Equinox Partners, L.P. - Q4 2018 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

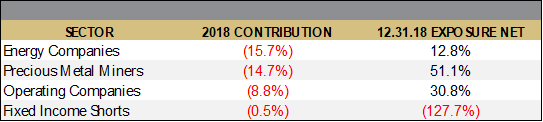

Equinox Partners declined -23.5% in the fourth quarter of 2018 and was down -41.9% for the full year.

THE STATUS QUO VS. THE FUTURE

As the Fed struggled to raise rates one last time in December, it became clear that America’s monetary policy is not on the verge of normalization. We simply have too much debt for meaningfully positive real interest rates. As such, America, and most of the rest of the Developed World, remains trapped in a debt bubble in which the solution to the problem of too much debt is more debt, and the solution to the problem of rising interest rates is central bank manipulation.

While investors are broadly uncomfortable with this disconcerting flaw in our financial system, they are focused on more urgent problems. The debate surrounding the Fed’s rate increase in December of last year was a case in point. The market’s long-term concern about the Fed’s failure to normalize monetary policy was completely overwhelmed by a far more urgent concern that the quarter point rate increase would tip our economy into recession.

In this environment characterized by growing uncertainty, traders are sticking with correlations that have been working, most notably buying core sovereign bonds when risks rise. The notion that the government bonds they are buying out of fear are creating most of the trouble in the first place remains a bridge too far. As such, the market’s reflexive rush into treasuries is not so much an endorsement of a brave new paradigm in which debt levels are irrelevant, but instead a failure to imagine an alternative.

The sophisticated, but ultimately ridiculous, arguments of economists like Olivier Blanchard that public debt may have little to no cost will simply never gain wide acceptance. Investors know that such a free lunch is simply too good to be true. Accordingly, we are confident that the search for alternative investments will continue. And, in that search, we are confident that gold, silver, and less-indebted emerging markets will rise to the top. This, however, has not yet happened.

In 2018, the market doubled down on the status quo, and we posted the worst performance in our twenty-five year history. The market continues to treat gold mining stocks as an environmental nuisance and gold itself as irrelevant, emerging markets as risky locations to be avoided in such an uncertain world, E&P companies as environmentally-problematic, potentially-obsolete undertakings, and core government bonds as unquestionably safe even though they are the root of the debt problem. In short, the status quo continues to embrace a worldview that is deeply at odds with reality.

Our companies are both well positioned for the actual world in which we live and incredibly cheap. Our largest gold mining investment trades at less than 4x FCF, our portfolio of operating companies trades at 10x earnings, our E&P companies at 4x CF with depressed commodity prices, and our bond shorts at a collective yield of roughly 1%.

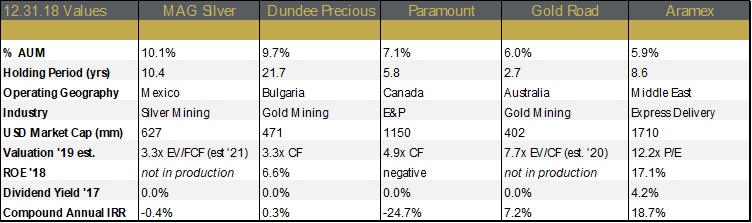

The letter that follows details our largest five equity positions and highlights the value embedded in our portfolio.

TOP-FIVE HOLDINGS

pARAMOUNT

Paramount is a Canadian energy company led by Jim Ridell with a $1.1b market cap, $900m in debt, and ~$200m of listed and unlisted investments in other companies.

U.S. oil prices started 2018 at $60, peaked at $76, and ended the year at $46. Compounding this decline, the differential at which Paramount sells its most valuable product, a very light oil called condensate, traded at a massive $20 discount to WTI at one point in the fourth quarter. As a result of these commodity price declines, Paramount’s stock fell from $19 per share to $7 per share during the year.

Since year end, the Canadian condensate differential has decreased from $20 to $5, and the oil price has recovered to $53. As a result, Paramount is on track to generate $359m in cash flow in 2019 and to grow production slightly. Paramount is buying back shares to take advantage of their very low share price, so the company’s per-share production growth could exceed 10% even with oil at $50 and Canadian natural gas at $1.40 CAD.

Paramount owns one of the best land packages in Canada with top-tier assets across several basins. The company’s land is capable of supporting multiples of their current production. Moreover, the company’s incremental production will be much more profitable as they scale fixed costs and existing infrastructure. We believe Paramount is in a particularly good position to take advantage of the current energy environment and to create value going forward.

Aramex

Aramex is the FedEx of the Middle East.

After promoting their long-serving CFO, Bashar Obeid, to CEO in November 2017, Aramex delivered particularly impressive results. Thanks to the company’s network effect and reputation, the business continued to generate close to a 50% adjusted return on equity (excluding cash and goodwill).

In the first nine months of 2018, Aramex was able to generate 8% revenue growth while walking away from low-margin business in India. This decision to prioritize profit over revenue reflects management’s renewed focus on costs and margins. The financial benefits of this decision were immediately apparent. Margins improved from 10% in 2017 to 12% in 2018. The margin increase led to earnings growth of 25% for the nine-month period, which is well above the high single-digits we forecasted for the year.

Bashar Obeid also decided to terminate Aramex’s joint venture with Australia Post after a couple years of little progress. While the JV no longer represents a blue sky opportunity for Aramex, the decision reflects management’s disciplined approach to capital allocation and costs.

MAG SILVER

MAG Silver is the 44% owner of the highest-grade undeveloped silver mine in the world. Located in Mexico, the Juanicipio JV generates an attractive IRR even at $10 silver and is being developed by the largest silver miner in the world, Fresnillo. The mine has a 19-year life with reasonable expectations for expansion. MAG’s JV with Fresnillo is fully funded for production, with no significant dilution risk to shareholders. Once in production, we expect Juancipio’s reserves to increase and new mineralization to be discovered on the JV’s land.

While the current mine plan stipulates 4,000 tonnes per day throughput, MAG anticipates an actual throughput of 8,000 tonnes per day. The JV has already purchased an adjacent plot of land for a possible processing facility which would allow them to double throughput. This upsizing of the project will improve the NPV and substantially increase the JV’s cash flow.

As a result of this planned expansion, MAG pushed back its construction timeline by a few months. Commercial production is now expected in mid-2020, instead of the first quarter of 2020. Trading at ~0.6x our estimate of NAV, the company is incredibly undervalued.

DUNDEE PRECIOUS METALS

2018 was an exceptional year operationally for Dundee. Their Chelopech mine, located in Bulgaria, produced 201k oz of gold and $80m in FCF outpacing the company’s original guidance of 165-195k oz. When combined with their Tsumeb smelter, the company’s total free cash flow last year rose to $90m.

On top of this recurring $90m USD of free cash flow, the company is in the process of bringing a new mine into production. The Krumovgrad mine—also located in Bulgaria—is currently being commissioned and is on pace to come in slightly below the $178m budget. Krumovgrad will generate an additional $70 million in FCF on an annual basis for Dundee over the next six years.

Combining the two mines at current metals prices, we expect Dundee to generate ~$150 million per year in FCF for the next 5 years. The real question going forward is how they will allocate this substantial free cash flow. At this current share price, the math of returning most of this capital to shareholders via stock buybacks and dividends is overwhelmingly attractive.

GOLD ROAD RESOURCES

Gold Road Resources is an Australian mining company in a 50/50 joint venture with Gold Fields. The joint venture is scheduled to start production in the second quarter of 2019 and will continue for at least 15 years. When in production, the JV asset is expected to generate ~$110m per year at current gold prices, $55m of which will accrue to Gold Road’s account.

With Gold Fields as the operator, Gold Road enjoys dramatically reduced execution risk: Gold Fields has considerable experience building mines around the world. At just 7.7x free cash flows once in production, Gold Road is very undervalued given the quality of their JV and longevity of the asset.

Surrounding the joint venture property, Gold Road has a vast land package which they will explore at a cost of ~$20m in 2019. While the company’s land package is highly prospective, we do not know if they will find additional economic ounces. Accordingly, if its exploration results are subpar, we will favor the return of capital to shareholders.

organization

As of January 1, our third-party administrator changed from Northern Trust to SEI/Archway. After an extensive search, we chose SEI/Archway due to its combination of culture, use of technology, and competitive fees. Specifically, the Indianapolis-based Archway has low employee turnover, has developed impressive fund accounting software, was recently acquired by global fund administrator SEI, and we negotiated a competitive fee structure. Moving administrators is also a result of the rapid changes in the fund administration business over the last 10 years; we intend to provide our partners with the best service-provider at the best value. Finally, our clients will now be able to access their statements online—directions for doing so are forthcoming in the beginning of February.

Please make note of the contact details for SEI/Archway:

Email: [email protected] (this is the preferred method of contact)

SEI AFO

8888 Keystone Crossing, Suite 1400

Indianapolis, IN 46240

Sincerely,

Sean Fieler Daniel Gittes

[1] Sector exposures shown as a percentage of 12.31.18 pre-redemption AUM. Performance contribution is derived in U.S. dollars, gross of fees and fund expenses. Interest rate swaps notional value and P&L are included in Fixed Income. P&L on cash is excluded from the table as are market value exposures for derivatives. Unless otherwise noted, all company data is derived from internal analysis, company presentations, or Bloomberg. All values are as of 12.31.18 unless otherwise noted.

Equinox Partners Investment Management, LLC | Information as of 12.31.24 unless noted | *SEC registration does not imply a certain level of skill or training

Equinox Partners Investment Management, LLC | Site by Fix8