DPM’s board to make the case for a sizable share buyback (see enclosed letter to DPM). At the time, gold was trading at $1,200 and DPM was trading at less than three times 2020 projected cash flow. With the construction of the company’s second mine nearing completion, we knew that DPM’s ongoing capital obligations would fall precipitously and the majority of the company’s cash flow would become free. By our calculation, the company’s five-year cumulative free cash flow was roughly double its market cap at the time. The math was not complicated.

To their credit, DPM’s board actively engaged with us on the topic of capital allocation. Several members of DPM’s board met with us in person, and DPM’s chairman went out of his way to give us an opportunity to make our case. DPM had a Normal Course Issuer Bid (NCIB) in place, but the company was buying back stock tentatively. Unfortunately, despite our best efforts, the company did not change its behavior. From their annual meeting in 2018 until its annual meeting in 2020, DPM’s shares outstanding shrunk by just 1.5%. In a nutshell, DPM took steps in the right direction but did so without sufficient commitment to make much of a difference. This indecisiveness was laid bare when a large block of the company’s stock came up for sale in the spring of 2020, and the board passed on the opportunity to meaningfully shrink DPM’s share count.

The recent capital allocation decisions at DPM perfectly capture the typical board response to pressure: 1) take small steps in the right direct; 2) defuse the situation; 3) don’t do anything precipitous. As we look back on the past few years of our engagement with DPM’s management and board, we cannot help but conclude that the board failed to take advantage of the market’s inefficiencies for the benefit of shareholders.

With DPM’s shares up and their potential acquisition targets becoming more expensive, we’ve reduced our position in this operationally sound and still undervalued company. While the overall experience was frustrating, DPM has been one of our better investments in recent years. Since June of 2018, the shares of DPM have tripled, more than doubling the performance of the GDXJ over the same period.

pan american silver

Michael Steinmann and Ross Beaty have led Pan American Silver through a series of well thought out capital allocation decisions over the years. Most notably, in late 2018, Pan American bought Tahoe Resources for just $1.1b USD. The company consummated this transaction at a time when Tahoe had undergone a series of failed management changes, had lost rights to its flagship property in Guatemala, and its shares were down 70% in a 12-month period. Pan American brought the management and financial strength that the Tahoe assets needed, creating value for shareholders of both Tahoe and Pan American.

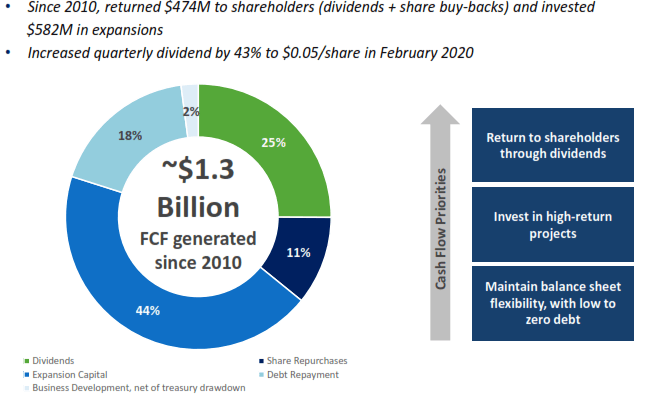

The countercyclical acquisition of Tahoe was possible because shareholders trusted Pan American’s leadership, trust that stems from Pan America’s demonstrated pattern of returning capital over time. Over the last 10 years, Pan American has returned $474m of the $1.3b of FCF that it generated. The leadership team at Pan American clearly understands that their long-term commitment to building value, not simply growing, has earned them a position of trust with investors—a fact they properly highlight in their presentation (see below).

Given this track record, when Pan American chooses to act countercyclically the market has been supportive. Pan American also has a history of under-promising and over-delivering. In recent years, Pan American has undersold the value of its La Colorada skar deposit in Mexico. By our calculation, the NAV of the project now exceeds $500m USD. Given management’s deliberate approach, we expect the market will embrace their decision to allocate capitol to La Colorada when they finally elect to go ahead with the project.

takeaways

The lessons contained in our experience with Dundee Precious Metals and Pan American Silver are nuanced, just like the stories themselves. First, while we are not satisfied with the recent capital allocation at DPM, it was unarguably the better investment of the two companies since the beginning of 2018. DPM shares appreciated 216% compared to the 119% appreciation for Pan American over the past twenty months. The superior performance of DPM highlights the importance of starting with an attractive valuation. Overpaying for the perfect capital allocator can result in poor returns just as paying a very attractive price for an imperfect but honest capital allocator can make for a great investment.

The larger lesson, however, is that over longer periods of time the allocation of capital matters more and more. The 20-year compounded stock return for Pan American is 13.4% compared to 9.9% for Dundee Precious Metals. Successful, long-term investing necessitates good corporate capital allocators, and superior capital allocators in a capital-intensive sector like mining deserve a superior valuation.

A board seat at RTG Mining

On October 12th, Sean Fieler joined the board of RTG mining. We first met Justine Magee, RTG’s CEO, and Michael Carrick, its Chairman, fifteen years ago. At the time, they were building a mining company in the Philippines which they sold to B2Gold for $1.13b USD. As part of that transaction, Justine and Michael spun-out the early-stage assets that would not receive much value in the transaction.

Over the past dozen years, Justine, Michael, and their team have painstakingly progressed those assets as well as acquired new ones in Asia. Believing that their years of hard work are about to pay off, we became substantial shareholders in the company this spring and took a seat on the board earlier this month. We look forward to furthering the value creation at RTG as the company’s projects move into production in the years ahead. We believe that the team at RTG will once again provide a case study in how to take advantage of the mining cycle.

organization

After a quarter century in New York City, our firm is relocating to Stamford, CT. New York City is no longer the necessity it once was for our employees or our business. Our new office space is just 45 minutes away from the city. Please come and visit us at 301 Tresser once we’re up and running in late November.

We have also changed the name of our management company from Mason Hill Advisors to Equinox Partners Investment Management. Having caused confusion with companies and investors alike over the years, the name change reflects how we’ve always done business, as Equinox Partners.

Sincerely,

Sean Fieler

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8