Equinox Partners, L.P. - Q4 2020 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

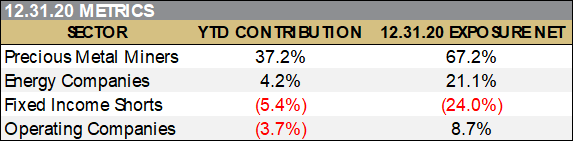

Equinox Partners rose +24.6% in the fourth quarter of 2020 and was up +33.1% for the full year[1]

Our value investing discipline doesn’t protect us from being wrong, and we certainly made our share of mistakes in 2020. For example, we began 2020 short both Tesla and government bonds. Our value orientation did, however, prevent us from getting disoriented last spring. In March, it was obvious to us what we needed to do. We covered our shorts and bought companies at incredibly low prices. As a result of these actions, our fund more than recovered after having been down over 50% in late March.

While buying near the lows and covering most of our shorts during the market crash was obvious in hindsight, at the time, it took real conviction. Our timely purchases of Crew Energy and RTG Mining have proven particularly beneficial to the fund. Both companies are now top-five positions. With respect to our short covering, our decisions to cover Tesla and much of our fixed income short exposure were also critical to our fund’s 2020 returns. Given the financial significance of these decisions, each merits a fulsome description.

We increased our positon in Crew Energy by over 50% between March 12th and March 24th. We then topped up our holding when the opportunity presented itself again on April 20th and April 21st. At its lows, Crew Energy was trading as if it was bankrupt. It was not. The market failed to grasp the attractive nature of the Crew’s debt—a $300m bond due in 2024 with no covenants. Crew had the luxury to wait for oil and gas to rebound. Not only were we confident that the sector’s history of imprudent overinvestment was behind us and that hydrocarbon prices would not remain below replacement costs, but even in the unlikely case that energy prices remained depressed through 2024, we thought that Crew’s equity was worth substantially more than $15m USD.

The second critical purchase decision we made last spring was increasing our position in RTG mining. Like Crew, we had a small positon in RTG at the beginning of the year. Accordingly, when the company chose to raise a modest amount capital in the spring we were perfectly positioned. Given the low price at which RTG was trading, the company’s insiders limited the equity offer to just $3.8m USD to minimize dilution. While modest in size, this equity sale was just the right entry point for us as we were looking to deploy capital with a management team and asset we already knew well.

The third decision—which should not be glossed over—was our active management of our short portfolio. Our short exposure ended up costing 7% of partners’ capital in 2020. But, these losses could have been much worse had we not aggressively trimmed our exposure as the stock market became increasingly frothy last fall. The more ebullient the market became, the more we shifted our short exposure to mundane companies, like Planet Fitness. While we lost money on these shorts as well, we are certain that money-losing, over-levered gyms are not worth 13x revenues. The combination of such extreme valuation and such pedestrian business models reinforced our confidence that we remain in the very late stages of extreme financial overvaluation.

yearend Top-five holdings

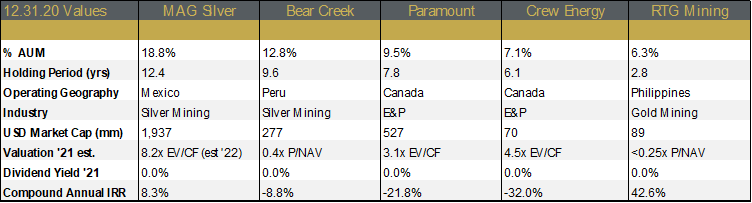

MAG Silver: 18.8% of 12.31.20 Partners’ Capital

MAG’s Juancipio joint venture is one of the world’s highest-grade silver mine. At an eventual 8,000 tonnes per day of production, the joint venture will produce 10 million ounces of silver per year at a cash cost of less than zero. For Mag’s 44% net interest, the JV will generate 4.4 million ounces. With spot silver over $25 USD per ounce, that equates to ~$100m in pre-tax free cash flow for MAG. The JV can sustain this level of production for more than a decade based on the existing resource, and there is good reason to believe that the deposit will grow in size as the joint venture identifies other economic orebodies on the joint venture property.

Despite the quality of the Juancipio joint venture, MAG Silver has long traded at a discounted valuation because of Fresnillo’s bad behavior as the majority partner in the joint venture. Fresnillo’s decision to slow walk the investment decision at Juancipio as they pushed ahead with their 100% owned properties infuriated MAG shareholders. With production fast approaching, however, the concerns about the timeline have begun to recede and the value of MAG has increased accordingly. While there could be further delays to the timeline, given the decline in production elsewhere in the Fresnillo district, Fresnillio is as motivated as MAG at this point to bring the Juancipio joint venture into production.

More importantly, with MAG now fully financed and Peter Barns assuming the Chairmanship of MAG this past summer, the company is well positioned to demonstrate its credentials as a savvy capital allocator. The joint venture should enjoy many years of high free cash flow as well as high-return investment opportunities. Given Peter Barn’s background at Wheaton Precious Metals, we expect he will clearly communicate a sophisticated financial approach to develop the joint venture and thereby achieve a premium valuation.

Bear Creek: 12.8% of 12.31.20 Partners’ Capital

Bear Creek is on the verge of financing its fully-permitted Corani project in Peru. The company has all its permits in place and has been working on a financing package for more than a year. If the company can secure 70%+ of the required $600m USD via an off-take agreement and debt package, its stock should rerate dramatically.

The project to be financed, Corani, is one of the largest undeveloped silver mines in the world. With 225m ounces of silver reserves, 2.7b pounds of lead, and 1.8b pounds of zinc, the contained metal value of the deposit exceeds $10 billion USD. Per the company’s December 2019 feasibility study, the project has an IRR of +20% and an NPV of $531m. With silver, zinc, and lead prices up substantially since late 2019, the project’s IRR and NPV have improved sharply.

There are two principal sticking points for the project: banks’ willingness to finance greenfield projects and Peruvian politics. The coronavirus downturn had clearly had a negative impact on the financial wherewithal of the banks that might finance such a project. Accordingly, good projects like Corani are being slow walked and then stuck in credit committees. With respect to Peruvian politics, the impeachment of President Vizcarra with just five months left in his term reminded investors once again that all is not well in Peru. As a result, lenders will likely want to wait until the after the presidential election of 2021 before extending a multi-year loan to Bear Creek.

For the company’s part, Tony Hawkshaw, Alan Hair, and Eric Caba are technically well qualified to negotiate and structure the necessary offtake agreements. We’ve also been pleased with the company’s prudence with respect to shareholder dilution. Bear Creek’s modest recent equity issuance is a case in point. This financial prudence, we believe, is a result of insiders’ ownership and a concentrated shareholder base.

Paramount: 9.5% of 12.31.20 Partners’ Capital

From its 2014 peak of just over $60 to its March 2020 trough of just under $1, the shares of Paramount declined 98.4% in slightly less than 6 years. Surprisingly, this 98.4% decline occurred while the company’s hydrocarbon production per share more than doubled. Underlying the collapse in Paramount’s share price is the decline in the oil prices. In the summer of 2014 when Paramount’s shares peaked, West Texas Intermediate crude fall from $105 to $45. The collapse in oil prices in 2014 happened at the worst time for Paramount, having borrowed heavily to complete a processing facility that ended up being both delayed and over budget.

Paramount’s traumatic near death experience has had a clearly positive effect on management behavior. Jim Riddell rationalized the company’s portfolio and middle-management. More importantly, both the company and its leadership has matured. They have a better appreciation for their own strengths and weakness, they realize they are good contrarian deal markers, and they don’t need to complicate that value-add with unneeded execution risk.

Like Crew, Paramount has more infrastructure and transportation commitments than makes sense at its current level of production. And like Crew, Paramount plans to go against the current market orthodoxy and grow production significantly next year. With its Q3 release, the company unveiled a plan to grow production 20% year over year by outspending cash flow by $100m in the first half of 2021. Once that growth is complete, Paramount will have a more sustainable cost structure that should allow it to generate $50m of free cash flow in the second half of 2021.

At current strip pricing, and if Paramount’s 2021 investments go according to plan, the company will have a sustainable leverage ratio by the second half of next year. Should that occur, Paramount will start to look very undervalued very quickly. Going forward, we expect Jim Riddell and his team to continue to make value-creating capital allocation decisions. Their decision to acquire shares of Nuvista Energy at 60 cents early last summer is one such example. Paramount is well positioned to grow and consolidate its core area as one of the survivors at scale in the Western Sedimentary Basin.

Crew Energy: 7.1% of 12.31.20 Partners’ Capital

From its year-end 2016 price of $7.50 to its March 2020 trough of 14.5 cents, the shares of Crew Energy declined 98% in just over 3 years. What’s remarkable is that this 98% decline occurred while the company’s hydrocarbon production per share remained roughly the same. Three things caused the share price decline: the decline in oil and gas prices, the market’s concern about Crew’s solvency, and the price the market is willing to pay for oil and gas companies.

As of January 13th, 2021 WTI oil is trading at $53 and Henry Hub gas is trading at $2.75. At these prices, the North American oil and gas industry can grow modestly if desired. The industry, however, is wary of growth given the ongoing uncertainty of the pandemic as well as the low market valuation of the sector. As a result, most large North American E&P companies are cutting back on capital expenditures and using cash flow to buy back shares and pay down debt.

Crew’s management, in contrast to almost all of their peers, is using today’s prices to grow into its infrastructure. Prior to the last down cycle, Crew had invested in infrastructure and transportation commitments to support 40kbpd+ of production. Due to the drop in pricing, Crew has been stuck at 22kbpd. As a result, Crew has been suffering from additional costs for infrastructure and transportation commitments that they couldn’t use.

In December, Crew’s management announced their plan to remedy this situation. Over the next 24 months Crew will grow their production to ~32k bpd from its current production of 22k bpd. Crew is largely funding this growth by borrowing an additional $50m from its banking syndicate. While this strategy is not without risk, Crew hedged a large portion of its production for the next two years to protect itself against another downturn in commodity prices.

Once production reaches 28k bpd in 2022, Crew expects to generate $140-$150m in cash flow and have ~$300-$350m in debt, which will bring its debt-to-cash-flow multiple to 2.0x-2.5x. This level of production will generate $40-$50m of free cash flow for further debt pay downs or share buybacks should the share price warrant it.

Finally, it is worth highlighting that Shell and its partners are going ahead with their LNG facility on Canada’s west coast. Crew’s portfolio of thousands of drilling locations is one of the cheapest ways for a supermajor like Shell to acquire the necessary resources for its project. While we have no intention of selling out, nor does management, the strategic value of Crew’s land package merits a special mention.

RTG: 6.3% of 12.31.20 Partners’ Capital

RTG is the spin-out of CGA Mining, a company we owned a decade ago. In 2013, the team at CGA sold its Masbate mine in the Philippines to B2Gold and spun out its early-stage assets into a new entity called RTG. While we elected not to keep our shares in the spin-co, we were pleased with CGA’s sale to B2Gold and with the clear alignment that RTG chairman Michael Carrick and CEO Justine Magee had with their shareholders. So, we jumped at the chance to invest with that team again in 2018 when the opportunity presented itself.

After our initial investment in July of 2018, the shares of RTG fell by 50% as the company failed to make much progress in moving the Mabilo deposit in the Philippines toward production or solidify its 30% ownership of the Panguna asset in Bougainville. This year, by contrast, the path to production for both of these projects improved meaningfully. In the case of Mabilo, the new Minster of Environment in the Philippines, Roy Cimatu, fast-tracked the project and RTG resolved a legal dispute with a former contractor. In the hope of positive developments, we increased our position in April and July through a series of small private placements. Thus far, these investments have been a good decision. Over the past eight months, the stock has quadrupled. Amazingly, RTG remains severely undervalued.

The company’s Mabilo project has an NPV of $473 million according to its 2019 feasibility study. This study, however, was done at $2.50 lb. copper. Today copper is trading at $3.56. The 5% NAV of the project at today’s metal prices is in excess of $600m by our calculation. More importantly, the vast majority of the capital for the project can be generated internally by RTG through the direct shipment of a high-grade starter pit that is 20% copper. While neither the financing nor the surface rights have been secured, we believe the project is likely to move forward in calendar 2021.

If RTG’s Mabilo project does proceed, the seven years of hard work that the board and executive team have put in nurturing that asset will finally pay off. This fall, Sean Fieler joined the board at RTG. We see this as a unique opportunity to build a larger gold-mining company with very little dilution, given the way RTG’s asset development can be sequenced. In the best-case scenario, RTG will soon be in position to redevelop the Panguna mine, an asset of truly world-class scale.

Sincerely,

Equinox Partners Investment Management

[1] Sector exposures shown as a percentage of 12.31.20 pre-redemption AUM. Performance contribution is derived in U.S. dollars, gross of fees and fund expenses. Interest rate swaps notional value and P&L are included in Fixed Income. P&L on cash is excluded from the table as are market value exposures for derivatives. Unless otherwise noted, all company data is derived from internal analysis, company presentations, or Bloomberg. All values are as of 12.31.18 unless otherwise noted. MAG Silver valuation using first full year of production and estimatied 8,000 tpd throughput.