Equinox Partners, L.P. - Q2 2019 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Equinox Partners, L.P. was down -2.2% in the second quarter of 2019. For the year to date through August 6th, we estimate the fund was up +17%.

sTILL NOT MUCH ENTHUSIASM FOR GOLD

While gold mining stocks are up sharply this year, there is no groundswell of enthusiasm for the sector. In marked contrast to the 2016 bull market in gold mining shares, capital has flowed out of the GDX and GDXJ gold mining indices this year. During 2016 these two indices collectively attracted $5.7b of inflows. By contrast, through August 5th of this year, these two indices have suffered cumulative outflows of $2.9b. Incredibly, the daily outflows from these indices continued well into July. Active managers of gold mining portfolios also experienced outflows in the first half of 2019. The gold mining mutual funds of Oppenheimer, Tocqueville, and Franklin-Templeton collectively distributed $89m more to their investors than they took in the first half of this year.

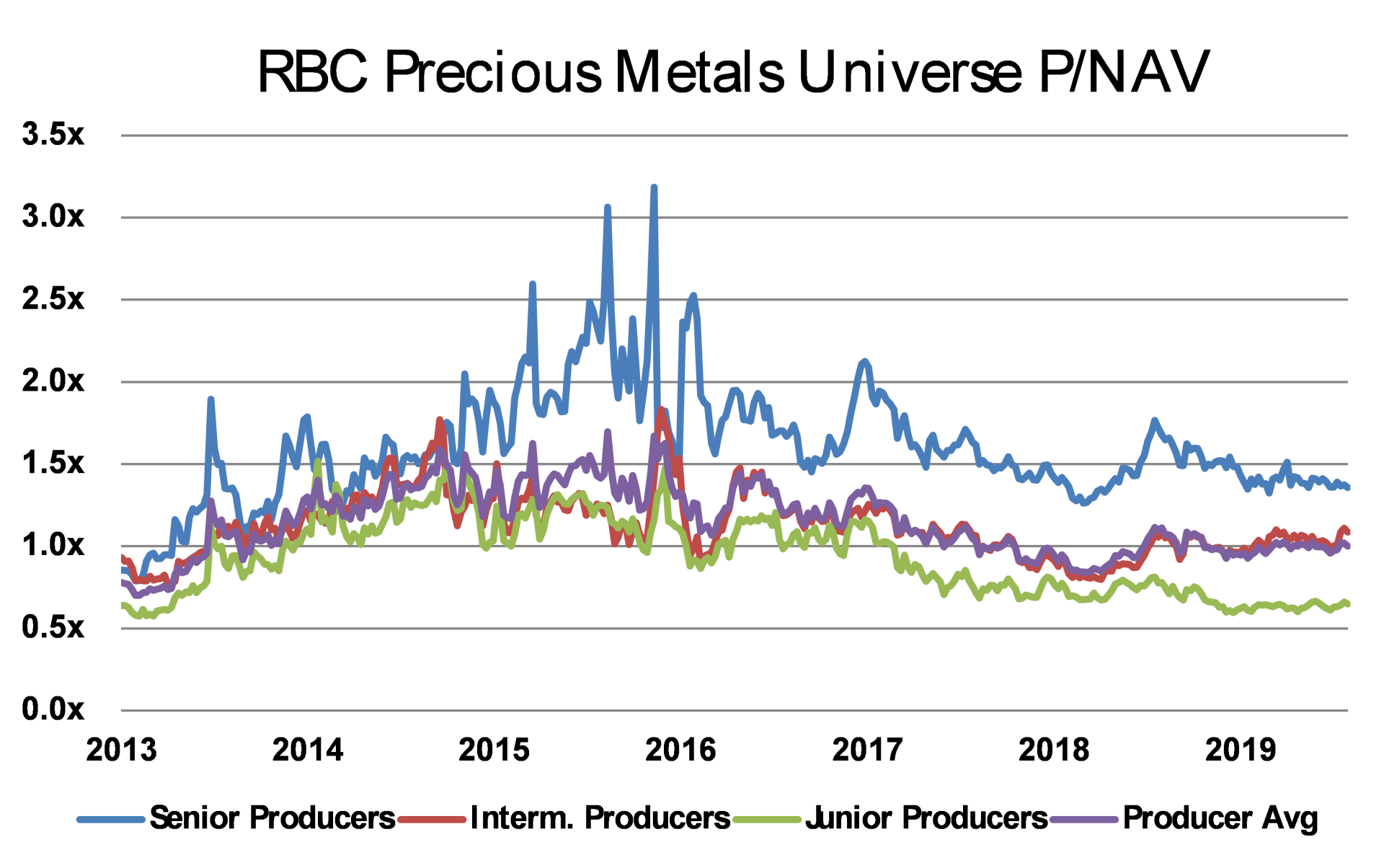

With such modest levels of investor interest in the sector, gold mining companies have appreciated roughly in proportion to their net asset values. Accordingly, the Price-to-NAV ratio for gold mining companies has remained broadly flat this year. There are, however, several notable exceptions to this trend. Detour’s shares, for instance, are up 101% through August 5th, while the company’s NAV is up 65% over the same period. But, as the graph of RBC’s coverage universe makes clear, P/NAV multiples for the industry remain roughly flat for the year to date as of July 31st.

A further indication that the bull market in gold miners is just beginning is the hesitance of the sell-side to adopt a higher price deck for gold. As of August 5th, the sell-side brokers we use were still modeling a long-term, average gold price of $1327, while today’s spot gold price is almost 14% above that figure. Specifically, BMO is using $1331, RBC is using $1300, and Cormark is using $1350. The subdued nature of this rally gives us confidence that the move upwards in the price of gold mining shares is still early as we break out of a very deep, eight-year bear market.

Responsible Investing is hard work

Our holdings are long-term partnerships with the managements and boards of the companies in which we are invested. Over the years, our partnership approach to investing has generated many valuable insights. In some cases, our meetings with management and directors have given us a much greater appreciation for the strategic challenges and opportunities our companies face as well as the skill with which corporate insiders are navigating these challenges. Other times, our interactions have revealed managements and directors who say the right thing but see their interests as fundamentally divergent from those of minority shareholders such as ourselves. In almost every case, our engagement has proven invaluable to our evaluation of management and corporate governance.

In addition to a better understanding of the people with whom we are invested, our long-term relationships with management and directors offers us regular opportunities to advance our own thoughts concerning the strategic direction of our companies. In our experience, an open dialogue characterized by informed and constructive back and forth is a natural result of a good relationship between well-aligned business partners.

While our input varies from company to company, we regularly emphasize the importance of disciplined capital allocation. For instance at Georgia Capital, we’ve advocated for share buybacks over business diversification given the holding company’s low valuation. In the case of MAG Silver, we’ve advocated for a reinvestment policy focused exclusively on its high-return joint venture property. At Ferreycorp, we’ve pushed for the sale of the company’s non-core, low-return businesses. With our Turkish company, Logo, we’ve discouraged management from scaling up the company’s unprofitable Indian subsidiary. And, in the case of Paramount Resources, we supported divestiture from lower-return infrastructure assets. While each case is different, we believe that our vantage point as a long-term shareholder gives us particular clarity when it comes to the rational allocation of capital.

These frequent interactions with the management and directors of the companies in which we are invested have also provided us an intimate appreciation for the evolving corporate governance landscape. Most notably, over the past two years, we have observed large passive funds becoming some of the most engaged and aggressive shareholders. The growing engagement of passive funds on issues of governance is not principally the result of investor pressure. These products are held for their low fees, liquidity, and accurate benchmarking. Instead, the impetus for these passive money managers’ growing interest in governance appears to us threefold: a desire to increase their market dominance, a long-term effort to attract Millennial investors, and an appeal to elite opinion makers in New York and Boston.

To better fulfill their role as arbiters of good corporate governance, the largest passive managers have all built out stewardship teams: “The Big Three in passive investment – BlackRock, Vanguard and State Street, which collectively oversee more than $15tn – have beefed up their stewardship teams in recent years and argue that they do hold companies to account. BlackRock has 43 people working in stewardship, Vanguard 35 and SSGA a dozen.”

While sizable, these centralized stewardship teams are dwarfed by the number of companies in which passive managers are invested. Consequently, passive managers remain drawn to cookie-cutter solutions that can be uniformly applied to their holdings. Leaving aside the obvious hot-button issue of quotas based on sex and race, we want to focus on the passive managers’ problematic approach to director independence. As engaged shareholders, we appreciate just how difficult it is to find directors who will actually represent the interest of shareholders when they are in tension with the desires of management. We were particularly disappointed this spring when passive shareholders failed to signal their support for one such director on Great Panther Mining’s board.

Great Panther acquired control of Beadell Resources in February of this year in a friendly merger. As part of the transaction, every member of Beadell’s board except one, Nicole Adshead-Bell, resigned. Nicole’s presence on the combined board offered important representation for the shareholders of Beadell in the new company—representation which any shareholder interested in board independence should have supported. Unfortunately, as the former CEO of Beadell, Nicole was not technically independent and therefore did not check the box for the passive managers seeking to increase the number of independent directors. While their implicit lack of support for her was not the precipitating event in her departure from the board this spring, it was an important factor in our opinion.

More broadly, we believe the premise that disinterested (“independent”) directors are somehow most qualified to direct companies is delusional. There will simply never be a disinterested priesthood that will govern companies better than the people who actually have a sizable financial interest in the companies’ success. Unfortunately, this obvious fact is not going to stop passive managers from putting forth a slew of independent directors for years to come.

Normally, fund managers advocating an ill-conceived governance strategy would underperform their benchmarks and lose assets. In the case of passive funds, however, they are the index. So, even if their proposals hurt the interests of minority shareholders in every company they own, they can still deliver their promised performance. Moreover, to the extent that they have an interest in boosting the prices of their holdings, this interest is best achieved by stifling competition amongst firms rather than improving each individual firm, a point detailed in an article by Jose Azar, Martin Schmalz and Isabel Tecu published in the Journal of Finance last summer.

Despite their serious shortcomings, passive managers are here to stay and will almost certainly become increasingly involved in the governance of the companies in which we are invested. The open question is whether other active managers will become more engaged on points of governance when they see the agenda of passive manager damaging their companies. This is, perhaps, the most realistic silver lining of the passive managers’ foray into corporate board rooms. If other active managers were more engaged with the companies in which they invest, there would be less opportunity for the passive managers to dictate board priorities. For our part, we will remain active owners of companies in which we are invested.

Sincerely,

Sean Fieler

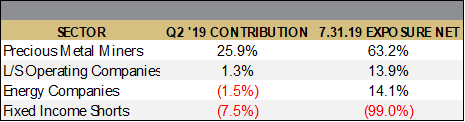

[1] Sector exposures shown as a percentage of 7.31.19 AUM. Performance contribution is derived in U.S. dollars, gross of fees and fund expenses. Interest rate swaps notional value and P&L are included in Fixed Income. P&L on cash is excluded from the table as are market value exposures for derivatives. Equity short positions of operating companies are netted out against long positions. Unless otherwise noted, all company data is derived from internal analysis, company presentations, or Bloomberg. All values are as of 7.31.19 unless otherwise noted.

[2] etf.com/etfanalytics/etf-fund-flows-tool. June 1—July 24 outflows: GDXJ -$481m; GDX -$596m. However, they have seen inflows since July 19th.

[3] Bloomberg, using fund total assets and changes in net asset values for the given mutual funds.

[4] FTfm, Thompson, Jennifer. US index funds less likely to hold companies to account, study finds. August 4, 2019

[5] The Journal of Finance, Vol 73, No 4, August 2018. Azar, et al. Anticompetitive Effects of Common Ownership